CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

- English

- Italiano

- Español

- Français

Eyes on key earnings as traders question if we’ve seen the lows

Sentiment is certainly pessimistic through markets. However, various market internals are not at extremes, and technically the various indices aren’t overly oversold either. That said, despite a lack of any major driver, we saw good sellers of volatility in the VIX index above 30%, and this seemed to coincide with a solid counter-trend rally in equity, with our NAS100 trading into 13,183 before rallying 2.8%. The US500 index has traded into the support zone on the daily, with price printing a bullish hammer (candle) into the 76.4% fibo of the March/April rally. The question is whether the bulls build on this support?

US500 daily

Part of the positivity can be explained by a better tone in US Treasuries, with yields down 8bp in 10s and this allowed some relief to long-duration assets, tech for example. We also saw the PBoC cutting banks' Reserve Ratio Requirements by 1ppt, which took some of the heat out of the USDCNH move and curbed the gains in the USD more broadly. The USDX still looks so strong on the daily and it's hard to bet against this trend now, although I think a turn is close, it will require the Fed to stop its consistent hawkish upgrades.

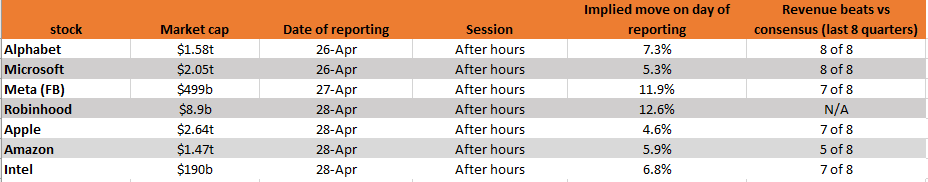

We can also see good buying in Microsoft and Alphabet ahead of earnings that come out after the close in the session ahead. Whether this was short covering or traders genuinely seeing the prospect of leadership emerging from these tech giants is another thing – the implied move on the day is 7.3% and 5.3% respectively, so the market expects movement here. Recall, these are both darlings of US earnings season and have incredible pedigrees of beating estimates, and they will need to really inspire in their respective outlooks to see real capital put to work in this ‘don’t fight the Fed’ market.

Microsoft is especially interesting, with a base-building into $270 – if this support breaks, then it could cause another leg lower in equities – contrary to the bear case, the bulls really want to see a move through the 50-day MA ($293) and the gap filled from 8 April ($296) to suggest tech can really start to trend.

It’s a huge week for US earnings with the bulk of US500 and NAS100 market cap reporting, so we can expect a lively tape to play out. The macro still dominates, but with the Fed in a blackout period until 5 May perhaps we can see risk stage a firmer footing – China is the elephant in the room but earnings this week matter – keep an eye on the after-market for direction.

New to trading? Check out our trading tools to help you get started.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.