CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

- English

- Italiano

- Español

- Français

It’s been quite well documented the disdain for USD exposures of late and rightly so the Fed went above and beyond with its move to AIT (Average Inflation Targeting). However, since then we’ve not heard any new substance to make us understand how they'll drive inflation expectation materially higher.

VC Clarida gave us little yesterday, while Lael Brainard who spoke in US trade, has given us a touch more colour about the objectives itself. Notably, that the Fed will “seek inflation modestly above 2%” and “ bond-buying and forward guidance remaining key policy tools”. I’m not sure the market was overly shocked by Brainard’s speech though as long-end bonds were bid (10-year Treasuries are -4bp and 30s -5bp), while breakeven rates are -3bp and thus real yields are a touch higher. Forward inflation expectations are lower too, with 5y inflation swaps -1bp.

Reverting to the Brainard speech and it’s hard to go past this passage, where the Fed has offered estimates as to how the economy would've fared in prior cycles had they been using AIT regime. Where using this model they wouldn’t have tightened nearly as much, if at all. We think back to 2018.

A focal point was a strong ISM manufacturing print with the diffusion index climbing to 56.0 (vs 54.8 eyed), which is the highest level since November 2018. New orders came in at a 16-year high of 67.6, new export orders printed 53.3 and prices paid the new ‘must-watch’ component given inflation is everything lifted to 59.5.

Historically this sort of growth in the ISM manufacturing index would have resonated in the selling of USTs (higher yields), but not today. A clear overlap of the USD vs rates and we see as soon as the USD moved higher than Treasuries sold off and inflation expectation fell. It’s easy to believe that the Fed needs the USD lower if they are to get inflation higher.

The problem with the Fed wanting a weaker currency is that so do many other central banks in DM. We’ve recently seen the RBNZ detail that its policy setting is aligned to that of the Fed. Why? Because they know policy divergence is a clear signal for FX players to buy the currency with the relative hawkish stance. The RBA hardly brought the radical jawboning action out yesterday, but they did include a new passage in the statement that the AUD has reached the ‘highest level in nearly two years'. The ECB clearly didn’t like EURUSD having a look above 1.2000 and it wasn’t long before ECB chief economist Lane said “the ECB doesn’t target FX rates, but EURUSD matters”.

(Source: Bloomberg)

I guess that's true when we saw Eurozone CPI estimate print -0.2% vs 0.2% expected and the weakest levels since April 2016. EU 5y5y inflation swaps are still well below where they need to be and possibly turning lower, so it's not hard to see that the ECB jawboning looks to have played out right on cue. The question worth asking is whether the ECB come back harder now, not that they really can, but they have told participants they can and are prepared to do more. Next Thursday’s ECB meeting gets just that bit more interesting.

Another aspect getting talked about the re-emergence of Trump’s chance in November, where bookies now have his re-election odds as a slight favourite over Biden. I'm trying to find the charts where we overlap the USD against Trump’s approval rating or odds of winning the election, but they were everywhere a couple of months ago. Now he’s slight favourite, does that mean we start covering election hedges?

We also need to consider positioning and sentiment. Risk reversals in currencies like AUDUSD and NZDUSD had reached the 99 percentiles of their respective 12-month range and threatened to go positive. This means that implied volatility of call options would trade at a premium to puts (a rare event indeed), showing traders expect great upside movement than downside over the predefined expiry. RR are also a great visual on semiotics. We also see positioning in the weekly COT report showing incredible levels, specifically in EURUSD.

(Source: Bloomberg)

Equity market's march higher

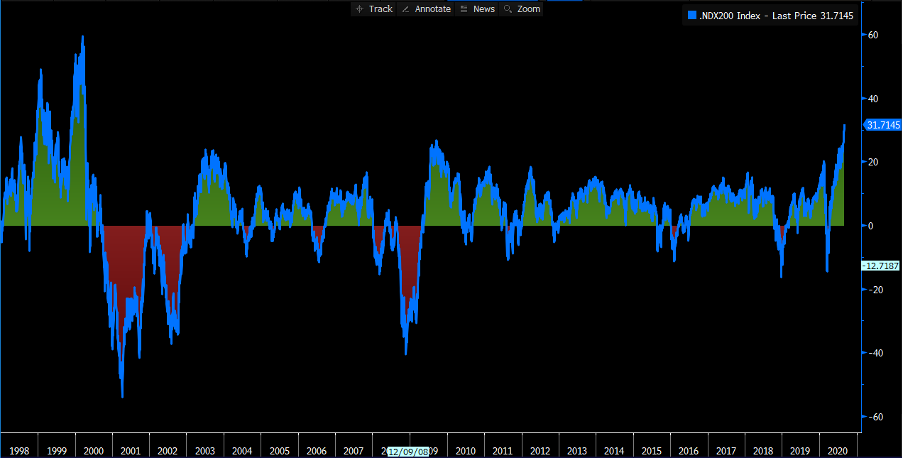

Equities don’t really mind. Either way, a race to the bottom is good for risk. Although the country with relative FX strength is seen their equity markets underperform - Just look at the FTSE100 and ASX200. All US bourses have closed higher, with the NAS100 leading the charge up 1.5%. The better ISM data seemingly being the inspiration and the rise in real yields was no biggy. Interestingly, we see the NAS100 31% above its 200-day MA which some feel could be a decent mean reversion trigger. I will add this increased to 59% in 1999.

(Source: Bloomberg)

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.