CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

- English

- Italiano

- Español

- Français

The Daily Fix: Could pension fund rebalancing cause a dip in risk assets?

We're also coming to month-end and the prospect of sizeable pension funds rebalancing should be a consideration for the bulls, given the absolute magnitude of the outperformance from equities over bonds in November.

This would result in funds selling equity and buying bonds to bring their exposures back in line with their set mandates.

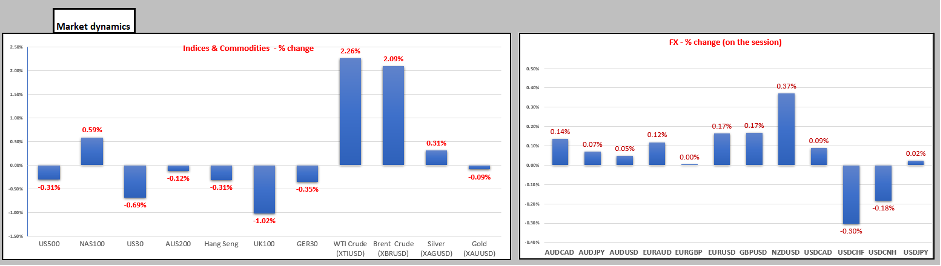

There's been some talk of funds selling USDs to rebalance, with talk of better buying of USD puts to capture this. There may be some merit to this given the USD has been offered across the spectrum with higher beta currencies, such as the NOK, ZAR, and SEK outperforming. AUDUSD is unchanged on the day having traded down into 0.7325 twice, before staging a move back to where we sit now at session highs.

The news we've seen hasn't impacted to any great extent with US weekly jobless claims coming in higher than expected at 778,000 vs 730k eyed. US Durable goods beat the street at 1.3%, while personal income declined -0.7% and with personal spending slightly better at 0.5%. The University of Michigan released its 1yr and 5-10yr inflation survey which was tweaked from the preliminary release to 2.8% and 2.5% respectively, and the Fed do look at this as part of a holistic inflation model.

Interestingly, when we aggregate the data we saw the Atlanta Fed upgrading its US Q4 GDP Nowcast model from 5.9% to 11%. If this comes anywhere near to fruition is far in excess of the current economist consensus of 3.2%.

FOMC minutes fail to provide a spark

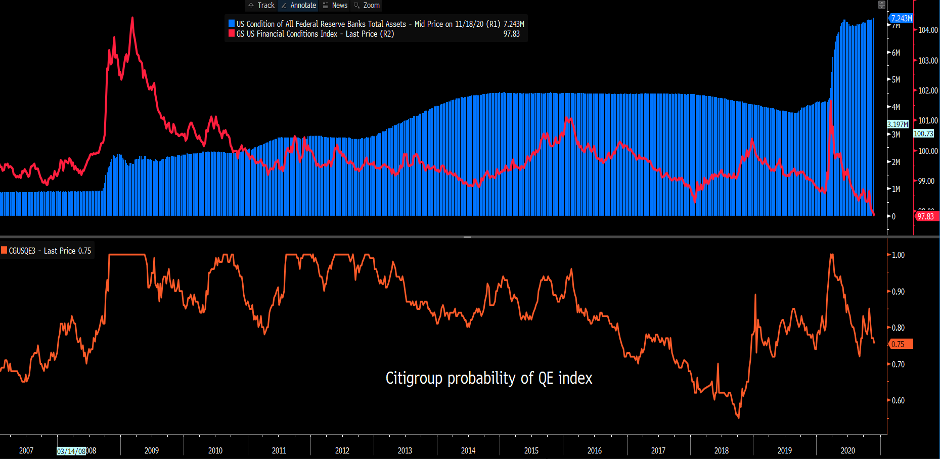

The Fed released the minutes from the November 4-5 meeting, although again the narrative failed to spark any life into the market. The wash-up is there's no real urgency expressed to increase either the run-rate or the weighted average maturities of monthly asset purchases in the upcoming December FOMC meeting. They certainly haven’t ruled this out either though, but given how incredibly easy US (and global) financial conditions are and how real-time data is holding up, there's hardly the necessity to change tactics at this stage, but the flexibility is there.

