CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

- English

- Italiano

- Español

- Français

The Daily Fix: December off to a flyer as inflation expectations ramp up

Clearly, new money is entering at the start of the month and there's been a strong pro-cyclical bid in risk in most parts of the markets.

EU and US equities are firm with the S&P 500 closing +1.1% with turnover in-line with the 30-day average, while NAS100 turnover was some 60% above the 30-day average. Breadth was ok with 76% of S&P 500 companies higher, where cyclical and inflation-inspired stocks worked, with the gains led by financials and tech, materials and REITS looking good too. US Treasuries have also sent out a message with 10’s and 30’s up 9bp and 10bp respectively, resulting in a strong steepening of the curve.

If inflation is the buzz word, perhaps the best equity market to own is the Nikkei225 given so many domestic funds are overweight JGBs. If inflation actually makes it way to Japan, which is a huge if, but even if the perception is it becomes a modest threat, then these funds could reweigh towards equities. Speculative funds may already be front running this trade.

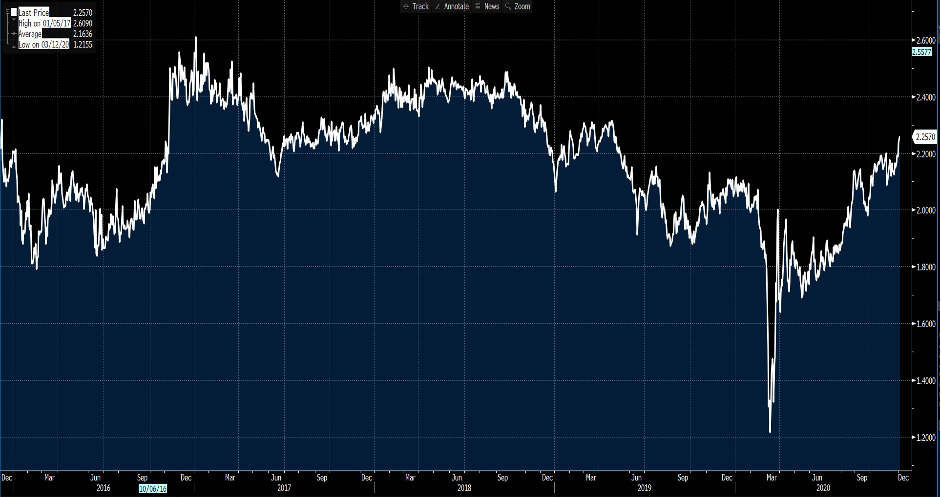

(US 5y inflation swaps)

(Source: Bloomberg)

It's hard to go past the USD flow as it's been at the helm of everything. The USDX is 0.7% lower and has broken down and volumes have rocketed higher. There's no clear reasoning here, other than upbeat sentiment is causing flows into other corners of the globe. US data was fine, the ISM manufacturing was modestly weaker at 57.5 vs 58.0 eyed and construction spending was +1.3% MoM.

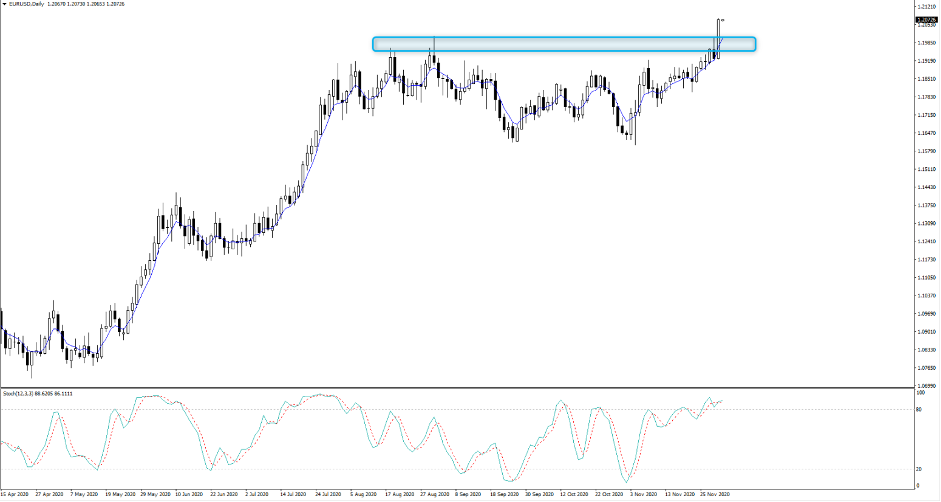

EURUSD daily

EURUSD smashed through the top of the range, which was something I focused on yesterday and this could be meaningful. If price can hold above 1.2000 it could provide the platform for something more progressive, but we need to be mindful of any ECB speakers from here on, as the prospect of a central banker talking down one-way EUR moves has increased. This risk gets extra credence ahead of next week’s ECB meeting, but we should consider the USD move is a clear positive for EM and that will have a positive feedback loop for European economics.

(US 5y inflation swaps)

(Source: Bloomberg)

One has to look at EUR 5y5y forward swaps, where we see inflation expectations headed higher despite the EUR move. This is fitting in with rising inflation expectations in most developed market countries and the view that 2021 will be a year of economic recovery. However, it would be a whole other argument if EU inflation expectations were falling amid a stronger EUR. Next week’s ECB meeting (10 December) looms large and traders at this stage don’t seem concerned about holding EUR longs into it. That said, a week in FX markets is a decent stretch.

We’ve seen good flow in GBPUSD with cable having a solid run from 1.3360 to 1.3440 on a tweet from Tom Newton Dunn (Chief Political Editor) at the Times. By all accounts we’ve entered “The Tunnel” and the key make or break period, with hopes on both sides of a deal being reached by the end of the week. We’ll see, as we’ve heard this sort of narrative before and one has to consider the Brexit premium already priced. There is a camp here calling for a buy the rumour sell the fact to play out in GBP, that's if we get a deal. I'm not sure that it'll be that binary, as we so often see twists within twists and nothing is ever straight forward.

EM FX has seen some flow, with USDMXN and USDZAR having moves and eyeing a potential re-test of the recent lows. USDCNH is at session lows and remains central to my macro world here – where USDCNH weakness is one of the most important factors driving broad USD weakness and supporting copper, iron ore and giving real backbone to the reflation trade for 2021. The level of carry involved in USDCNH makes it compelling to be short and given relative deposit rate settings CNH 12-month forward points sit up at 1673 it’s hard to be long this cross.

There's no getting past the moves in precious metals either, as finally the buyers have stepped back in and certainly in silver it was a solid snapback. On one hand, we know gold was grossly oversold and had diverged from real rates and USD weakness, so the flush out had played out and the relationship wasn’t going to breakdown forever. There's been some selling in the crypto space, so whether that's had a hand in pushing up gold et al is unclear. Either way, gold has been a shining light with price closing above the 5-day EMA for the first time since 11 November. The question is whether we can push into 1848 and the former breakout low? That's the line the gold bulls need to face to assess if this is more than just short-covering or an oversold rally.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.