- English

- Italiano

- Español

- Français

Flip to the four-hour chart (of the US500) and you can see the support into 2955. One questions if we reclaim the 3000 level, then 3020 looks quite achievable — a level where traders have been happy to fade of late. I like the fact that the Russell 2000 (+1.1%) outperformed the large-cap index, with cyclicals outperforming the defensive sectors of the market, while volumes were in line with the 30-day average. S&P500 Implied vol has fallen a touch, and we can see the VIX index lower by 1.09 vols at 15.96%.

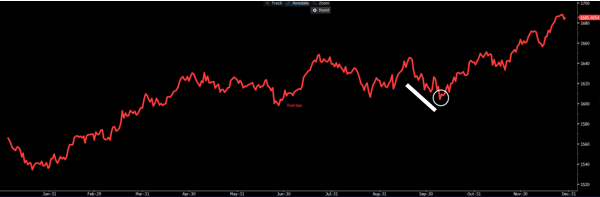

Another interesting factor is the seasonal effects in the S&P 500. Granted, we’re coming into the meat of the blackout period, where US corporates can’t buy back their stock, which has been such a massive suppressor of volatility. However, we’re approaching 9 October (circled area), which if we blend the index moves (into one) over the past 15 years, we see average index performance looking like this. Past performance doesn’t guarantee future returns, of course. But for those who assess seasonality, it’s worth highlighting the period ahead of us.

Fixed income and rates market still suggest further action from Fed

In the fixed-income world, we saw selling across the curve, notably driven by a sell-down in duration, leading the long end of the curve to underperform. That said, we’re seeing some buying through Asia today in US Treasury futures, with Twos’ -2bp and Tens’ -3bp yields on the headline that “the US imposes sanctions on certain China companies over Iranian oil,” and in turn this has pushed gold +0.3% and silver +0.7%.

I like to focus on the US Treasury Twos vs Fives spread as this has been an incredibly reliable predictor of the Federal Reserve easing cycles. While having moved a touch higher, it still remains inverted by 7bp, offering insight that we’re going lower in the fed funds rate. My basic model, in the meantime, suggests the fed funds rate is still 31bp too restrictive. Commentary from Chicago Fed President Charles Evans — a noted dove — that he sees US inflation rising 2.2% this year and sees Fed policy as “a bit accommodative” is at odds with my call.

The ‘goldilocks’ scenario in play

There’s no doubt that US data is coming in better than expected of late, and August new homes gaining 7.1% seems case in point. Dallas Fed President Robert Kaplan (modest hawk), who spoke in early Asian trade today, detailed that he forecasts solid growth in the US and a low risk of a recession in the coming 12 months. I can’t disagree here even if the risks for growth are skewed to the downside. For those who missed, I focused on the trigger points for a recession in the “A world looking over the edge” webinar. While we see warning signs in CAPEX and trade volumes — not to mention worrying economics in Europe and China — we’re just not seeing the moves in variables such as jobless claims, the US service sector or consumer data points.

In fact, if we look to next week’s US ISM manufacturing report, there’s a view we see this back in expansion at 50.5. One questions how the economic doomsday prophesiers will see the US economy if this comes out closer to 51.0.

The USD flying high again

It’s the USDX (USD index) and USD pairs that have been well-traded by clients, which won’t shock given the USD index closed +0.7% — the biggest daily gain since 1 July, and was a two-standard deviation move. It's hard to be short the USD with conviction given the backdrop and setup seen on the daily or weekly timeframe. Although the idea that we’re going to see the Fed purchase some $300bn+ of assets in the coming six months (likely starting November), increasing excess reserves, may start to impact the USD soon. It seems a matter of time beforeUS President Donald Trump tweets about the USD. Timing is obviously key, because a convincing break out in the USD is what I’m eyeing.

It hasn’t just been US data and Fed chatter behind the move. Trump’s comments on trade have resonated, too, as have moves in the US funding markets. The Fed offering out USD $60bn in 14-day system repo’s and $100b in overnight repos have seen funding markets (forward-rate agreement/overnight index swaps – white) trading tighter. And, as we can see from the inverse correlation, the USD subsequently rallied. Reduced concerns around the Trump impeachment proceedings have also helped, with the Department of Justice saying the transcripts of the call between Trump and the Ukrainian President didn’t breach campaign finance law.

EURUSD has garnered the lion’s share of attention with moves into 1.0937, although we’re seeing buyers stepping in through Asia and we watch for a breakthrough 1.0926 — that’d likely see USDX breakout.

USDJPY sits at 107.70 and has broken out of the flag pattern, as has CADJPY. Watch the retest here and act accordingly, but if the flag plays out true to form, the technical target sits north of 109.

The RBA meeting a must-watch

AUDUSD fell just shy of printing a bearish outside reversal with price printed a lower high, but the flow suggests an elevated risk of testing the 67-handle. Next week will be very interesting with the RBA meeting in play on Tuesday. Consider the market is already quite short of AUD (as we can see in the weekly Commitment of Traders report), and we see the demand of AUDUSD one-week 25-delta options has been to pay up for put volatility over calls.

Economists are split here, with 10/21 calling for the cut, while the markets (more importantly) have a cut priced at 75.4%. I’ll explore this meet in more depth on Monday, but the call could go either way and going long AUDs into the meet in the hope they leave rates on hold isn’t a straight-forward strategy given they’ll likely provide a strong view of a cut in November.

A better strategy, if you felt the risk is they hold, could be picking higher levels to work sell limits into, as we could easily see a quick move higher, followed by an equally quick move lower. I see a cut, however, and while there’s an argument to hold, if they’re going to cut, why wait? It's hard to believe the Q3 CPI print (30 October) is going to be materially different from its current 1.6% pace.

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.