CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

- English

- Italiano

- Español

- Français

Super Tuesday: How the Democratic candidates could move markets

Super Tuesday is set to be extra ‘super’ this year. Not just because a third of democratic delegates are up for grabs on the day, but because the race is a crowded field and Michael Bloomberg’s campaign could yield a surprise result.

Fourteen states and one territory will vote for the Democratic nominee on 3 March. The two most populous states California and Texas are among those voting on Super Tuesday. Sanders is expected to win California and Biden Texas.

But an unexpected result in Iowa propelled South Bend Mayor Pete Buttigieg into the spotlight and made us all rethink Joe Biden’s assumed lead. It must be concerning for the Biden campaign that a two-term former vice president trailed so far behind Buttigieg, a mid-west mayor of 100,000 people.

So which states are voting on Super Tuesday? What are polls and betting markets suggesting? And will we have a clearer idea of the Democratic nominee by the end of the day?

We have four possible scenarios in mind

1. Betting markets have it right: Bernie Sanders emerges victorious and markets begin to price in the risk of an administration ready to regulate Wall Street.

2. Biden emerges victorious on the day due to his popularity among southern democrats. A Biden win is the status quo across most polls. Stocks rally on the market-friendly news as a Trump-Biden election is anticipated.

3. Buttigieg gains traction after a stellar result in Iowa. Winning a number of delegates will split results further and in this situation we’ll be unable to call a winner just yet.

4. Bloomberg surprises and wins a few states. Currently polling shows this unlikely but don’t underestimate his ad spend and tactical focus on 2016 Trump counties. In this case also, the field will likely be too divided to call a winner.

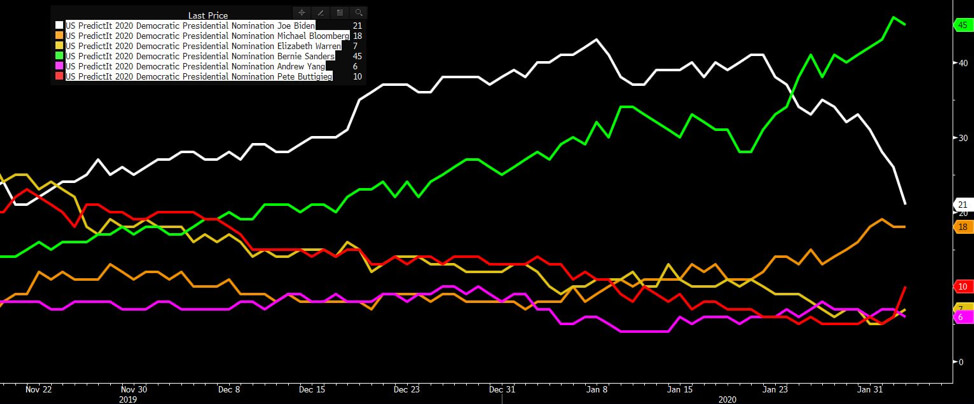

Bernie Sanders remains the favourite to win in betting markets. Biden’s popularity has slid considerably, while Buttigieg has seen a slight tick up.

Source: Bloomberg, PredictIt Markets

All aboard the Bernie-bandwagon

Bernie Sanders was one of two clear favourites in Iowa, according to early results. He’s expected to win New Hampshire, where he defeated Hillary Clinton in the 2016 primary with 60.4% of the vote. He’s also a serious contender for Nevada. If he sweeps these states, by Super Tuesday it’ll be all aboard the Bernie-bandwagon - a risk markets have not yet priced in.

Sanders is expected to win California, Minnesota, Colorado, Utah, Maine, Vermont, and Massachusetts (Elizabeth Warren’s home state) on Super Tuesday, according to FiveThirtyEight.

Markets will spook if the Bernie bandwagon continues to pick up speed. His campaign is built on medi-care for all and an anti Wall Street message, taking on the top end of town with sweeping financial taxes and plans to break up big tech companies.

