CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

- English

- Italiano

- Español

- Français

They did give their blessing for a short-term plan of $540b, although we have no idea how it will be funded and this is not the panacea to stop an impending 15% contraction in GDP - 15% being the number ECB president Lagarde made mention of overnight.

EURUSD has seen whippy price action, trading a range of 1.0846 to 1.0756 through European and US trade, and is currently sitting towards the low-end of the range. The technical set-up on the daily has become just that bit more damaged and the prospects of a re-test of the 23 March low has increased a touch, but the bears will want to see the 6 April low give way.

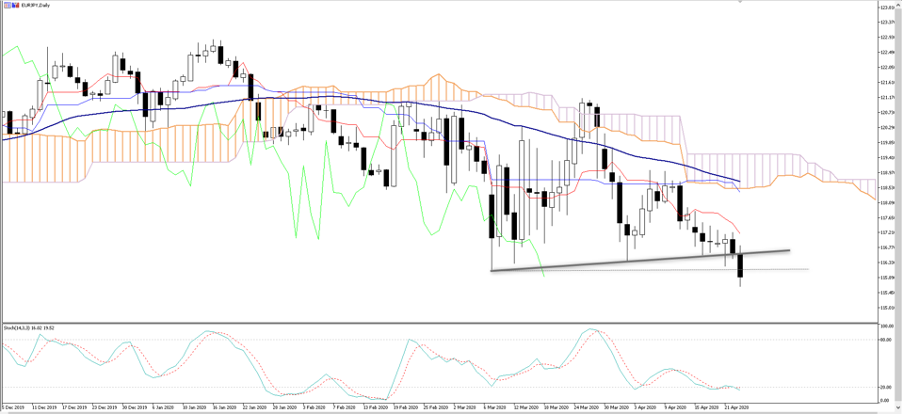

I looked at EURAUD shorts in yesterdays ‘Daily Fix’ trader thoughts and I’ve added to that position through 1.7014, as its working well – as in life, if something is working you do more of it. The 100-day MA at 1.6771 beckons. EURJPY (see chart below) also gets attention as we’ve seen a break down through the September lows of 115.87 and a convincing break here opens up a test of the 115-figure, where there’s not as huge amount of support through here.

There has been no move in EUR vols, with EURUSD 1-month implied volatility holding below 8%, but one factor that some traders are talking about is the Euribor-OIS spread. We see this pushing up sharply, suggesting growing stress in the EU banking sector. Granted, we’re some way from the levels seen in the GFC or even the European debt crisis (2011), but there are a few stresses in the system that are getting attention and if they start to really move higher the EUR will find sellers easy enough.

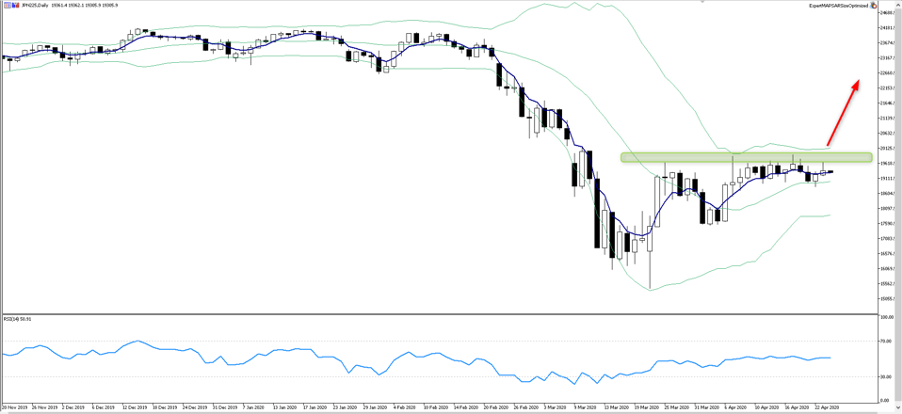

Staying on the JPY, there has been a focus on the idea that the BoJ will announce a plan to remove its ¥80t bond-buying limit. The central bank is due to meet on Monday and we may hear plans then, but we haven’t seen much of a broad sell-off in the JPY as a result. We can focus on the JPN225 (Nikkei 225) as this could be a beneficiary if the BoJ do step up its liquidity drive. On the daily, which is good for oversight here, I see both the 5-day EMA and 20-day MA headed sideways, with the RSI mid-range – it’s a range traders paradise right now, but my view is to let the market come to me. For that, I would buy a closing breakthrough 19,886. That would give me some belief the market is benefiting from changes to BoJ asset purchases and ready to trend.

USDBRL has seen some flow too, with the pair hitting a new record high of 5.5554, largely thanks to Justice Minister Moro resigning. NZDUSD has printed an outside day (on the daily) and could make a tilt at the 50-day MA at 0.6095 – watch for follow on here, and if this prints a higher high today it could take us to the average and 14 April high. More positive times have been seen in the NOK, with better flows seen in crude. As I type front-month Brent sits up 7.2% and WTI 23%. I am not sure much has fundamentally changed, but price has shifted. Interestingly we haven’t seen any real relief in inflation expectations, with 5-year breakevens unchanged, with the HYG ETF closing -0.05%.

The S&P500 also closed -0.05%, again on light volumes, with futures finding sellers after the close. One to keep an eye on as there was no interest in participants supporting the index above 2800. Asia looks to open on a flat note and while we react to price, my hunch is sellers will get the upper hand through trade.

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.