- English

- Italiano

- Español

- Français

The Chinese authorities are unlikely to be bullied by the markets into detailing firmer stimulus plans, notably because the timing of the initial set of announcements was designed to pump up markets into the Golden Week holiday, and the 75th anniversary of the People’s Republic. That said, if they are credible on plans to drive demand, which I’d argue they are, then they must keep the peddle down to alter households and businesses mindsets and drive a positive expectancy on CAPEX, and investment opportunities in equity, property, and infrastructure.

Unless the authorities can shift the mindset to one where households and businesses truly believe that investment offer greater opportunity than increasing savings or paying down debt, then the recent raft of measures will fail to get the sort of economic traction that is needed.

With a decent washout of extended long positions in China/HK cash equity markets and modest selling in the CHH (offshore Chinese yuan), we look to Hang Seng futures and see a whippy ride through US trade but currently sit unchanged from the cash exchange close. Subsequently, our opening calls for Chinese/HK cash equities look ominously calm at this point. The market will look to find a fair value for these markets, and this may mean more volatility and two-way price action - while I have no doubt there will be pockets of traders trying to pick a low point in the sell-off, I would wait until we see the buying kick in with good volume, noting intraday rallies could easily be used as exit liquidity.

The lack of real substance from the NDRCs fiscal plans have seen big selling in crude, with Brent crude -4.1%, where we have seen a sizeable 643k contracts traded, and the second largest number of options contracts traded ever. The geopolitical news flow remains fluid, but the falls in crude speak to a perception of Chinese demand, over any positive feel that Iranian supply has a reduced chance of being impacted.

Gold has also found sellers, with price closing -0.9% and below the recent consolidation lows of $2624. While we’ve seen modestly lower US Treasury yields, and a flat USD, with geopolitical concerns still very much in the mix, many of the fundamentalists will say the selloff seen in yellow is perhaps a little unjustified. This just reinforces the notion that gold does what it wants on any given day, and what is claimed to have caused the move in gold on one day, may have absolutely no influence on another.

While we see a solid shake-out of Chinese equity, US equity has found love with a solid intraday trend seen in the S&P500 and NAS100. One could argue that an element of capital recently put to work in Chinese/HK equity may have switched back to US markets, and notably, as we head into US Q3 earnings, while it is also worth flagging that Trump’s odds of becoming president have lifted, increasing the possibility of increased tariffs. Either way, US equity has worked well, and the bulls will be enthused by the hold of range lows in S&P500 futures of 5724.

The S&P500 energy and materials sectors closed lower, which won’t surprise given the part unwind of the China fiscal dream, but the switch into big tech/AI, comms services and discretionary plays looks real and may have some near-term legs. Certainly, Nvidia has regained some real form and is showing leadership once again, and while volumes were not overly significant, there is good underlying upside momentum here. 3m Nvidia calls traded on the day, relative to 1.51m, so this would have played a part as dealers hedged exposures by buying the shares to manage their exposures as price through into or through the various strikes.

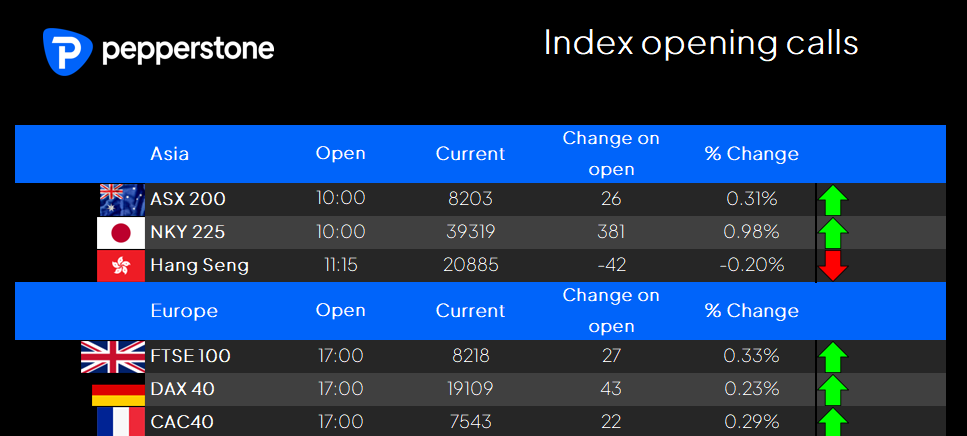

Turning to Asia and all eyes remain on the reaction seen in the China/HK equity, as well as commodity markets – iron ore futures, crude, and copper. Our calls for the ASX200 look constructive at this stage, although we could see materials having a tough open, with BHP likely to open around 1% weaker. Banks should therefore put in the points, with consumer names and tech plays working. Japan will start us off on a positive note, with a 1% gain eyed for the NKY225.

The known event risk today falls on the RBNZ meeting, where NZ swaps imply a 50bp cut at close to 90% - subsequently, should a 50bp cut play out then the reaction in the NZD should be limited and the move will likely come in the tone of the RBNZ statement and the appetite to cut by another 50bp in the November meeting. Should we see a 25bp cut emerge then one would expect a sharp initial rally in the NZD, although that may reverse quickly if the statement reads dovish.

Elsewhere, we get FOMC minutes and several Fed and ECB speakers.

Good luck to all.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.