CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

- English

- Italiano

- Español

- Français

If Mario Draghi brought out the big guns at this week’s ECB meeting, then the reaction to the FOMC meeting confirms that the market wasn’t disappointed by all they heard in the hours between 4 am and 5 am GMT+10.

If Mario Draghi brought out the big guns at this week’s ECB meeting, then the reaction to the FOMC meeting confirms that the market wasn’t disappointed by all they heard in the hours between 4 am and 5 am GMT+10.

The “dots plot,” or its fed fund projections, on where each Fed member sees the fed funds rate by a set date, have been a market-mover when so many had said they were redundant. With seven Fed members now forecasting a 50bp cut this year, a movement has started. The Federal Reserve Governor Jerome Powell even went further, detailing that those members whose “dot” call was unchanged for this year felt “added accommodation may be necessary.” They just need a bit more convincing.

The removal of “patient” was mostly in the price, where we see new guidance, and where “in light of these uncertainties and muted inflation pressures, the committee will closely monitor the implications of incoming information for the economic outlook and act as appropriate to sustain the expansion.” Another highlight of Powell’s speech were the lines: “In a world where you’re closer to the zero-lower bound, it’s wise to react to prevent weakening from turning into prolonged weakening.An ounce of prevention is worth a pound of cure.” Aside from the theatrics in his choice of words (my emphasis), it gives us a belief that when they ease, they could try and get ahead of the curve. This appeals to the magnitude of easing.

The triggers for a 50bp cut

The reaction in rates markets couldn’t be any clearer. Now we see a 100% probability of a cut at the July meeting, and over 100bp (four cuts) over 12 months. The question of a 50bp cut in July has come up, and I guess that’ll be determined by the outcome of the G20 meeting later this month. But we have to consider the data, too. Between now and 31 July, we look for core PCE (28 June), ISM manufacturing (2 July) and non-farm payrolls (5 July) as our guide. Specifically, if US non-farms come anywhere near the numbers, we saw in May, then, 50bp is a thing. In the market’s eyes, it’s on — and a race to the bottom. This notion of currency wars is kicking fully into gear. It feels like this week is genuinely significant, with powerful insight to what could lie ahead.

