- English

- Italiano

- Español

- Français

The Daily Fix: Equity volatility comes alive as double dip recession fears rise

The US VIX (i.e 30-day implied volatility in the S&P 500 index is up a sizeable 4.9 vols into 32.40%, while implied vol in the NAS100 rose to 37.3%. So traders have priced in movement and the breakeven levels for those who have bought portfolio protection have just got a little more onerous. For context, the daily implied move in the S&P 500 is now over 2%, while this is 2.34% in the NAS100.

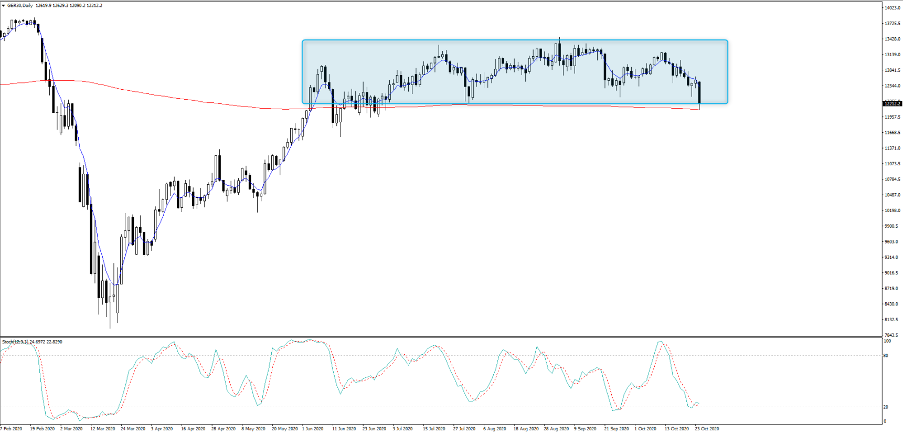

It’s not uncommon for EU equity vol to trade at a discount to US equity volatility, but outside of the EU Stoxx 50, we’re seeing larger movement in the German DAX which fell 3.7% (a 3 z-score move). But not only did the index underperform other European markets, but a major headwind came from SAP global (-21.9%) who downgraded sales guidance prompting investors exit in droves and the tech name was taken to the woodshed. While SAP would command a chunky weight in the EU tech index, the set-up here looks ugly and rallies will likely be sold.

(Source: Bloomberg)

The DAX index itself is sitting on both the July low and the 200-day MA. The index needs to find some love tonight at this support or the GER30 could be headed for 11,400 quite rapidly.

It's interesting to see the US tech down >2%, yet Apple closed unchanged of its earnings this week. This is true of Amazon (obviously not a tech stock). For equity and index traders do consider we get Apple, Amazon, Google and Facebook reporting after-market on Thursday, with the average implied move (across the four stocks) at 3.1%. They represent over 30% of the NAS100 weighting, so it could be a volatile aftermarket session. I wrote on this recently, so take a look as it could impact the index too.

The Covid-19 case news flow has clearly resonated and is all the talk on the floors at present and price action tells the story fairly well. Headline writers will talk about a lack of near-term US stimulus agreement from the DEMs and REPs, but personally, I think markets gave up on this some time ago and see this as a 2021 story. Fears of a double-dip recession in Europe are impacting both equity and crude, with WTI and Brent down close to 3%. The Dow Transports lost 2.3%, the S&P 500 airlines index -5.6%, while Copper lost over 1%. The reflation trade which was working so beautifully is being partly unwound – not because of election repricing but due to the new wave of Covid-19 cases.

In Treasuries, we’ve seen good buying in 10’s and 30s and curves have flattened. Although the moves have been well contained and buying quite orderly. We’re not seeing too much angst in EU fixed income with both UK gilts and German bunds down just 1bp.

FX markets, outside of the TRY have not moved. We’ve seen some buying of USDs, where my theory continues to be that this has been led by USDCNH which gained +0.5%. Unsurprisingly the CAD has been offered given moves in crude but it’s all quite sanguine. EURUSD has lost 0.4% falling to a session low of 1.1803 and has found any counter-rallies shot down. Let’s see if Asia can push price through the figure. Maybe FX looked more closely at the lack of movement in fixed income over equities and if we look at FX implied vols they’re quite contained. This is largely a function that realised moves have been so limited in this plays a role when market makers set options prices.

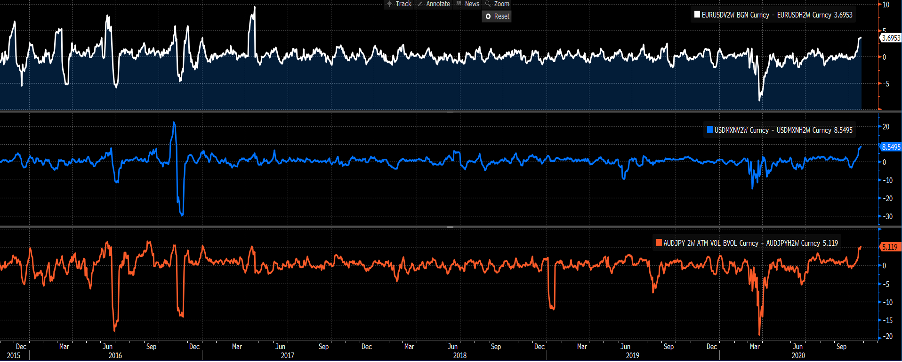

- Upper pane – EURUSD 2w implied > realised vol

- Middle pane – USDCAD 2w implied > realised vol

- Lower - AUDJPY 2w implied > realised vol

(Source: Bloomberg)

If we look at 2-week implied over realised volatility (see above) we can see this at multi-year highs. This is where the US election movement premium is best seen. Traders are expecting movement but the lack of recent move has held back the absolute implied levels. For those who use volatility as a core input for their risk management, this is spread between implied and realised could be key.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.