- English

- Italiano

- Español

- Français

Analysis

Commodities have been screaming reflation for some time, with USDCNH central to this bull trend – how much good news is in the price? A lot and the risk of a correction of sorts in risk is clearly very high, but whether that plays out before 2021 is yet to be seen.

The macro framework

Arguably when thinking about the year ahead we must consider the risks, the catalysts and trends taking place and the key debates that forge a macro framework – for me there's nothing even remotely close to the most pertinent question in macro than the inflation vs deflation debate. If you run a macro framework and trade in and out of this framework, then this is the overriding question at hand.

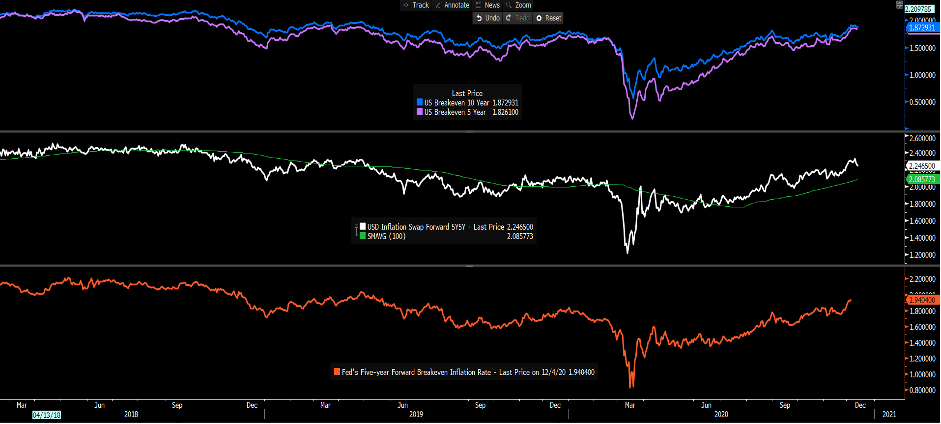

(Market-based US inflation expectations)

(Source: Bloomberg)

When it comes to macro, we must have an open mind and while we have a core view, we also need to be mindful of alternative scenarios. We must learn to recognise when they increase in probability and be ready and able to change one’s mind.

Inflation vs deflation

My own view for what it’s worth, inflation is likely to push higher in 2021 and nominal GDP in developed countries will push strongly higher too. With the output gap closing and productivity showing clear signs of improvement.

The USD is core here and while it's a clear consensus trade and that worries, I do sit in the camp that the downside risks are greater than upside, with EURUSD pushing to the high side of strategists Q4 high-low forecast of 1.28 to 1.15. Outperformance from the AUD is also a core consensus view, with the street calling for 78c by Q4 (range of 81c to 68c). Although, a lot will be determined by USDCNH and whether there's still further downside – if there's then the AUD will work well in 2021.

The consensus is we see US 10-yr Treasuries yield 1.23% by Q4, although it’s hard to recall the last time the consensus was anywhere close on its median forecast for USTs. US 10s are central to this puzzle as the cost of credit is priced off this benchmark and government deficit spending relies on yields staying contained relative to nominal GDP.

I guess if financial conditions don’t change too greatly then the Fed will be fine with higher yields and it’s the rate or velocity of change that typically matters. Inflation expectations hold the answer and provided we see ‘breakeven’ inflation marching higher then real yields will stay deeply negative and equities will work well again. With cyclical and value the areas of the equity market that investors will want to be exposed too.

Banks are key

Banks are key, as they are central to the inflation argument. As many have alluded to, we can get a generational spike higher in M2 money supply, but it’s the velocity of money that creates inflation and right now that is broken – a steeper yield curve and pent-up demand released into the underlying economy could turn velocity around and that’s a big ‘if’ but it's key.

