- English

- Italiano

- Español

- Français

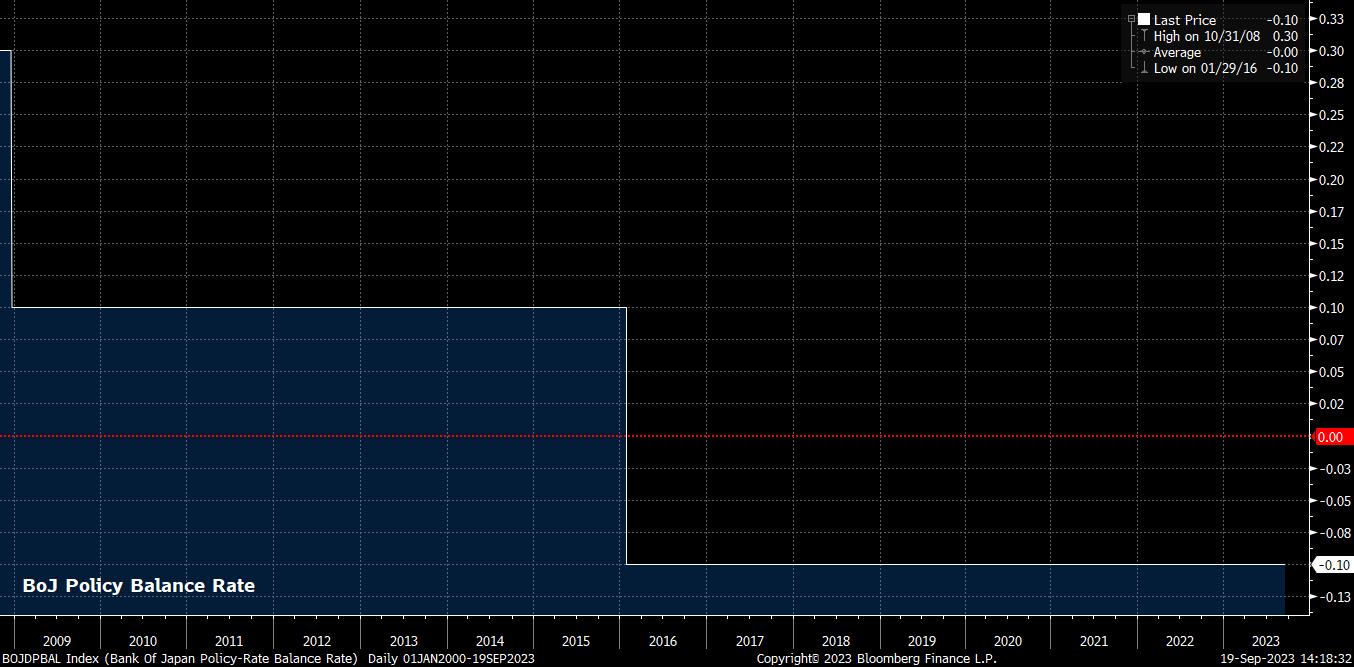

It goes without saying that rates will remain unchanged at this meeting, with markets pricing no chance of such a move, and policymakers being highly unlikely to surprise, given the gradual pace at which they want to exit decades of ultra-easy policy. Nevertheless, OIS does fully price a 10bp hike from the BOJ by March 2024, pricing that would likely be brought forward significantly were the guidance accompanying the policy decision to prove surprisingly hawkish.

It’s also highly unlikely that the BoJ will make any tweaks to yield curve control (YCC) at this meeting. Despite 10-year JGBs having climbed north of 0.7% since Ueda’s aforementioned remarks, yields remain some distance below the 1% cap introduced at the July meeting. Policymakers appear content with relatively modest jawboning, coupled with occasional media ‘sources’ reports, to keep the bond market in check for now.

Consequently, almost all attention surrounding the decision will be focused on how it is framed, as well as the commentary and guidance that the BoJ provide. In this realm, there are three primary focused.

Firstly, is how the Bank view the balance of risks in terms of the inflation outlook. While headline CPI has faded from the 4.3% YoY peak seen in January, policymakers continued to flag downside risks to the sustainability of 2% inflation at the July decision, though overall viewed these risks as relatively balanced, being offset by ‘signs of change’ in price-setting behaviour. Said changes can be seen via the core inflation measure, excluding food and energy, which re-accelerated to a cycle high 4.3% YoY in July.

Were this description of risks to change, indicating a greater bias towards the upside, this should be interpreted as a hawkish sign, and a nod towards NIRP ending in line with the schedule recently hinted at by Governor Ueda.

