- English

- Italiano

- Español

- Français

In US equity we see the S&P500 closing +0.8%, in turn, printing its 46th new all-time high of the year, with the index eyeing a test of 5900, and S&P500 futures now above the big number. The NAS100 also closed 0.8% - a solid enough day, although the bulls would have liked to have seen greater expansion in the daily high-low range, and the index closing at the highs, which wasn’t the case. While all S&P500 sectors bar energy closed in the green, its big tech that has again shown leadership, with Nvidia closing at a new all-time closing high, with the 0DTE options crowd big buyers of the $140 and $145 0DTE strikes – so once again, momentum strategies are working well, and with Nvidia, semi’s and the QQQ’s finding a better trend, there are signs emerging of a chase, where the options market plays a massive role in that.

The USD has been given some additional legs with Fed Gov Waller suggesting the Fed should proceed with caution on rate cuts. He also offered some context on the upcoming US payrolls report (due 1 Nov), detailing that weather-related effects could reduce the payrolls count by 100k. Most knew that recent disruptions would result in the NFP print being a messy affair, but Waller’s comment goes some way in quantifying the sort of disruption we can expect. Essentially, with the next NFP so distorted, the market won’t have the same level of control in pricing risk into the November FOMC meeting.

On a broad basis, the DXY continues to lift and pull away from the 103 level, with EURUSD back testing 1.0900, and USDJPY gaining ground. EUR sellers remain in control but there may be some hesitation to add to shorts here given Thursday’s ECB meeting looms large, and the market not only fully expects a 25bp cut but a dovish statement. USDJPY has broken to a new run high, although found sellers into 150 – a tough one to be short for traders working outside of intraday timeframe, where the trend remains to the upside, with price holding the 5-day MA, and those set long will be looking for the 200-day MA (151.22) to be tested soon enough, although many will want to see the reaction in the US Treasury market upon re-open, and we still need to navigate US retail sales on Thursday.

AUDUSD gets focus with the spot rate holding a range between 0.6700 to 0.6750 – inspired partly by the reaction in China’s equity markets to Saturday’s announcement of various fiscal measures and plans to remove many of the constraints that have made local government a big part of the deflation loop. Conversely, AUDSD was then weighed down by broadly positive semantics towards the USD and buying seen in USDCNH. Consolidation, for now, seems likely but a downside break of 0.6700 would get me interested in chasing the move lower.

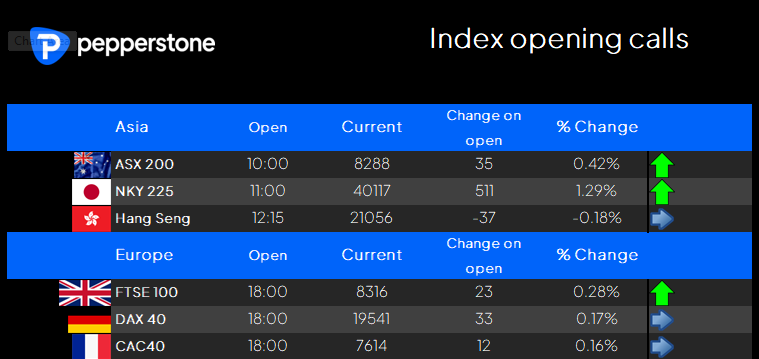

Turning to Asia, our calls suggest gains on open for the ASX200 and NKY225, with the HK50 eyed modestly lower and following on from the bleed lower we saw through late cash trade yesterday. The ASX200 should test the ATHs of 8285 on open, with Aus SPI futures needing to find 13 points to take out its ATH of 8334. The NKY225 cash market re-opens after being closed yesterday and we should see the index break out for new run highs – finding a footing above 40k.

China reported fairly poor trade data yesterday, with export growth slowing to +2.4% y/y (from 8.7% y/y) and imports +0.3%. We watch out for further economic data this week in the form of Q3 GDP, industrial production, retail sales and property sales – however, these data points pre-date the fiscal and monetary easing measures so the market will give this data some cushion as we try to model the impact the recent measures have on future property prices and business confidence. For now, liquidity and flow drive HK/China equity indices, but if the measure does really resonate with investors over time, then mainland equity could outperform HK equity, so long CN50/short HK50 may be a trade to put on the radar.

Good luck to all.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.