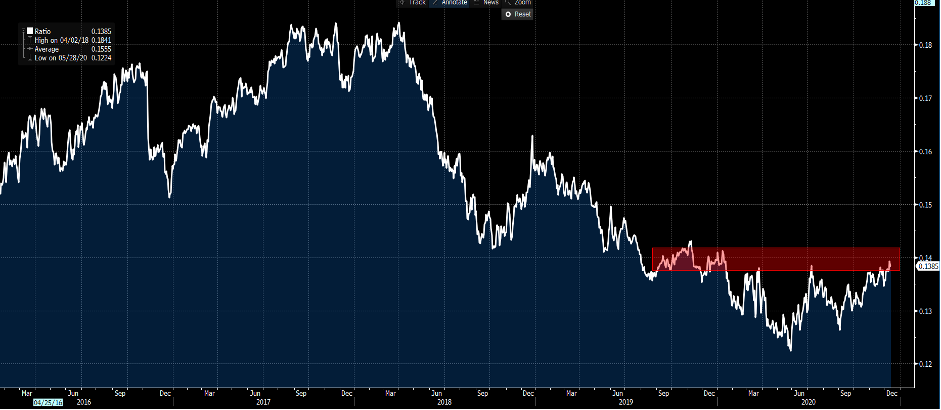

I look for relative value plays 2021 and the use of CFDs offer the ability to go long and short of an instrument, giving the flexibility to play long and short strategies within the framework. Long XLF and short SPY ETF is one way to play this, although there's a funding consideration from the swap charge. China is flavour du jour too and again this is a big consensus trade. So much of China is driven by the internet stocks but if EM is going to find solace in a weaker USD then EEM ETF v SPY may work.

(Source: Bloomberg)

A steeper yield curve and higher nominal rates will galvanise the view that equities are going higher and investors want a slice of that corporate cash flow. Unless we see real yields moving materially higher and a stronger USD, I see gold moving north of $2000 (strategists forecasts for Q4 21 is 2300 to 1600). That’s why owning gold equity over the underlying commodity makes sense to me – get leverage to the gold price, but also access the dividend income that comes with the equity.

Crypto will not replace gold anytime soon but I am a convert to the scene and think digital assets and the blockchain will play an increasingly greater involvement in our daily lives. Within our regulatory backdrop, Pepperstone are set to introduce weekend trading in select popular cryptocurrencies shortly which will give greater control on trading. We'll watch the evolution of central bank digital assets, but a crypto ETF should it come in 2021 would be a game-changer.

The future of QE?

One of the key talking points, which will naturally flow if we get higher inflation expectations and lower real yields is the future of monetary policy. While monetary policy is almost there to complement fiscal, the big debate is when will the Fed taper its QE program. It certainly doesn’t feel like it will be until late 2021 at the earliest and most probably 2022 but as long as the recovery continues then this will be one of the big questions in 2021 and the Fed will need to get this correct if they are to avoid an ugly tightening of financial conditions.

The RBA are up first though and will need to make a call on extending its QE program which is due to finish mid-2021.

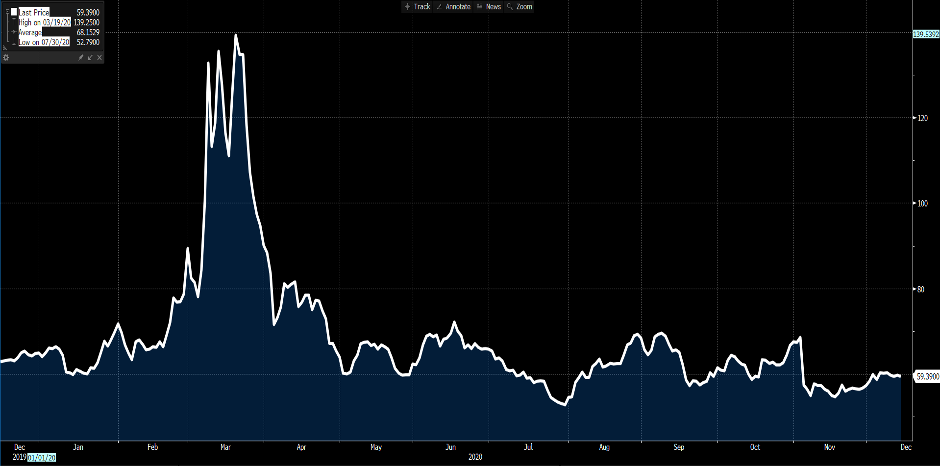

As we move into the new year, I'll explore some charts that offer clarity on this view. However, in a world where volatility (vol) is central to trading, perhaps if this thesis does play out it'll be the rates market that will give the clearest insight. I would expect implied volatility in rates to lead bond vol and if we see a climb in either of these volatility metrics then FX and equity vol will come along with it. That would have huge implications for trading.

(Source: Bloomberg)

I will update periodically on measures of interest rate volatility. If traders do see a better world with higher nominal GDP (not just stagflation) and a better labour market, then towards the latter stages of 2021 we may start to see interest rate expectations change and implied vol in rates lift – this may be a must-watch in 2021.

I'm sure many will disagree with this view, that’s fine. However, an open mind is essential and if this is indeed remotely correct, 2021 will be a fascinating and perhaps very bullish year for risk.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.