CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

- English

- Italiano

- Español

- Français

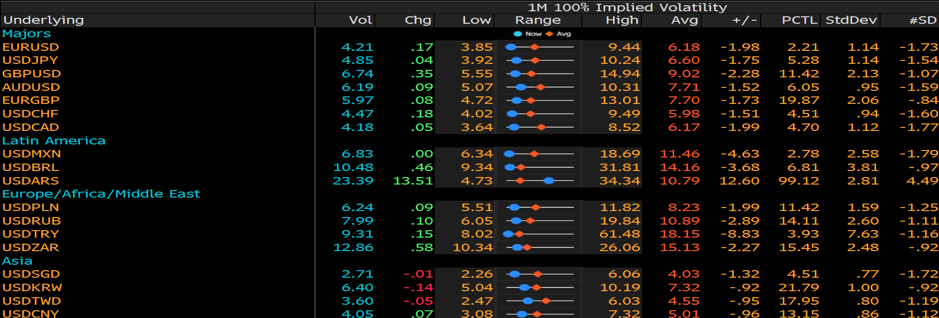

This seems fair given the Teflon nature of markets and the ability to shrug off any vol events – however, we also should consider the cause of this - low implied volatility (the VIX index sits at 12.3%, FX vols can be seen below), the Fed/BoJ/ECB growing their balance sheets by c$100b a month, positively trending equity markets (and very tight credit spreads), and stability in global economic trends.

The fact USDCNH is trending lower is also a core considering, and as the yuan is strengthening, so too are a number of other Asian currencies. It is likely keeping the AUD supported too.

(Implied vols across FCX markets nearly all below 20th percentile of the two-year range)

The fact that the US Treasury department has taken China off its currency manipulator list this morning shouldn’t surprise too much, although the fact the they left off the THB, TWD and VND from its list has surprised a touch. Consider this as a symbolic gesture ahead of tomorrow’s US-China trade talks.

Carry is a thing right now, and it makes sense as FX players adjust to the trading backdrop and deploy their strategy accordingly. It's no surprise, then, that EUR vs EM FX is under pressure as the EUR (and CHF) remain the dominant ‘funding’ currencies for carry.

Central bank divergence a headwind for sterling

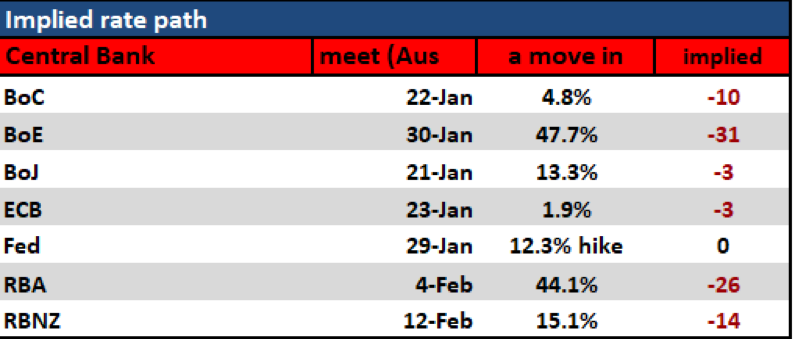

Another core strategy, which is probably more beholden to rates and FX trading, is making a play on central bank divergence. At its most simplistic (or extreme), divergence occurs where one central bank is eyeing rate hikes, and another offers guidance about future easing. We can look at the UK here, as this is playing out right now, where various members of the MPC have been stating their case to ease policy in the near-term.

As we can see from the rates table below, where I focus on what’s priced for the next central bank meeting, and what’s priced over the coming 12 months, we can see an almost 50% chance the BoE cut on 30 January. This probability sat at 23% yesterday.

Of the nine MPC members, we know Saunders and Haskel have already called a cut in December, but in the last week, we’ve also heard comments from Carney, Tenreyo, and Vlieghe, that gives traders the real belief that there will be the required 5 MPC members voting for a cut later this month. The fact UK rates markets are priced at 50/50 suggests GBP vols should rise into the meeting and rallies in the GBP crosses are to be sold.

A poor UK (Dec) CPI print tomorrow or (Jan) PMI print next week (on 24 January) could see this pricing closer to 70% and GBP continuing its merry march lower.

