CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

- English

- Italiano

- Español

- Français

The Daily Fix: US equities eye new all time highs despite a stronger USD

Yesterday’s US ISM manufacturing report was very interesting, notably the ‘prices paid’ sub-component which has flown – for the first time since 1978 in this industry survey, every company reported higher prices. I’ll be watching today's US services ISM (02:00 AEDT) for this very sub-survey as the service sector holds a greater weighting on total US economics. If I look at the US 5s vs 30 Treasury curve it's breaking higher, steadfastly portraying inflation – in the bond market we trust.

(Source: Bloomberg)

Silver has been sold (currently -8.5%) and has given up all the gains from $30.10 and currently below Friday’s closing price of $26.98. The CME hiking margins 18% tells a message to the market that you can try and take on markets outside of stocks and there will be headwinds – the number of people casting their minds back to the ultimate case study of ‘Silver Thursday’ in 1980 was evident and while the situation this time is vastly different, we’re not seeing the retail frenzy winning this one just yet. Gold seems to be following its higher beta cousin lower with price below its 5-day EMA, and all longer-term moving averages and eyeing a move to $1800 and the low of its recent range.

Move into the mania stocks and GME, AMC et al are down hard today, so perhaps this is a small factor boosting sentiment and we see the likes of the S&P 500, NAS100 and Russell 2000 eyeing moves back into the all-time highs.

Equity volatility is been hit hard, with the VIX index falling nearly 5 vols to 25.28% and NAS VIX -4.6 vols – this still suggests 1.6% and 1.9% implied daily moves in the respective indices, with traders removing some of their downside hedges and this makes sense when the market is moving higher on good volume.

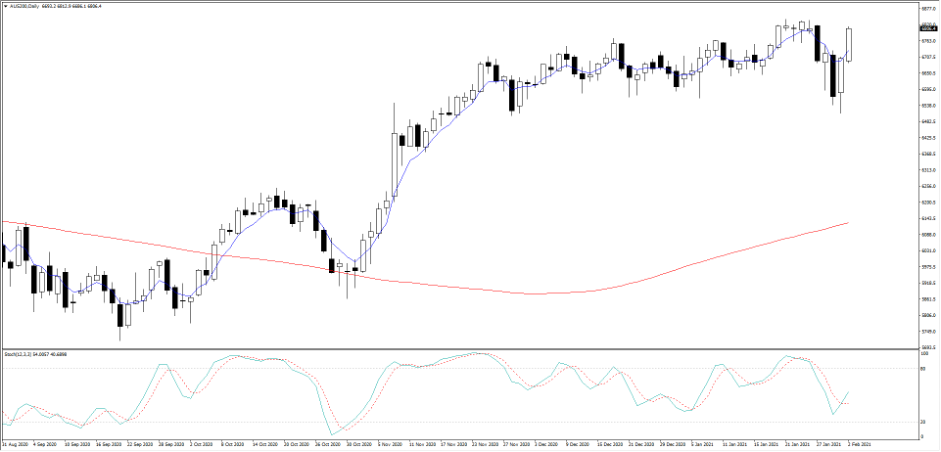

(AUS200 daily)

In Asia, the AUS200 look strong, and our index cash opening calls see this market having the outperformance vs Hang Seng, Nikkei and China A50. A test of the January highs looks in play, but whether the momentum is there to push through, and hold is what the technicians will watch for. Aussie earnings start to play a greater role from here and we’ll see greater single stocks volatility play out – outlooks from CEOs are the key, as its clear from yesterday’s RBA meeting that we’ve got a central bank who see better times ahead, yet whose reaction function is maximum dovish. How refreshing that they will go one step ahead of expectations to keep the AUD from looking more attractive than it has to be.

On a side note, with earnings in play it's a fitting time to release Aussie equities to clients. There's more intel here for trading some of the more liquid, blue-chip names that many of our valued clients have requested to better express thematic ideas more cleanly. For example, having two-way (long or short) opportunity on airlines due to changes in international travel restrictions. Having direct exposure to banks as the Aussie economy improves and credit is pushed into the economy or access to the oil plays, as a higher beta play over the oil price, which today looks so strong.

