- English

- Italiano

- Español

- Français

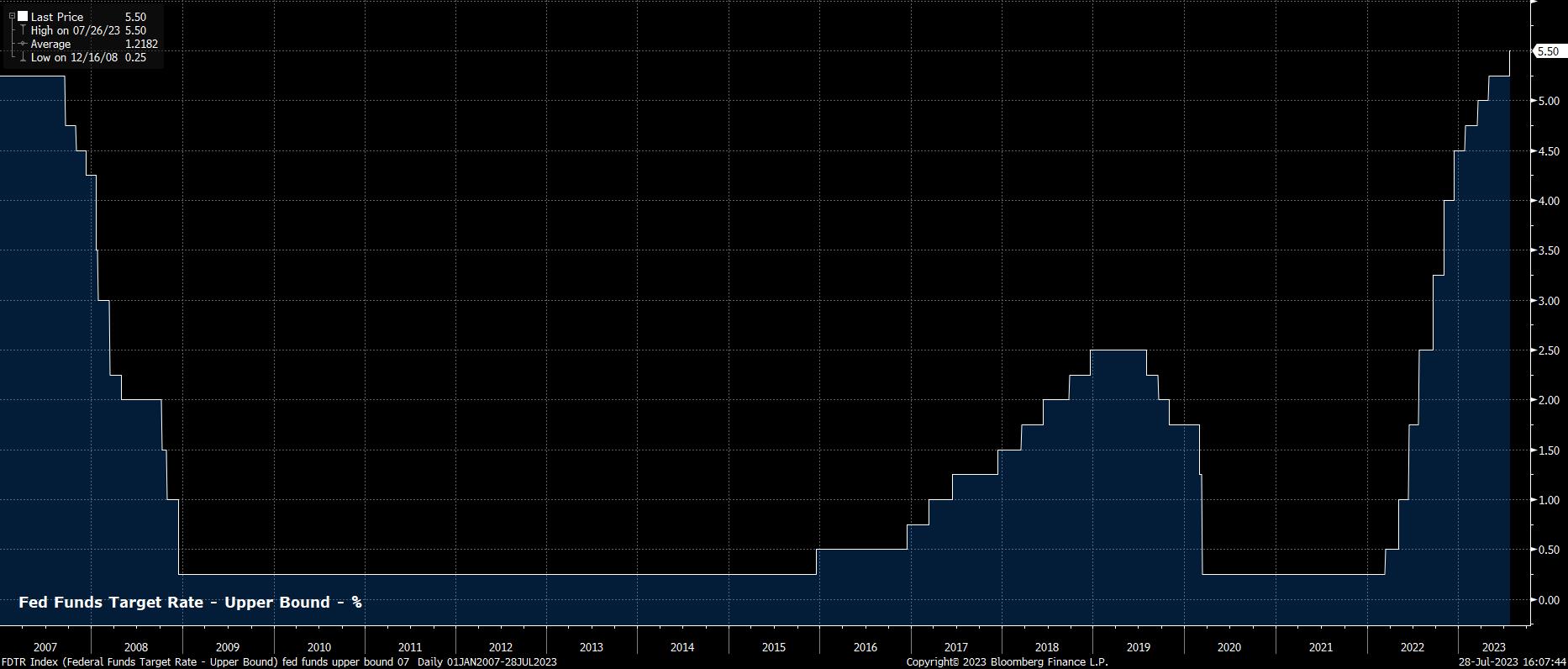

Starting with the Fed, where the FOMC unanimously voted in favour of the 25bp hike markets had fully priced, taking the target range for the fed funds rate to 5.25% - 5.50%, the highest in 22 years.

In many ways, this was one of the most unexciting FOMC decisions of the cycle. With the hike having been so clearly communicated in advance, the rate move itself provoked little by way of market reaction. Furthermore, the accompanying policy statement had almost no changes from that delivered in June, besides a rather insignificant shift to describe the pace of economic expansion as “moderate”, rather than “modest”.

Chair Powell’s press conference was similarly uninspiring, giving very few explicit hints as to the policy outlook, though a hawkish bias was once again evident, as the FOMC remain in data-dependent mode over the summer. Perhaps the most interesting remark was Powell referring to policy as “restrictive”, but not yet being prepared to say that policy is “sufficiently restrictive”, the latter language likely being used as and when rates reach their terminal level.

While that is not to say that the Fed will definitely deliver another hike, though a move in either September or November remains on the table if data continues to come in hot, it is clear that the Committee are not yet ready to declare the tightening cycle over. This is likely due to both a continued desire to keep financial conditions tight, and concern over a potential resurgence in inflation later in the year, as favourable base effects fade.

With this in mind, and taking into account how significantly US data continues to surprise to the upside, current market pricing of just a one-in-five chance of an autumn hike seems too low, presenting upside risks to the USD in the FX space.

_D_2023-07-28_16-07-28.jpg)

Over in Frankfurt, the ECB’s latest policy decision was considerably more interesting. While also deciding to raise rates by 25bp in a unanimous decision, taking the deposit rate to an equal record high, policymakers overall struck a much more dovish tone than expected.

The policy statement, for starters, noted that rates will be “set at” sufficiently restrictive levels, rather than being ‘brought to’ such levels as mentioned at the June meeting. This was taken by markets as a sign that the ECB may already be at the terminal rate, particularly after President Lagarde stressed the deliberate nature of this wording change at the post-meeting press conference.

At the press conference, Lagarde continued to strike a dovish tone, noting that she has an ‘open mind’ as to the September decision, while refusing, when asked, to repeat the prior guidance that the ECB has ‘more ground to cover’ in raising rates – again, increasing the likelihood that July marks the end of the tightening cycle.

Subsequently, as you’d expect, markets have repriced sharply in a dovish direction, now seeing just a 30% chance of a 25bp hike after the summer break, roughly half the odds that were placed on such an outcome at the start of the week. While this has taken the EUR back beneath the $1.10 handle, there seems likely to be room for further downside, particularly if markets further reprice the FOMC outlook as alluded to earlier.

_eurusd_mb_2023-07-28_16-07-03.jpg)

Last, but by no means least, is the BoJ. What initially looked like a hawkish decision to widen the YCC bands, turned out to be a dovish one, with Governor Ueda stressing at the post-meeting press conference that the change was not a step towards normalisation, but instead was intended to increase the sustainability and longevity of the present ultra-loose policy. As such, the move is unlikely to put a floor under the JPY for the time being.

_U_2023-07-28_16-06-28.jpg)

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.