CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

- English

- Italiano

- Español

- Français

The Daily Fix: A new level of volatility hits Asia - trader thoughts

Asian equities are getting taken to the cleaners, notably the Nikkei 225…gold traded into 1703, but has since retreated, I guess to raise cash for other, not so profitable exposures.

(Daily of WTI crude)

Crude sits at the epicentre of this though, with everyone seeing an all-out war between the major oil-producing players. On Friday we saw the OPEC meeting in Vienna, with the market fully expecting a firm response to the falling demand driven by the global outbreak of the coronavirus. Expectations were high for a 600k+ barrel p/d reduction in production, but instead, we saw Russia walk away and basically say that from 1 April everyone is free to produce whatever they like. Saudi’s Aramco has reached out and lowered pricing to the US customers, thus starting a price war with US shale – it’s on, the oil market will be in a sizeable surplus, everyone is after market share again and oil is getting taken to the woodshed.

FX moves are insane

FX markets are crazy today, I haven’t seen anything like this for years. To say its extreme is an understatement, where the rug has literally been pulled from beneath the price in many pairs - it reeks of incredibly poor liquidity and has been clearly led by moves in crude, with US equity futures going down hard in appreciation. It is this backdrop of very high implied vol and poor liquidity that has promoted a massive bid in the JPY, and it seems that when USDJPY smashed through 105 and into 101.45 this resonated across other JPY crosses - which has weighed on AUDUSD, NZDUSD and the high beta pairs.

(WTI vs USDJPY)

But the moves have been staggering, they have been violent and we ask now, what is the response, specifically from the Bank of Japan. There really isn’t much the BoJ/MoF can do, as directly selling JPY in the open market puts them on a collision course with other countries, such as the UST and would stoke a currency war, which is looking more and more likely anyhow. However, if this backdrop continues we will see a further one-way appreciation of the JPY and that will promote a huge deflationary impact on the Japanese economy. If you want to know central bank limitations look no further than the BoJ.

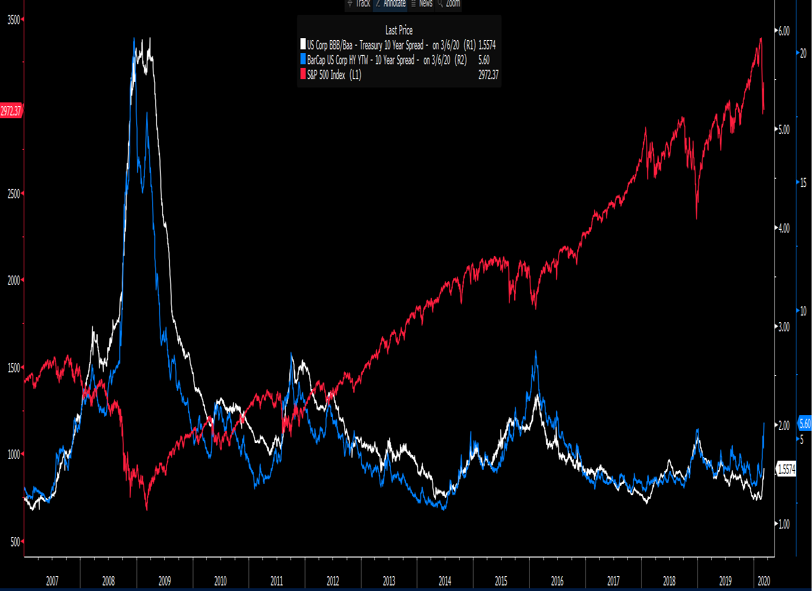

Credit spreads are key to broad sentiment

The new development for sentiment is that the credit (i.e. corporate bonds) markets are blowing up, largely because a lot of corporate debt was issued by energy companies and the ability to refinance that debt is becoming more and more expensive. What is genuinely worrying it we are also seeing signs of stress in the funding markets too now, with FRA-OIS and FX basis moving fast and sending ripples through the market that perhaps there really are similarities between this and the GFC.

Falling oil is not good when so much investment is tied to higher oil and it will be deflationary at a time when central banks have no way of dealing with this.

(White - BBB credit spread, blue- HY credit spreads, red - S&P500)

Source: Bloomberg

It doesn’t help that Italy has taken some punchy action and restricted movement, Wuhan style, to the Lombardy region, which includes the financial centre of Milan. Italy is looking very precarious and the more stringent the measures, the bigger the impact on economics – time to focus on Italian politics again as the anti-EMU parties will use this to their advantage - Further out in the past 48 hours 6585 new cases have been reported, with 84 countries now confirming cases within their borders.

The Fed QE trade

The Fed will now cut by 75-100bp at the 18 March meeting, but lower rates are not a solution here and the market knows it. Cheap money is no cure for the virus and the associated behaviours we are seeing play out in society, and the coronavirus is exposing the limits of central banks like no other ‘crisis’ has done since the GFC. There is already talk that we will see QE being implemented at some stage soon, with Boston Fed President Eric Rosengren saying if we get the US 10-year Treasury into zero (we’re now at 51bp) they’ll look at proposing legal changes to allow the Fed to buy corporate bonds and even equities. That would be a game-changer in my opinion, as no one in their right mind would want to be short an index when against a central bank with unlimited funds. It seems the bond vigilantes are out to get the Fed to go hard here.

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.