- English

- Italiano

- Español

- Français

Bitcoin Breaks $100,000 – Key Drivers, Market Reactions, and What Comes Next

We saw very little defence and supply (from the sellers) in the move through $100,000, and perhaps after spending much of January above $100,000, the taboo of having 100 as the front number has dissipated. We shall see, but given the focus on Trump’s trade deals, the rebound in equity, and the ongoing debate around the USD and US recession risk, the rally in Bitcoin and crypto more broadly has flown under the radar for many, in what has been somewhat of a stealth rally.

That re-focus on Bitcoin from a broader array of market players has now increased, with media mentions of Bitcoin starting to increase, as are our client volumes in Bitcoin, Ethereum and the bigger market cap coins. Clients continue to be biased for further upside in price, with 72% of open positions in our Bitcoin CFD held long, and it’s interesting that, unlike in January, when price broke above $100k, we haven’t seen any notable pickup in short positioning flow.

The Trading Playbook?

After such a strong run, the scenario of a short-term pullback into the breakout high of $97,944 is a risk. Should it play out, it would offer traders insights into the sustainability of the rally, as my thinking is that as long as price holds the former highs and can hold (on a daily closing basis) above the 5-day EMA and 8-day EMA, the bias is for a run at the ATHs at $109,571.

Many will find it hard to initiate new longs above $103k, but with sentiment rising but nowhere near euphoric levels and bullish positioning starting to build (but not at extremes), if price kicks above $104k, then the momentum in the price is there for the chasing.

If the move really kicks onto the radar of the momentum accounts, with the move perpetuated by further short covering and options hedging flows, the prospect is that we could see a push into $120k over the coming weeks, before consolidating in a $120k-$108k range.

Assessing Sentiment and News Flow

Sentiment reflects the recent price drivers and news flow, and the anticipated catalysts, and these have been numerous. While there are many others, I would highlight the following:

- The suppression in the cross-asset volatility and the rebound in the S&P500 and NAS100 futures have been a tailwind for crypto. The 5-day rolling correlation (between Bitcoin and NAS100 futures) is impressive at 80%, with the 20-day correlation at 37%, having recently pulled back from 80% on 5 May. While relationships break down, if the NAS100 can break above the 200-day MA and the 25 March highs, this would likely provide further tailwinds for BTC.

- On Thursday, Coinglass reported the biggest day of short covering of BTC positions since 22 April – expect further short covering to play out should price kick higher.

- Over the past few weeks, we’ve seen well over $5b of inflows into the various spot BTC ETF’s, with net inflows seen on all but 2 days since April.

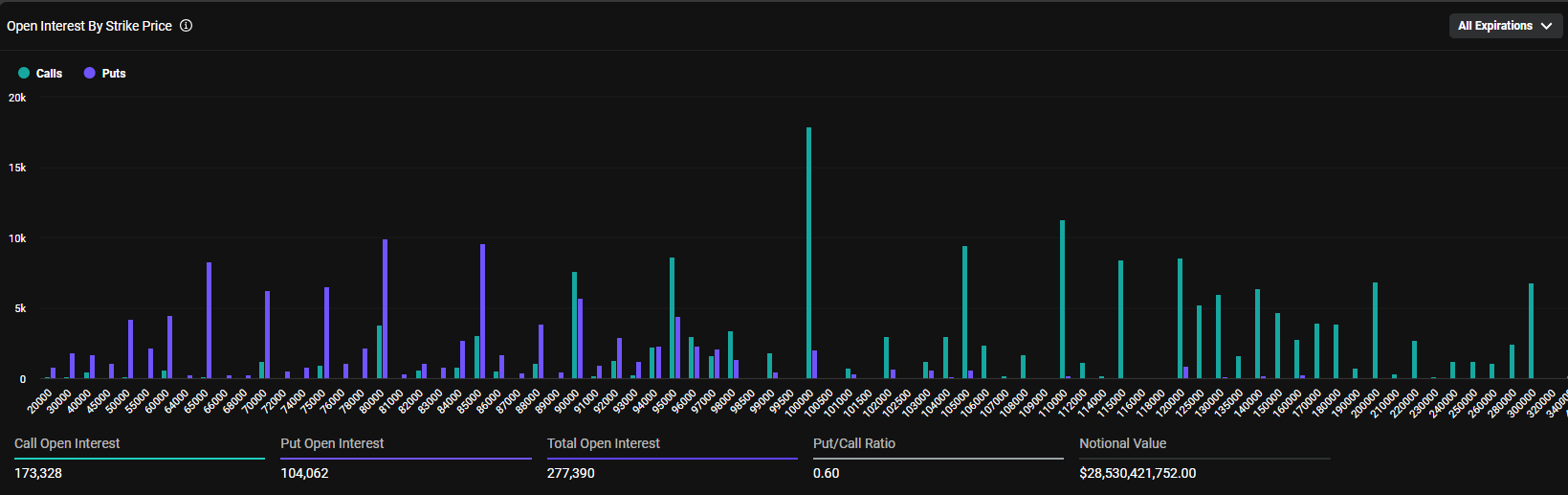

- Options are playing a role in driving the BTC price appreciation – Looking at open interest in options positioning on sites such as Deribit, we see high open interest in call options at the $105k, $110k and $120k strike and across the many expiries. This dynamic is also true in the IBIT ETF (iShares Bitcoin ETF) with high open interest in the $60 strike for 20 June expiry.

If the BTC price can rise further, options market makers will dynamically hedge their gamma exposures by buying BTC perpetual swaps, ETFs, or futures, which subsequently feeds into a higher BTC price. - MicroStrategy (MSTR) have resumed its buying activity and on 5 May disclosed they had bought a further 1895 Bitcoin’s (purchased between 28 April to 4 May). MSTR now own 555,450 coins or 2.6% of all Bitcoin’s in circulation.

- There is increasing market talk that other US corporates are looking to add Bitcoin to the assets they hold on the balance sheet.

- A recent report showed the Swiss National Bank and the Norges central bank buying MSTR to hold in their portfolio. • The Abu Dhabi Sovereign Wealth Fund recently disclosed it had purchased the IBIT ETF (iShares spot BTC ETF).

- The US state of New Hampshire (NH) recently announced that the treasurer department could purchase up 5% of the capital in state’s strategic reserve fund in digital assets – this could open other progressive US states to follow NH in increasing digital assets as part of their strategic asset allocation.

- M&A in the crypto eco-system – we’ve just heard that Coinbase has put in a bid for Deribit for $2.9b.

- The FOMO chase could build, even above $100k – Bitcoin exudes the phenomenon of ‘Fear of Missing Out' like few other asset classes - where the idea of buying higher and selling at higher levels can often work well as a trading strategy for Bitcoin traders.

There are other catalysts that have lifted sentiment towards Bitcoin and the crypto ecosystem, and while we naturally need to consider the risks – either to crypto or macro markets more broadly – the current trend in Bitcoin looks strong, and pullbacks should be well supported. If Bitcoin wasn’t on the radar before, given its qualities as a momentum trading vehicle, it should be now.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.