- English

- Italiano

- Español

- Français

Markets increase the prospect of Israel targeting Iranian oil supplies, with the Pentagon detailing they are closely reviewing what a potential counterattack could look like, and whether they would support it.

The market is on high alert for headlines surrounding conflict developments, and this will have big implications on today’s trading session, with traders seeing a real risk that news breaks through trade today and if that doesn’t play out, then we contend with news emerging through the weekend, which of course, throws up the possibility of gapping risk for the Monday re-open.

Oil strategists have attempted to model the potential impact that an attack on Iranian oil infrastructure and storage facilities could have on Iran’s exports and how that could impact OPEC+ spare capacity. This is obviously not a simple exercise, but we understand that Iran produces around 3.4m b/d, exporting around half of that daily production, notably to Asia. The extent of any counter from Israel will determine the potential temporary disruption to Iranian exports, but the potential impact would presumably be less than 500k b/d in lost output, and given we’ve seen crude gain 5.4% on the day, one could argue that the oil markets have now discounted some degree of lost production.

Semantics are at play though, and while punchy calls of $200 crude have been made from some circles, and in the options space, there’s been big demand for December $85 and $100 Brent call options, an open mind will always serve a trader well, as the crude market has been known to have moves that challenge conventional wisdom.

Near-term, few would want to be short crude, and to a lesser extent gold, headed into the weekend and one also considers if that same thought process will apply to equity and risk FX. The US nonfarm payrolls will largely dictate sentiment on the floors in the session ahead, but as we tail off into the session close, and if we haven’t seen new news emerge today on the geopolitical front, traders will need to go into risk management mode and consider hedging out potential gapping risk.

A punchy rally in the crude aside, we haven’t seen any real worries in US equity markets, and while 78% of S&P500 companies closed lower on the day, at an index level, the S&P500 closed just 0.2% lower, tracking a tight 41-point range on the day. Energy equity names have worked well, which won’t surprise given the flows in crude, and tech has held in well and comm services have added points. Geopolitics aside, a solid US ISM services report (the headline print came in at 54.9) is supportive of equity risk, as it reinforces the US soft landing thesis, but with US Treasury yields rising 5 to 6bp across the curve, there hasn’t been too much concern expressed at an index level on the lift in Treasury yields either.

There has been a propensity to hedge out equity risk, with the VIX index rising above 20%, with greater demand for S&P500 put volatility relative to call vol. Gold has also held in well, with traders torn between holding gold as a geopolitical hedge, while facing the negative force of a 7bp lift in US real rates and a stronger USD – these conflicting cross-currents resulting in the yellow metal continuing to consolidate in a $2685 to $2624 range, and while some may run long gold positions into the weekend, the near-term kicker will be todays US NFP report.

Trading the US NFP report is never an easy proposition, as we need to contend with the number of jobs seen in the BLS Establishment survey, the unemployment rate (set off the BLS Household survey), average hourly earnings and revisions to the prior NFP reports. Keeping things as simple as possible, I would weigh the unemployment rate as the key factor that the algo’s will key off most intently to. Here, the consensus is that we see the US U/E rate remaining unchanged at 4.2%, with the economist’s distribution of guesstimates set between 4.05% (rounded to 4.1%) to 4.35%. Naturally, any U/E rate print that rounds up to 4.4% will not be taken well by risk markets and would see the prospect of a 50bp cut in the November FOMC become the market base case – the soft-landing narrative would be challenged, the USD would be sold, and gold should move to new highs.

Conversely, a U/E print that comes in at consensus, and one that marries with an NFP print between 150-180k, is a good backdrop for risk to work in. Here, equity should find relief buyers, with the USD likely to find a renewed bid, notably vs the GBP, CHF, and JPY, with gold likely to find modest downside.

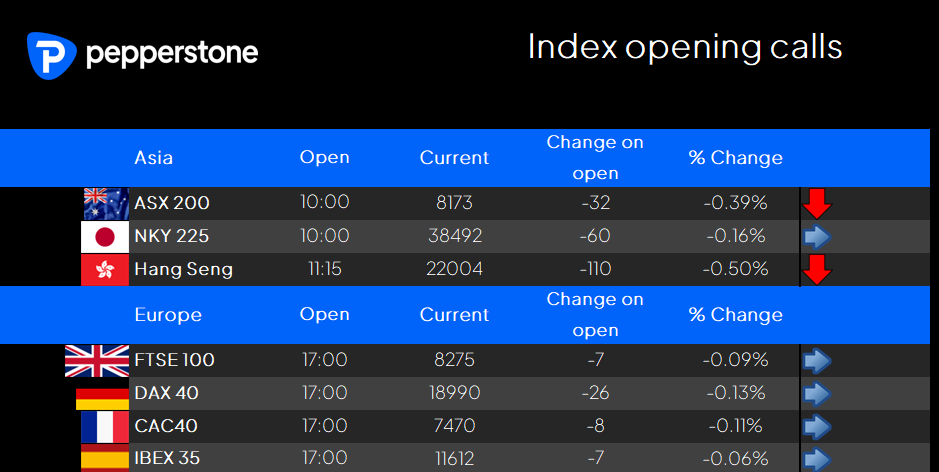

Turning to the Asia open, our calls suggest equity sets off on a negative footing, with the HK50 likely to modestly underperform. With little in the way of economic data to trouble traders and investors today, it is a day to manage geopolitical headline risk and further consider exposures over today's US NFP report.

Good luck to all.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.