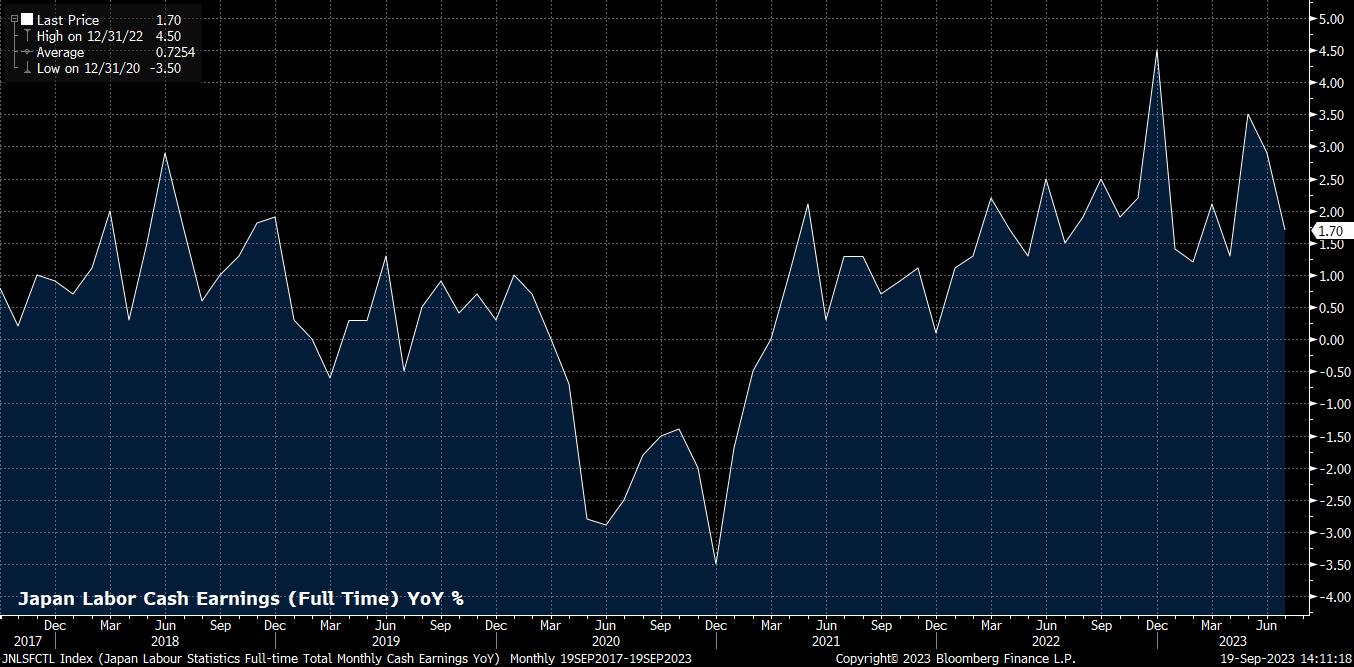

Secondly, is how the BoJ view developments in the labour market. Not only do policymakers wish to see inflation sustainably achieve the 2% target, there is also a desire for this to be accompanied by wage increases.

Recent data on this front suggests progress, with cash earnings increasing by just shy of 2% YoY in July, albeit on a relatively limited sample. However, this is unlikely to be enough for policymakers, who may wish to see the results of next year’s ‘shunto’ wage negotiations, and the announcements from labour unions of their desired earnings increase targets beforehand, ahead of becoming convinced that sustainable wage inflation is now embedded within the economy.

Lastly, and most importantly, markets will pay incredibly close attention to Governor Ueda’s post-decision press conference, with the vein of questioning likely to centre on what would represent the ‘sufficient information and data’ needed to determine the timing of an eventual rate hike.

Ueda has what appears to be a binary choice here – either to lean into the remarks and provide additional clarity as to what exactly policymakers will want to see in order to tighten policy, or to try and soften the tone of the recent article and stress that data doesn’t yet flag the need for any near-term policy shifts. The latter option seems marginally more likely, taking into account recent reports from ‘people familiar with the matter’ that Ueda’s interview remarks are largely ‘consistent’ with routine remarks that have been made of late.

That said, the BoJ’s potential to surprise – as seen with the YCC tweak over the summer – is well-known, hence a more hawkish shift cannot be ruled out. This begs the important question of why policymakers would want to tighten policy in the first place.

As with the decision itself, there are three factors behind such a desire.

Firstly, is the value of the JPY, which continues to depreciate as rate differentials with other G10s continue to widen. This depreciation comes with significant political implications, not least given higher burden of delivering planned fiscal stimulus should the JPY slip further. The MoF have already intervened once this cycle, and may wish the BoJ to place more weight on currency considerations to avoid the need to do so again.

_2023-09-19_14-09-08.jpg)

Secondly, is the matter of the real policy stance. As inflation, and inflation expectations, rise, maintaining the policy rate at -0.10% results in greater easing being delivered, via a falling real policy rate. Most, presumably policymakers included, would view this greater easing as excessive in the current environment, with looser financial conditions and ever-lower real rates both contributing significantly to the weakness in the JPY.

Lastly, comes the issue of rate differentials. With tightening cycles coming to an end across G10, and markets pricing significant policy easing next year, including a full 75bp of cuts from the FOMC, the BoJ may be beginning to worry that their window to end the era of negative rates. Questions around the sustainability of easing have already been raised, and are well-documented, while we may not be too far from the point where markets will move to price even-deeper sub-zero rates as DM recession risks intensify.

For the JPY, a hawkish slant from the BoJ is likely to kick-off a more sustained rally, given the repricing it would spark across the OIS curve. A move towards the low-140s in USD/JPY seems reasonable over the medium-term, if the hawkish rhetoric was supported with action in due course. On the other hand, pushback on Ueda’s recent remarks would ignite another round of JPY selling, putting the 150 handle firmly in the market’s crosshairs, and restarting the conversation around potential FX intervention.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.

.jpg?height=420)