- English

- Italiano

- Español

- Français

We saw the VIX index up 2.32 vols into 18.56%, pushing back into the 18% - 22% range short-term traders tend to find an attractive hunting ground. Vols in the credit and treasury market have pushed higher and look to be targeting the lofty levels we saw in August, although it’s disappointing FX implied volatility (IV) has barely budged. Even AUDJPY or AUDCHF IV have hardly moved, while cable one-month vols sit around 11%. And while this is high relative to other G10 FX vols, I’d be far more interested if this sat north of 12.5%. With British Prime Minister Boris Johnson plans to hand down his final plans to the European Union tonight — which are most likely going to find some serious headwinds from the Irish Foreign Minister — perhaps we’ll see higher GBP volatility. But it feels unlikely until after 11 October or 19 October.

Global growth called into question

Global growth has been brought into question again after we saw some paring back of some crowded Armageddon trades of late. Granted, manufacturing equates to a mere 11% of US GDP, but the market (especially fixed income) is incredibly sensitive to the outcome. So, we tend to take it badly when it comes out well below consensus, especially when that outcome turns out to be lowest level since January 2016. Global manufacturing sits at a post-crisis low, too.

We’ve seen the effect on volatility. But we can look into the fixed-income world, with solid buying seen in the short end resulting in the UST twos vs 10s curve steepening by 5bp. We saw US five-year real (or inflation-adjusted) yields lower by 4bp into 15bp, so it’s no surprise that a number of gold traders have had to square and reversed their shorts, now assessing price action into USD $1284 and the former range low.

January fed funds future rallied 5bp, subsequently taking the implied chance of a December rate cut (from the Federal Reserve) into 63%. The market now feels that on balance we’re going to see not only a rate cut but the simultaneous announcement of a restart of QE — or measures to increase the balance sheet. This has weighed on the USD a touch, with the DXY pushing into trend resistance and finding supply.

All AUD sellers

It's been all AUD sellers in G10 FX, though. And if you wanted to take a more defensive position, the better vehicle here was short AUDCHF than AUDUSD. We’re seeing the reaction today in Asia, with the Aussie three-year Treasury trading at a record low of 63bp, while the 10-year sits -3bp at 95bp. The international appetite for Aussie bonds must be sky-high. The ASX 200 sits -1.4%, on volumes in line with the 30-day average, with the Nikkei 225 sitting -0.6%.

The ZAR has also fared poorly, with USDZAR making a play at the August highs. When global growth is being called into question and we see higher equity and rates vol, we sell high-beta currencies — EM, AUD and NZD. Marry that with the Reserve Bank of Australia effectively opening the door to another rate cut this year, and it’s like red rage to a bull. In this dynamic, selling any strength in the AUD is going to work well, especially against the CAD, JPY and CHF, with AUDCAD at the lowest levels since 2010.

Daily chart of AUDCAD

Buying USD versus higher-beta FX is less assured (than CHF and JPY) given last night’s ISM manufacturing. That said, traders still must navigate through Thursday’s US services ISM and Friday's non-farm payrolls report, as they do Fed Vice Chair Richard Clarida’s speech. He’ll be speaking during early Asia trade on Friday. Let’s see how the data falls. But as we head into high-level talks between the US and China and a pivotal moment in the Brexit process, one questions the logic in Clarida being anything but accommodative.

RBA has a tough task changing the psyche of the consumer

Touching back on the RBA, it's interesting to see the level of focus in this backdrop not just from our antipodean clients but broader global participation. The world has both Australia and NZ on its radar, and the potential next step given the diminishing returns that’ll come from cutting the cash rate further. What’s interesting is, Aussie 12-month swaps sits at 10bp — effectively portraying that in 12 months’ time, the RBA’s cash rate will on balance sit at zero. They could be wrong, of course, but by strengthening its policy objectives to achieve full employment (we can take that to be c. 4.4%) and the inflation target (that being 2-3%), one questions how on earth they’ll achieve this by cutting rates alone.

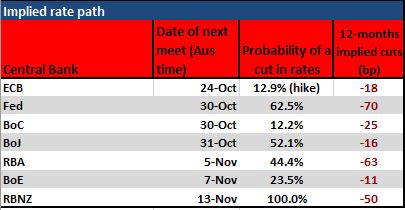

Rate cut expectations

As they stressed, external factors are a major consideration. There’s little they can do here. But on a domestic basis, if they want to change the consumer’s psyche, boosting animal spirits that feed into business confidence, we need a sharp jolt to the system. Make your own conclusions here, but cutting rates to zero isn’t going to cut the mustard. Forex traders know this, and a conversation around unconventional policy will need to play out at some stage.

It's never easy being a macro trader. One minute we look at a world asking what if this trend of economic beats continues, the next we’re looking at some disturbing manufacturing data points.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.