- English

- Italiano

- Español

- Français

The Week Ahead Playbook – Higher For Longer Sinks In

Of course, last week’s main event came from Powell & Co., with the FOMC’s policy decision. As had been widely expected, the target range for the fed funds rate remained unchanged at 5.25% - 5.50%, with the accompanying policy statement largely a ‘copy and paste’ job from that which had been issued after the prior meeting in July.

The Fed’s dot plot provided significantly more intrigue for financial markets, with policymakers continuing to project a further 25bp hike before year-end, while also revising higher fed funds rate expectations for next year by 50bp. Of course, as inflation continues to fade, this will represent a mechanical tightening in financial conditions, and higher real rates, in 2024, just as the US economy is likely to be losing momentum towards the end of the cycle.

This waning momentum, however, is what the FOMC desire to see, with Chair Powell again reiterating that a period of below-trend economic growth is required in order to bring inflation back to the 2% target. Such below-trend growth is likely to need a significant weakening of the labour market to occur, something that seems some way off at present, particularly with initial jobless claims falling to 201k in the week to 16th September, a period which references the next nonfarm payrolls print.

In any case, while the dots reinforced the Fed’s ‘higher for longer’ – or ‘higher for long’ – message, the macroeconomic impacts of a further 25bp hike this year are likely to be relatively small, as alluded to by Fed Chair Powell. Strong arguments can be made either way here, with the hawks likely to point to a strong jobs market as reason to tighten further, while the doves may seize on disinflation progress thus far in addition to a potential government shutdown as reasons for caution.

By and large, though, the FOMC decision progressed largely as markets priced, and as economists had expected. Those looking for surprises in terms of central banks last week needed to look to the other side of the Atlantic, where both the BoE and SNB delivered dovish surprises.

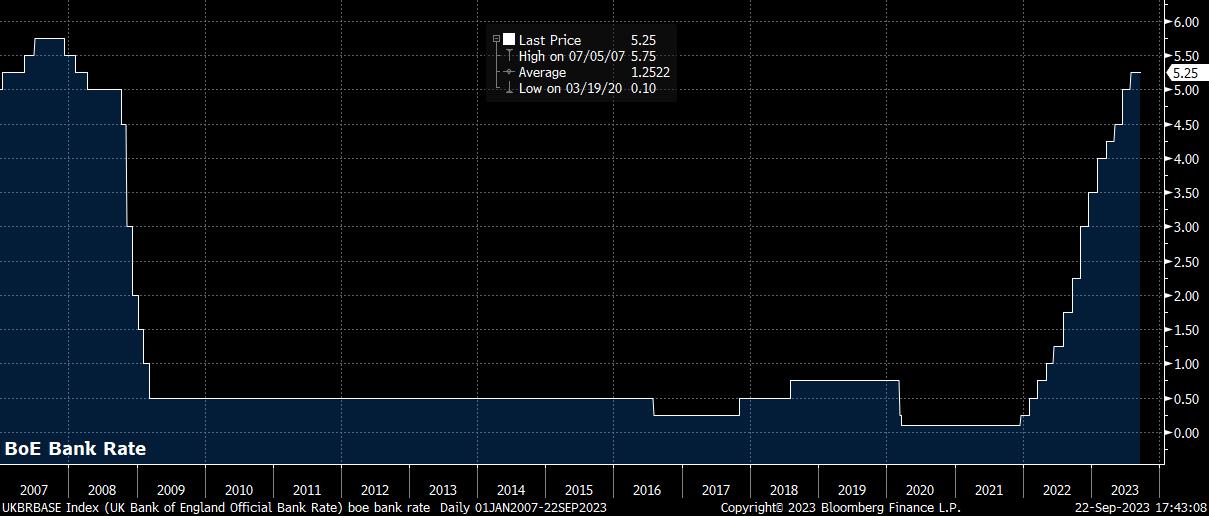

After a significantly cooler than expected August inflation report – CPI rose 6.7% YoY, core CPI rose 6.2% YoY – the BoE’s MPC voted narrowly, by five to four, to maintain Bank Rate at 5.25%.

Although the Old Lady’s guidance was largely unchanged from that at the August meeting, noting that policy will be further tightened if signs of persistent inflation were to emerge, it does appear that the BoE’s tightening cycle has come to an end, with just one more jobs and inflation report due before the November meeting, and economic momentum likely to wane more rapidly during the remainder of the year, as the wave of remortgaging away from sub-2% deals fixed during the last five years accelerates; a point evidenced by the rather grim ‘flash’ September PMIs released on Friday.

This poses downside risks to the pound, with cable having broken below the 1.23 handle, while having also sliced through the 200-day moving average with relative ease. A further decline towards the 1.20 mark seems a reasonable expectation here, over the medium-term.

