CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

- English

- Italiano

- Español

- Français

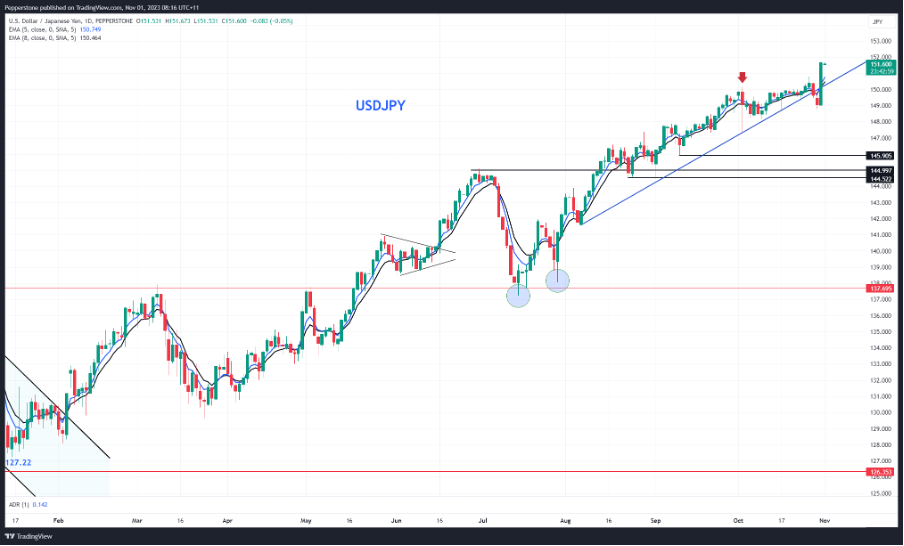

USDJPY – tweaking those JPY longs

Arguably the story of the day was the BoJ moving to a flexible cap on 10-year JGBs (Japanese Govt Bonds) and using 1% as more of a reference point going forward - Curve control is essentially being phased out. The market has seen the tweak to a flexible regime as clear dovish development, certainly relative to press speculation, and once again market players have been left frustrated by the lack of urgency shown by the BoJ, and either closed JPY longs or flipped into outright JPY shorts.

Some have focused on the BoJ’s new inflation projections, which for fiscal year 2024 sit at 2.8%. If we deflate either the BoJ policy rate or govt bond yield by this expected inflation estimate it offers deeply negative real rates. More conventionally, if we use the market’s measure of expected inflation (i.e. the ‘breakeven’ rate), we see Japan’s 10-year real rates at -0.4% vs 2.48% in the US – highly supportive of USDJPY.

Having rallied to 151.71 the question of whether the MoF are closer to intervention is further debated. Certainly, the rate of change won’t sit well with authorities. However, confirmation the MoF didn’t intervene at all during October suggests the higher probability level for intervention sits above ¥155. Retail traders will be selling into this move now, but I question if the positioning has fully played out. Consider in the session ahead traders need to navigate the FOMC meeting statement (5 am AEDT), with Chair Powell speaking 30 minutes later.

AUDUSD – a battle is underway

On the daily, we see strong support into 0.6288, which may be tested again soon if the USD strength continues, and we don’t see a sharp turnaround in Chinese/HK equity markets. A closing break of 0.6288 would suggest the October lows would be revisited. Counter to that scenario, we can see a falling wedge pattern, portrayed by a series of lower highs, and compression in the price action that suggests a move is coming. The double bottom neckline sits at 0.6452, but that would take a break of the trend resistance and as it stands price action is hardly suggestive of an explosive upside move – at present, range trading is the preferred strategy. As a short-term driver, today’s FOMC meeting could promote a USD move, although isn’t expected to offer any significantly new intel, and we get the NFP report on Friday. The RBA are, on balance, expected to hike next week.

NAS100 – make or break

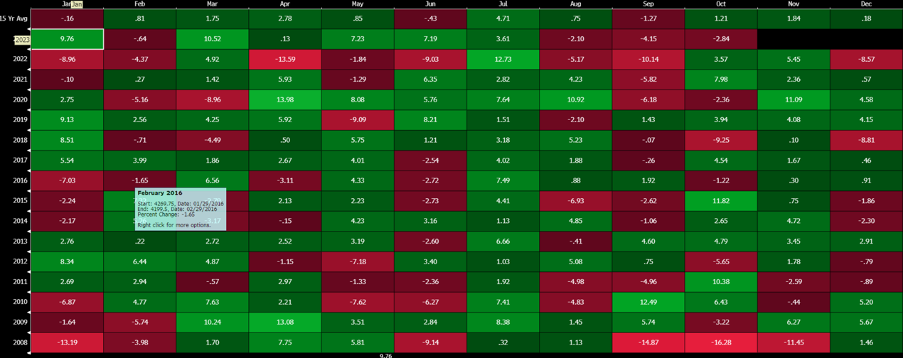

With month-end flows behind us and the NAS100 closing out October with a decline of 2.8%, we look ahead to November knowing the index has strong form – We see the index rallying in the month of November in each of the past 11 years.

On the daily set-up, we see the NAS100 re-testing the Sept/Oct lows at 14,443. The move back to re-test has been unconvincing, so the technicians will want to take the timeframe in and see the behaviour into the former lows. A rejection with a higher ROC could suggest new shorting opportunities. The FOMC meeting may offer a catalyst, but we also look ahead to Apple’s earnings (after-market Thursday), with the market implying a move (higher or lower) of 3.7%. Apple command easily the greatest weighting on the index, so it can easily influence like few other stocks. Many will recall the 4.8% decline we saw in Q323 earnings – one bad earnings report doesn’t make a trend, but with the form guide in November so hot, it suggests putting the NAS100 on the radar.

Long CN50 / short CHINAH idea – play the China equity put through the CN50 index

Poor China PMI data and a below consensus HK Q3 GDP print further impacted sentiment in China equity, resulting in a further $4.75b of outflows from China’s mainland markets through the ‘Northbound Connect’ yesterday. The talk is the PBoC will inject a sizeable level of liquidity into the money markets today, which may support China equity, although the market has been somewhat insensitive to liquidity injections of late. There has been talk of an ‘equity put’ but it appears as though not all China/HK equity indices are acting equally, with a solid rebound seen in the CN50, while the CHINAH and HK50 have not caught on, with the CHINAH index eyeing a test of October lows of 5756. Being long CN50/short CHINAH and a pairs trade has been working incredibly well and I still like this higher.

WTI cash crude – big swing levels tested

We see both Brent and US crude finding better sellers of late, and the tape looks heavy. Clearly, the market is paring back expectations of a supply disruption arising from the Middle East tensions and seeing a low probability that Saudi oil production is impacted. Tomorrow, we get the weekly crude inventory data and that could offer a new catalyst with expectations of a 1m barrel build. We see price testing the 6 Oct swing low, so the bulls will want to see that hold or we face a quick move into $79.00/$78.50.

.png)

Food for thought – are we seeing a new currency war in the mix?

I know China and Japan have been vocal in supporting their currency and ultimately trying to engineer a low vol regimes. However, elsewhere the opposite is true. The Riksbank (Sweden) gave a full speech on the effects of currency weakness which may be the reason they hike on 23 Nov (19bp of hikes priced). The BCCh (Chile) cut by 50bp last week and by less than was expected. Similarly in the Philippines and Indonesia came out with a surprise hike. BoE policy maker Catherine Mann recently suggested a weakening GBP was part of her thinking behind her hawkish bias. The RBA may hike next week, not really a function of AUD weakness, but they have made mention of it.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.