Some estimates suggest a drop in the S&P 500 by as much forty percent should he occupy the oval office. US stocks are trading near all-time highs: they are not yet ready for a Sanders administration. If Sanders is ahead of the game after Super Tuesday, price action will account for the apparent risk: stocks down, USD down, gold and safe haven forex pairs up.

Biden wins Super Tuesday

A win for Biden on Super Tuesday is the current status quo across polls, although betting markets are pricing his chances of winning increasingly lower. Where he’s likely to win, he’s expected to take a considerable lead. Where Sanders is forecast to win, Biden trails fairly closely behind. This means that if Biden and Sanders won half the states each, Biden’s on track to collect significantly more delegates due to stronger wins.

Biden would be the favourable Democratic candidate in the market’s eyes. He’s campaigning to continue the work of the Obama administration, and would be an easier ticket for China than Trump. A phase two US-China trade deal will feel closer if Biden leads the Democratic party, and markets will price this in if he’s ahead: stocks up, USD up, gold and safe haven forex pairs down.

According to fivethirtyeight polls, Biden is expected to win Texas, North Carolina, Virginia, Tennessee, Alabama, Oklahoma, and Arkansas on Super Tuesday.

Buttigieg rides the wave from Iowa

The South Bend mayor delivered a surprise result in Iowa where, according to his victory speech, ‘an improbable hope became an undeniable victory.” All candidates made a victory speech of sorts on the night, due to technical difficulties delaying results until the following day.

The question now is whether the South Bend mayor can ride this wave of popularity through to other states. In 1976, underdog and peanut farmer Jimmy Carter did just this, riding an Iowa win all the way to the White House. So don’t underestimate the surprise result.

Buttigieg is a moderate candidate, competing with Biden, Klobuchar, and Bloomberg. He wants to raise minimum wage to $15 an hour, and halt the use of tariffs to pressure foreign countries into action.

He has unique views on big tech companies. He agrees with the anti-competitive nature of big tech in some instances and favours regulation, however not to the extent of Sanders or Warren who would have them broken up completely. Buttigieg favours empowering the Federal Trade Commission to act on anti-competitive behaviours before contemplating break-ups.

In some other ways, he is more aligned with progressives Sanders and Warren. For one, he would bring climate change and human rights violations into trade negotiations with China, which are likely to be sticking points and delay a phase two trade deal.

It’s too early to tell if Buttigieg will continue to perform well, but what is clear is that he’s slightly less market-friendly than Biden or Bloomberg, but considerably more market-friendly than Sanders or Warren.

Michael Bloomberg surprises with wins

The billionaire candidate chose to skip the early states and begin his campaigning with Super Tuesday states. He’s spent an estimated $224 million building that campaign with a particular focus on key states California and Texas.

The ad spend is already yielding results. Bloomberg is now polling in the top four in several Super Tuesday states as his campaign gains traction. Across betting markets, he is second or third most likely to win the Democratic ticket.

Bloomberg could further divide the moderate field. As he gains traction, he so far seems to be taking from Biden’s assumed lead. This is also a threat for Buttigieg. Further, Biden’s poor result in the Iowa caucuses suggests support for the former Vice President mightn’t be as strong as pollsters had expected. This gives Bloomberg more room for a surprise sweep on Super Tuesday.

If he can’t surpass Biden and Buttigieg across the board, his main contribution will be boosting Sanders’ chances. The progressive end of the field is far less divided.

Markets will be favourable to a Bloomberg nominee. Should he pull off a surprise result on Super Tuesday, chances are we’ll have a mixture of candidates with wins so we’ll be unlikely to call a winner just yet. Markets will react when we have a clearer idea of a winner.

A Bloomberg surge at this point seems unlikely - and I agree - but remember the prospect of a President Trump was also shrugged off in early days. Bloomberg is prepared to spend big to get ahead, and we can’t underestimate the effect this might have.

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.