_2023-09-22_17-43-46.jpg)

As mentioned, the SNB delivered last week’s other policy surprise, in deciding to maintain rates at 1.75%, despite the ECB’s surprising depo rate hike to 4.00% a week prior. While a reiteration of the SNB’s preparedness to intervene in the FX markets was, unsurprisingly, present, policy divergence should continue to see the CHF soften, with further upside in EURCHF and USDCHF, which now trades above the 0.90 handle, seeming likely.

_us_2023-09-22_17-44-09.jpg)

Overall, while the six G10 central bank decisions did throw up plenty of surprises, the core message coming from policymakers is the same across the globe; outside of Japan, where the exit from decades of ultra-easy policy remains painstakingly slow, and any further tightening seems some way off.

That message is the same that we have heard for some time, in that rates will have to remain ‘higher for longer’. As noted by numerous G10 central banks of late, policy stances across DM are now restrictive, with rates having reached their terminal level in most jurisdictions. The question facing markets going forwards is how long rates remain at said level, and when the first cuts may arrive.

While the inflationary beast remains far from slain, deteriorating economic momentum may indeed be the catalyst for central banks to loosen policy sooner rather than later. It is for this reason that we continue to see the G10 FX market trading off relative growth differentials.

The eurozone looks particularly vulnerable here, especially after the rather grim ‘flash’ September PMIs, with the potential high for Lagarde’s 25bp hike two weeks ago to turn into another version of Trichet’s well-documented policy mistake a decade or so ago. Consequently, EUR/USD remains under pressure, having closed beneath the 1.0650 May lows last week, with the bears now looking set to send price towards a test of the 1.05 handle.

_eurusd_mb_2023-09-22_17-44-36.jpg)

While the FX market trades on growth, the fixed income space trades on policy expectations, with the ‘higher for longer’ message having finally appeared to sink in. Treasuries sold off to new cycle highs on a yield basis last week, with the 2-year hitting its highest since 2006, and the 10-year rising above 4.5% for the first time since 2007.

This all had a spillover impact into other areas of DM fixed income, with 10-year bunds selling-off to their highest yield in just over a decade, though long-end gilts were able to rally after the cooler than expected inflation print and dovish BoE, despite the ‘Old Lady’ quickening the annual pace of gilt sales to £100bln, from £80bln prior.

Higher yields have exerted downward pressure on equities, with the bears wrestling control of global stocks over the last 5 days. The S&P 500 dipped over 2% last week, the 2nd weekly loss in three, with the rate-sensitive tech sector leading the declines.

Looking through a technical lens, the bears appear to have the upper hand for now, with the S&P trading below the 100-day moving average for the first time since March, while also trading below the psychologically important 4,400 handle. The Nasdaq 100 has, just about, managed to cling on to its own 100-day moving average, though also appears rather vulnerable to further downside pressure.

Turning to the week ahead, the economic calendar is significantly quieter, with few top-tier data releases, giving market participants a chance to digest last week’s central bank bonanza, with month- and quarter-end flows also having the potential to cause a pick-up in volatility.

While quiet, markets will pay close attention to the latest German IFO surveys for any signs of further downside risks facing the eurozone economy, in addition to the September ‘flash’ eurozone inflation print to gauge whether disinflation continued across the bloc this month. It must be said, however, that the policy implications of these releases are likely to be relatively limited, with markets seeing the ECB having reached terminal, though pricing of the first cut may be brought forward from July 2024 on softer than expected figures.

Elsewhere, the final reads on Q2 GDP from both the UK and US are unlikely to spring any surprises, though the weekly US continued jobless claims figure (exp. 1.673mln vs. 1.662mln prior) does deserve close attention, given that it relates to the survey week for the September nonfarm payrolls figure. A slew of central bank speakers are also due, with seven FOMC members due to make remarks, in addition to eight ECB Governing Council members.

One would expect most FOMC speakers to ‘stick to the script’ outlined by Chair Powell, who we will hear from at a town hall on Thursday, at last week’s press conference. ECB speakers are likely to express a more diverse range of views, though with markets seemingly certain that terminal has been reached, downside growth risks intensifying, and disinflation continuing, the bar for another hike appears a high one.

Overall, heading into the new trading week, the balance of risks appears to point to equities continuing to slip, having breached key levels last week, with the bulls failing to regain control. Fixed income also appears set to experience further downside (higher yields) as investors continue to position for the ‘higher for longer’ regime, while both sides of the dollar smile (haven demand and US outperformance) continue to work in favour of the buck, meaning that the greenback’s 10-week winning streak could continue for some time yet.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.