It’s no surprise then that GBP has been the worst performer given the views from the central bank, where economic data has been at the heart of that. This is interesting, as it cements the notion that GBP has moved from being an out-and-out political currency to one that is more influenced by cyclical factors. Recall, during the Brexit negotiations data meant very little to the GBP, and now the trend in economics has actually resulted in a dovish shift from the bank.

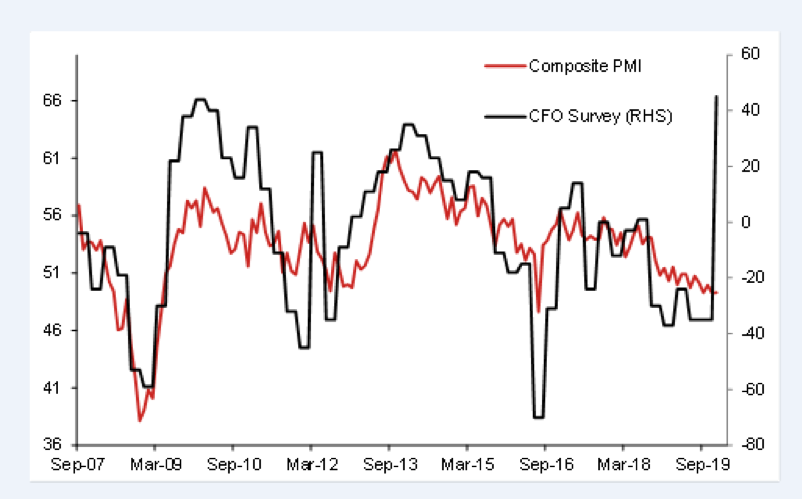

GBP bulls will take heart in the CFO outlook

GBP bulls will have taken heart, however, from Deloitte’s Quarterly CFO survey, which was conducted between 13 December to 6 January (post UK election), having shown a solid increase in optimism – this is what we wanted to see manifest into a bounce in business confidence and CAPEX into Q320, and the potential trigger for a more hawkish turn from the BoE - notably given the tight labour market and the fact the neutral rate of interest is over 100bp over the cash rate.

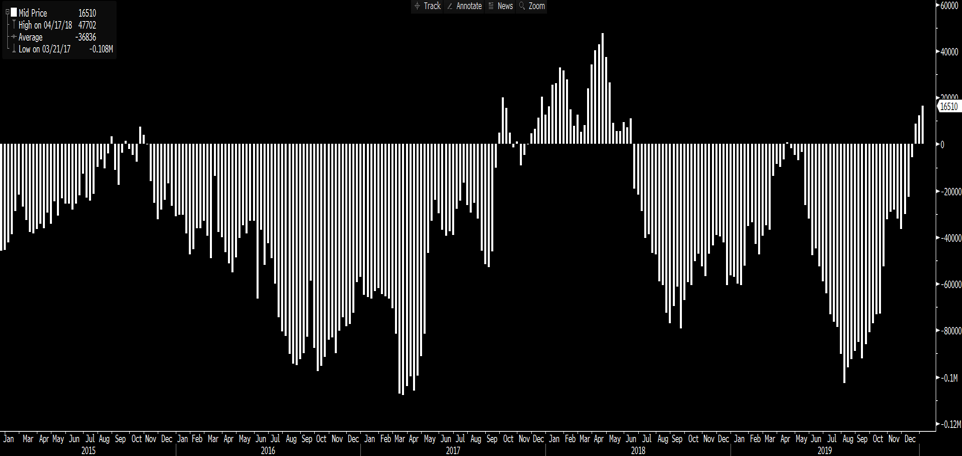

Consider, if we look at the weekly CoT FX futures positions that net longs have been steadily rising and while clearly not at extremes, the speculative trading community is net long.

So, GBP is firmly on the radar, as the moves to price in a cut this month has been swift, and to some, it has come from almost nowhere. Even EURGBP looks bullish here, although GBPCHF shorts have worked nicely and as we see on the daily it's hard to be long the cross. Tactically, I would be waiting for the PMI data to make itself known, before I even considered buying the GBP.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.