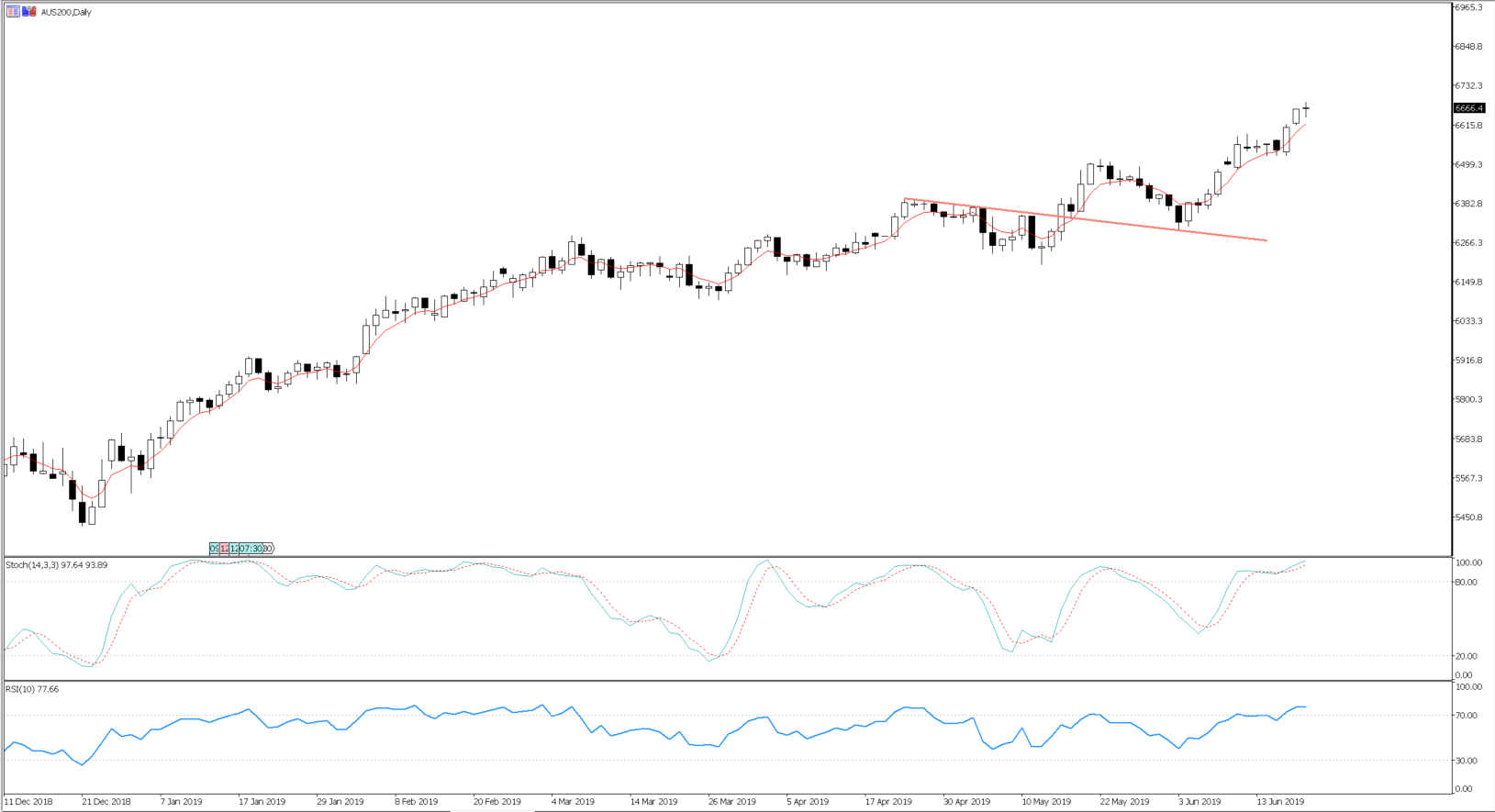

While we’ve seen Asian equity indices finding buyers, it’s the flow in our ASX 200 index that’s been noticeable. Interestingly, the ASX 200 is just 2.8% from a test of the 1 November 2007 all-time high.

Valuations are punchy here, and the forward price-to-book is at an all-time high, with the 12-month price-to-earnings ratio at 16.22x — the highest since December 2017. I’m not sure valuations matter too much when we look at subdued and implied volatility, as well as Aussie bonds yields, which are negative if we adjust for inflation expectations and the “real” return. The market will generally be interested to pay up for those earnings in this dynamic, especially as the current earnings yield in the index is now some 427bp (or 4.27ppt) above what Aussie 10-year bonds yield.

And it’s the moves in bonds that have reverberated — they’re in beast mode right now. We can see when US two-year Treasury’s smashed through 1.80%. It just heightened the need to buy more, and the 50-week average at 1.59% beckons. US 10s have sailed through 2% through today, trading a further 5bp on the day to 1.97%. While there’s just so much love for bonds, this is a juggernaut that few sellers are going to get in the way of. If we adjust these bonds for inflation expectations, and look at 5- and 10-year Treasury’s on a “real” basis, then at 17bp and 28bp, they’re not too far from turning negative. In Aussie fixed-income markets, we see the inflation-adjusted yields in Aussie 10-year bonds now at -9.9bp — a record low.

Gold is the best house in a progressively awful neighbourhood

If the loser from the moves in rates and bond yields is USDJPY, which we see at 0.3% lower at 107.73, the beneficiary of these moves in bond yields is gold. Our flow has lit up today. We’ve mostly seen two-way flow in USD-denominated gold (XAUUSD). We’ve also seen good buying of AUD-denominated gold (XAUAUD), which has smashed through A$2,000 and into new highs.

The FX translation effect isn’t a huge issue at this point, as gold is rallying in every G10 currency, including NZD, which is the best-performing currency today after a slight hotter-than-forecast Q1 GDP (2.5%). When gold is rallying in every currency, you know it’s hot. Traders see gold as a currency in its own right and the best house in an ever-deteriorating neighbourhood. As long as real rates are headed lower, the pool of negative yielding bonds increases (currently $12.3t), then gold is only going one way.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.