Top pane – Goldman Sachs US financial conditions index (orange) and the Fed’s balance sheet (blue)

Lower pane – Citi’s probability of QE model

The of lack of urgency to move from the Fed may disappoint the bulls to an extent, but the prospects of additional QE from its current run-rate of $120b p/m had diminished anyhow given recent market moves. So with my financial stability hat on, there should be about a 15-20% chance of additional asset purchases in the December meeting.

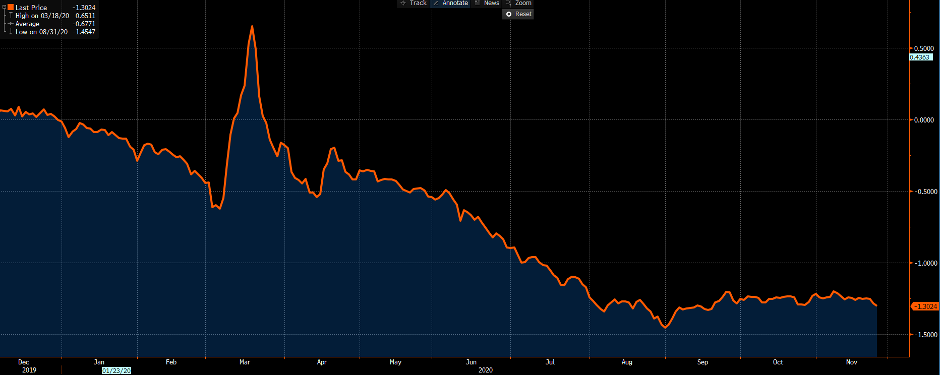

I've previously argued that the Fed could really seize the opportunity and go hard now and promote a hot economy, pinning down the 10-year part of the Treasury curve, boosting inflation expectations and subsequently pushing down real yields. The fact then that the market has lowered expectations for near-term additional QE, yet real Treasury yields are still falling suggests we shouldn’t be surprised by this statement.

(US 5yr real Treasury yields)

I also think we should consider the fact that “most” Fed officials are looking to add into its future narrative, qualitative guidance surrounding the conditions required to taper the monthly run rate of purchases. This seems like an incredibly prudent thing to do if they are to convince the market that organic growth can take over from QE – Imagine that.

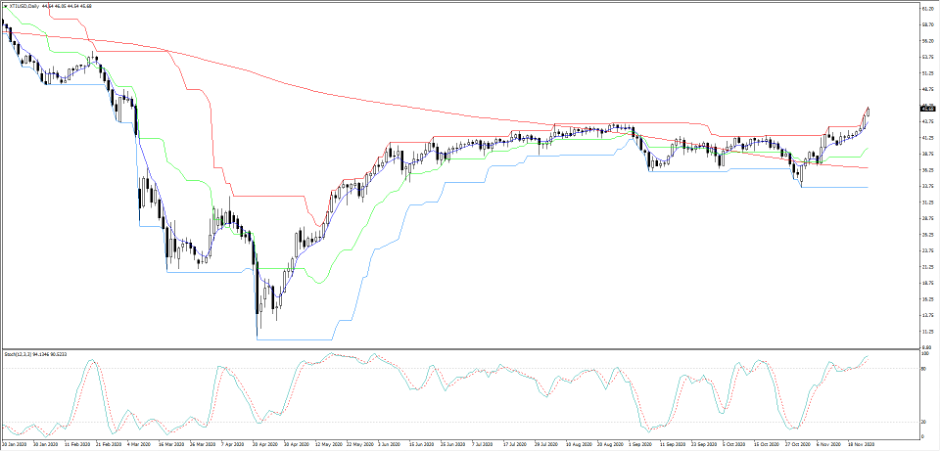

(XTIUSD daily)

Elsewhere Crude continues to find buyers through the recent breakout above $43.50 and pushing up to $46. A weaker USD is helpful but we also saw the weekly crude inventory result in a drawer of 754k barrels, while there's been plenty of headlines of a ramp-up in demand from Asia, notably India and China. The crude market has had a good run and one where it really wouldn’t surprise to see a slight retracement here.

We’ve also seen good flow in the crypto world, with Ripple getting attention given the continued massive daily ranges seen, while we watch for new highs in Bitcoin.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.