- English

- Italiano

- Español

- Français

Analysis

The Daily Fix: The USD bid as its sensitivity to US Treasuries increases

But as we know, you can keep this old dog down and from the moment the S&P 500 cash market opened until the final 50 minutes there was a relentless bid in the market. The S&P 500 closed unchanged on the day, although, gains in the NAS100 were more pronounced, with the tech index up 0.9% and rallying for a sixth day.

Volumes and turnover were light through, and some 21% below the 30-day average, with 1.47m S&P 500 futures contracts traded. Healthcare led the charge, with tech and consumer discretionary also in the green. On the downside, financials closed -1.9%, with energy (-1.7%) and materials (-1.5%) also weighing, suggesting today’s ASX 200 open could be on the soft side – Aussie SPI futures sit -0.4%. Look for outperformance from Japan though, who will always like a touch of JPY weakness.

Cross-asset analysis

Elsewhere, the mood was somewhat less optimistic when we go cross-asset class, with HY credit spreads widening a touch (the HYG ETF -0.5%), while copper closed -1.1%, and front-month WTI and Brent crude -0.8% and 3.2% respectively, although we’ve seen buyers emerge on the futures re-set.

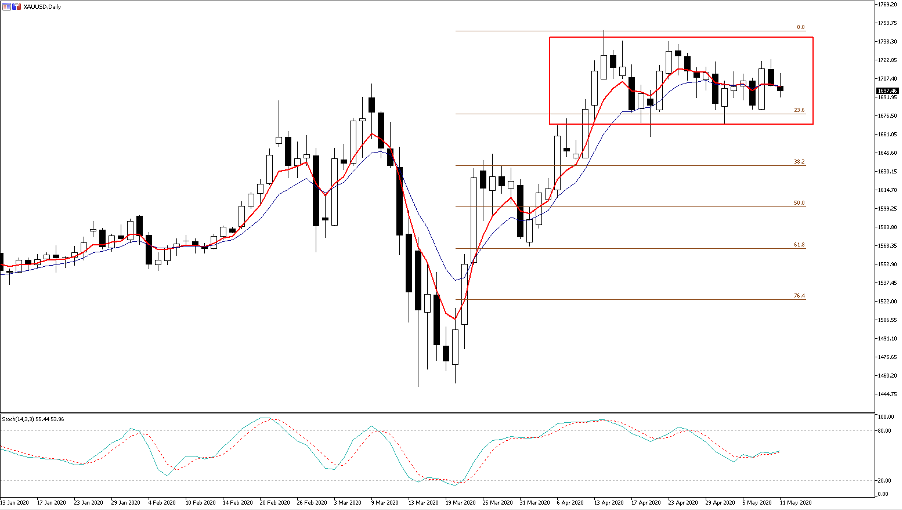

Gold is down smalls at 1697 and held back by the selling in US Treasuries (more on that below) - price maintains the trading range seen since 13 April and holds a central focus on the watch list for a potential breakout – it may take a week or so, but it’s coming, and the catalyst will likely be a move in real (or inflation-adjusted) US Treasury yields.

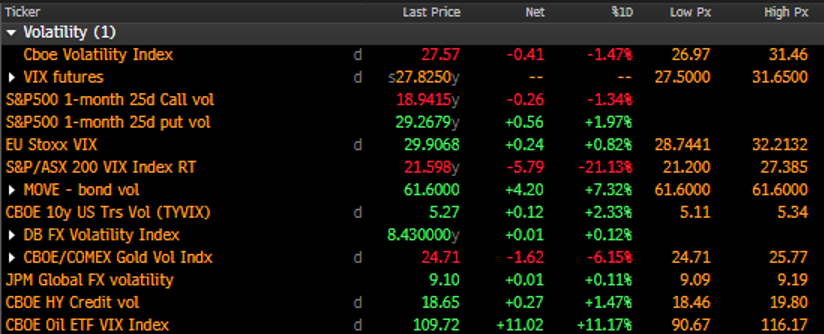

Looking at the implied vol indices they are largely unchanged, with the VIX index -0.41 vols at 27.57%, with limited moves across the various implied vol indices.

