CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

- English

- Italiano

- Español

- Français

A Playbook for The Last ECB Decision of 2022

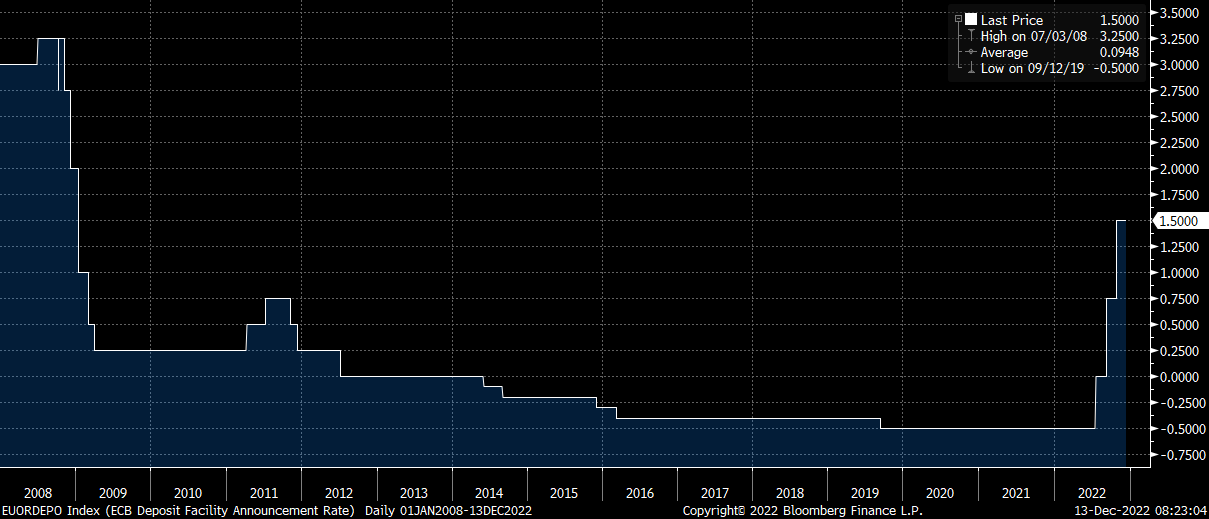

Markets assign a roughly 90% chance to the ECB downshifting to a 50bps hike at this meeting, after back-to-back 75bps moves at the prior two meetings. While highly likely, such a slowdown in the pace of tightening is unlikely to be a unanimous decision among policymakers, with several – including Holzmann and Schnabel – having expressed reluctance to ease off the economic brake pedal before seeing further concrete signs that inflation in the eurozone has peaked.

Said signs are beginning to emerge, with the latest ‘flash’ HICP data pointing to a sharp moderation in price pressures last month, with the headline gauge rising by 10.0% YoY, down from 10.7% a month prior. Almost all of this decline, however, was driven by a sizeable decline in energy prices, and a surprise 0.2pp rise in core inflation to 6.6% YoY will give the hawks some ammunition coming into Thursday’s decision.

While headline inflation is beginning to recede, the ECB’s staff macroeconomic projections are likely to see the HICP forecast revised sharply higher in both 2022 and 2023, with the ECB simply ‘marking to market’ its projections, as it has done for much of the year. The 2024 forecast is of much more interest, however, given its use as a signalling tool for longer-run policy expectations, and may be revised downwards from the 2.3% seen in September, closer to the 2% price target. In any case, drawing conclusions about the future policy path from this forecast seems folly, given the deep recession that the eurozone looks set to endure this winter, and in early-2023.

Perhaps it will prove to be the balance sheet where the hawks are able to ‘flex their muscles’ a little more.

Markets have been awaiting colour on the timing, speed, and scale of balance sheet reduction plans for some time now, and with rate normalisation well under way, the December meeting seems an opportune time for policymakers to provide more guidance on this matter. Outright asset sales, akin to the BoE’s action over the last couple of months, seem off the cards, with policymakers instead more likely to decide on a gentler course of action – gradually reducing the amount of bond holdings which are reinvested, halting reinvestments entirely by the end of next year at the latest. The quicker the pace of balance sheet reduction, the more hawkish such a decision should be interpreted as.

This might not be good news for the EUR, however. The quicker liquidity is drained from eurozone debt markets, and the less the ECB is seen as a backstop for said markets, the more markets are likely to worry once more about fragmentation risk, pressuring the currency. All eyes should be on the BTP/Bund spread to monitor this, with a widening back above 200bps to be interpreted as a warning sign that markets are not taking the ECB’s QT in their stride.

Speaking of the EUR, we come into the meeting with the common currency delicately poised – though with the latest US inflation figures, and the final FOMC decision of the year both due before we hear from the ECB, traders should be aware of much more than just domestic factors.

Nevertheless, EUR/USD has spent much of the last week consolidating at the 50% level of the YTD decline; a move to the upside would target the 61.8% retracement at 1.0750, while the bears may look to capitalise on any declines and move us towards a test of the 200-day moving average at 1.0350 once again.

Given the busy US calendar this week, traders looking to trade the EUR over the ECB may want to look at the crosses for cleaner opportunities; EUR/JPY, for instance, has recently broken out of the bearish trend that has been in place since mid-October, while EUR/NZD looks to be building a base at 1.6415 after falling 6% in around 6 weeks.

As for equities, Germany’s DAX finds itself stuck bang in the middle of its recent range ahead of the ECB meeting, though did form a ‘golden cross’ on Friday, with the 50-dma crossing above its 200-day counterpart. It must be noted, however, that this signal doesn’t have the best of records at pointing to further gains. Since 2010, the signal has been produced six times (limited sample, so caveats apply), with the subsequent 10- and 30-day returns being positive and negative on an equal number of occasions.

In the here and now, it seems more likely that we see a downside break of the recent range, with the prospect of a bullish catalyst in the form of a dovish ECB surprise seeming rather remote.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.