- English

- Italiano

- Español

- Français

Analysis

Economic Optimism Spreads To The UK

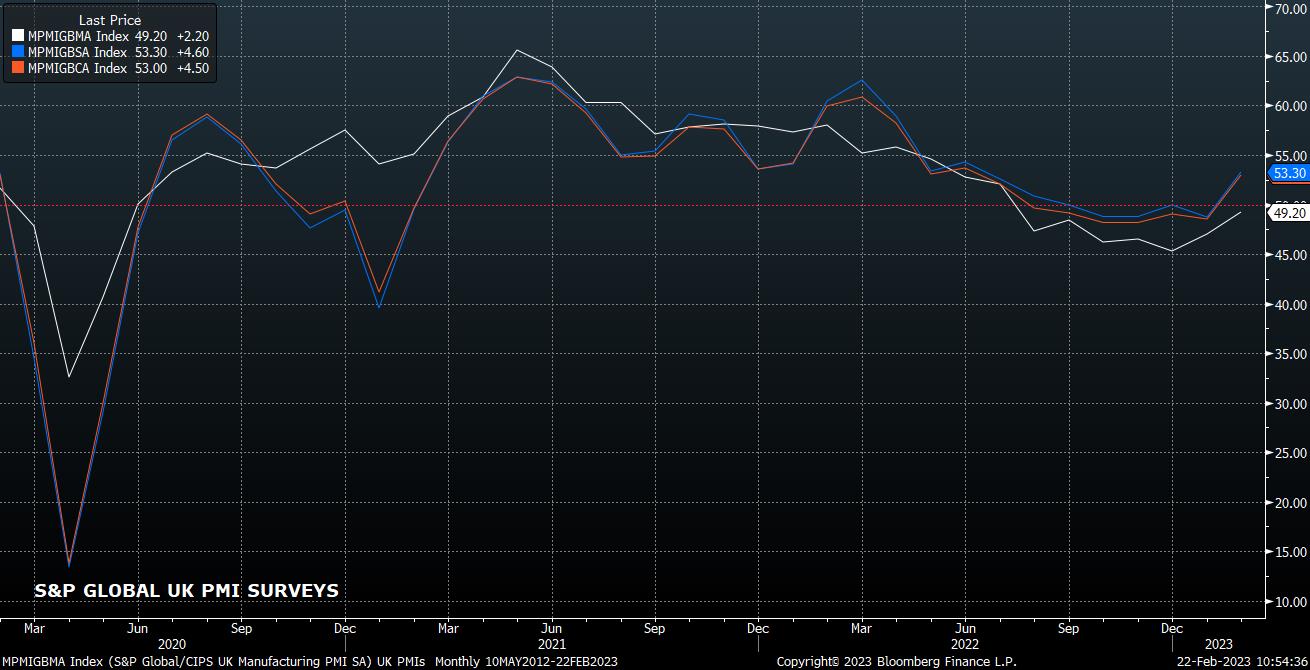

Tuesday’s surprisingly stronger than expected UK PMI figures have clearly led more than a handful of market participants to rip up the recessionary playbooks that they had outlined for the year ahead, after data showed an unexpected expansion in the services sector, along with substantially better than expected conditions in the manufacturing industry.

The market reaction to the figures was significant, and sudden; again being let by fixed income, as has been the broader theme across the globe of late. Stronger than expected figures led traders to re-assess their expectation that the BoE would bring the hiking cycle to an end next month, with money markets pricing in almost an entire extra 25bps hike in the spring between the data dropping, and this article going to press.

This hawkish repricing also saw gilt yields tear higher across the curve, with 2-year yields piercing the psychologically important 4% mark, while the 10-year tenor sold off by the most since 6th January. Unsurprisingly, this sparked notable demand for the GBP, which had its best day of the month against the greenback, though moves were more pronounced in the crosses – EUR/GBP touched near 1-month lows, while GBP/AUD rose to 1-month highs.

These moves leave one pondering whether the ‘doom and gloom’ narrative that has been pressuring the quid of late might have run its course. From a technical standpoint, cable has managed to hold above the 1.20 handle, with the bulls having also mounted a valiant defence of the 200-day moving average around 1.1940. Perhaps the ‘double-top’ formation that was on everyone’s radar won’t play out after all.

_2023-02-22_10-52-29.jpg)

It is, again, in the crosses however where better opportunities may present themselves.

Take EUR/GBP, for instance. The EUR side of the equation sees a rate curve that fully prices what the ECB have pledged to deliver, leaving scope for dovish disappointment, along with an economy that while performing well, now faces a higher bar when it comes to upside data surprises. Meanwhile, in the UK, data seems to be improving (not only in terms of activity, but also borrowing, with an unexpected budget surplus seen last month), energy prices are rolling over nicely, and the labour market remains impressively, and surprisingly, tight.

In this environment, a lower EUR/GBP seems like a logical expectation. The technical picture supports such a view, with price having closed below the bottom of the uptrend channel that has been in place since the turn of the year, and said resistance holding upon a re-test. The bears are likely to target the 100-day moving average around 0.8750 initially, though a break of this level could see spot trade back towards the mid-0.86s as seen towards the tail end of 2022.

_E_2023-02-22_10-52-02.jpg)

Long GBP/JPY is another cross that should be on the radar. The post-PMI rally rather stalled at a confluence of the 100- and 200-day moving averages just north of 163, though the bulls will be poised to pounce on a break above this level. A closing break here, and even better a move above the 50% retracement of the Q4 22 decline, leaves the door open to a return towards 165.

_2023-02-22_10-51-42.jpg)

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.