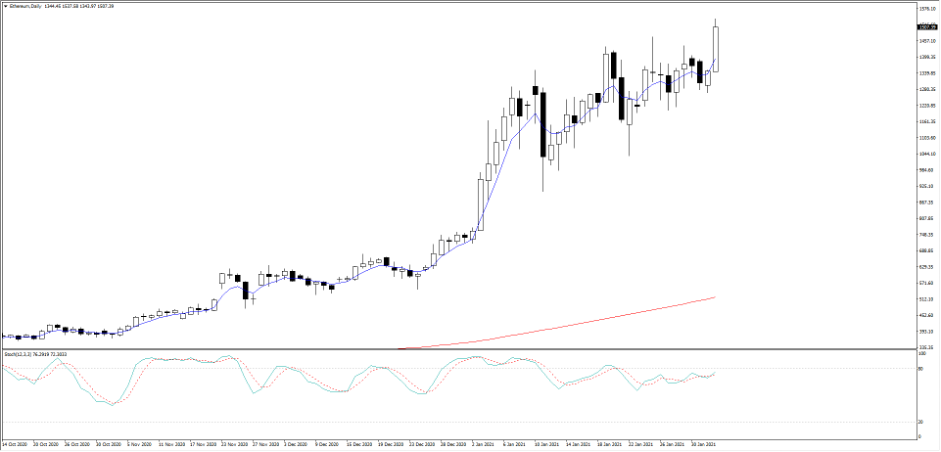

(XETUSD)

Crypto has been well traded, notably Ethereum which has broken $1500 and up double-digit and price looks really strong. 10-day realised volatility in XET has pulled back to 81% (from 186%), which is still punchy and again this is not the sort of instrument to trade if one’s risk tolerance is not there, as the moves can be extreme. Volatility is your guide to risk and if you respect vol then it can be your guide and friend – XET vol is rising, but the wave of capital is moving in one direction and traders are prepared to pay higher prices. One to watch.

In FX, the USD is up 0.2% but this is mainly a function that EURUSD has been sold all through EU trade, hitting a low of 1.2012 – Italian politics is starting to look dicey but there are many other factors in play. The set-up in USDX is looking quite attractive and interestingly hasn’t weighed on US equities – perhaps capital is flowing back to the US, where the fundamental backdrop for being long USDs over EURs is clear.

It’s the AUD which attracted a lot of the flow, having made a session low of 0.7564. A fall in iron ore and copper also weighing a touch, but the RBA didn’t waste time announcing an extension to its QE program and implying the yield curve control is set to run on. Most had an extension of its QE program pencilled in, but the RBA got it out of the way and a pre-active RBA is a positive change. By way of event risk, RBA gov Phil Lowe speaks today at 12:30 AEDT and may go into economics and policy in more depth.

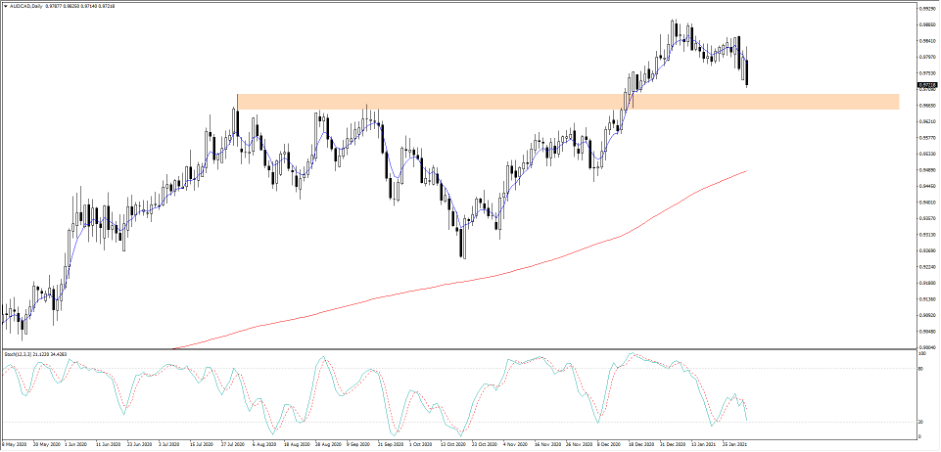

AUDUSD remains below the 50-day, and there's no real clear reason to buy at this stage based off price action alone. Shorts in AUDCAD, AUDNZD or longs in GBPAUD longs look the more compelling trade right now judging by the reversals seen on the daily. If oil can push higher here and ADUCAD takes out the 50-day, then AUDCAD should push to 0.9670 and 0.9627 fairly comfortably.

(AUDCAD daily)

GBP is a tougher proposition and while many are becoming reluctant GBP bulls we have the BoE meeting tomorrow and that may offer small insights into their world. My colleague Luke Suddards wrote on the BoE meeting, so take a look.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.