(Source: Bloomberg)

FX moves to focus on

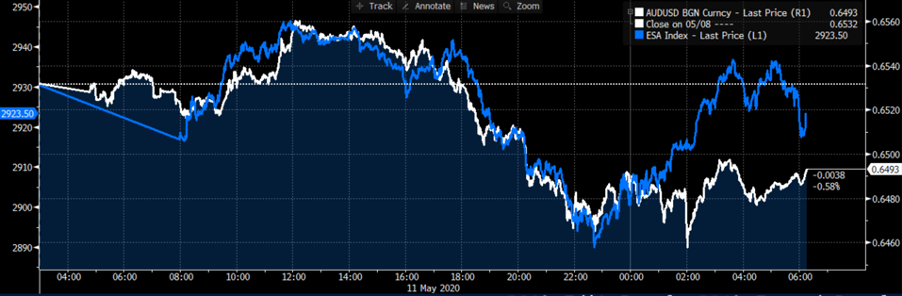

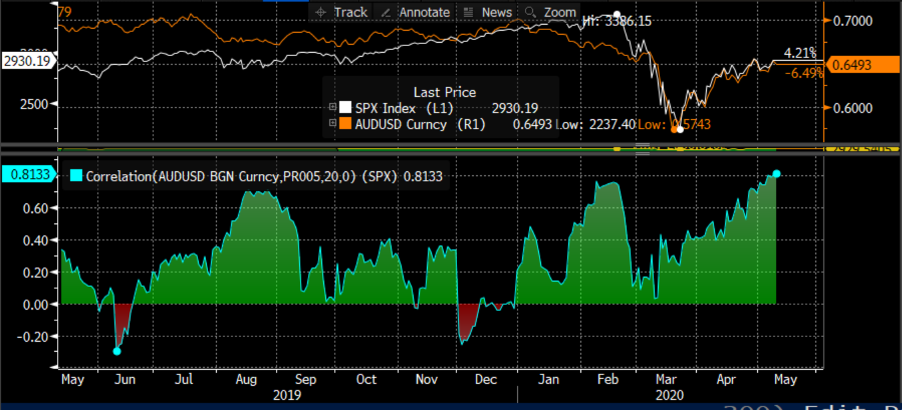

EURUSD has been well traded, for the move into 1.08, but its risk FX has largely underperformed, and never really got going when the S&P 500 futures pushed higher into the open of cash trade, which surprises somewhat as the AUDUSD has an 80% 20-day rolling correlation with the S&P 500.

I looked at the trade case for EURAUD shorts yesterday, and continue to like this trade, and while it’s never pleasing to see price heading against the anticipated direction, we know this is a fact of trading and I will hold until price closes above the 5-day EMA. As we see on the daily, price tested this average and subsequently found sellers, so that is pleasing. I will add, if and when price can firmly close below the 30 April low of 1.6540, with the 200-day MA sitting just above here.

With the lockdown restrictions being gently rolled back here in Australia, we watch to see the handover from stimulus to the private sector. This is a balancing act that needs skilled timing and one that carries risk – it seems fitting that today (at 11:30 AEST) we get NAB business confidence, ahead of Westpac consumer confidence data tomorrow. Neither should be vol events for the AUD, but still one for the macro watcher.

The USD has pushed +0.5%, with the gains broad-based. USDJPY has certainly shown an increased sensitivity to the US rates market and front of the Treasury yield curve, gaining 0.9% and pushing through the ST downtrend and into 107.66. It feels like this could push into 108.08, where supply may be more pronounced.

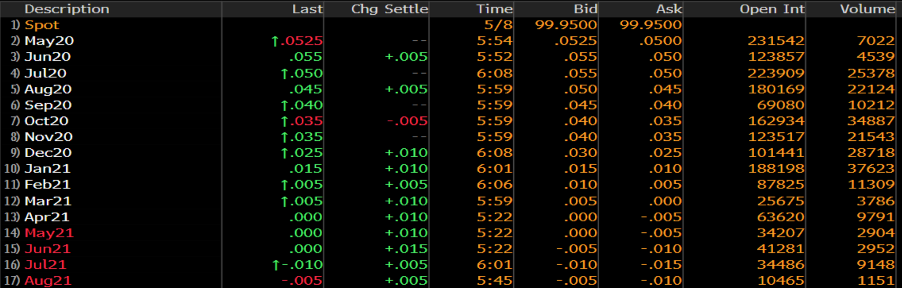

On the session, we have seen US 2-yr Treasuries +2bp into 17bp and well-off last week’s low of 10bp. The Fed fund futures curve has also lifted a touch, with traders really focused on contracts past December 2020, and into mid-2021, with the slight pricing out of expected negative rates driven by comments from Chicago Fed President Charles Evans and Atlanta Fed President Raphael Bostic, who unsurprisingly both opposed negative rates. The stage has now been set for Fed chair Powell, who holds a webinar on Wednesday (23:00 AEST), where he scheduled to speak on ‘current economic issues’ - although most want to hear his views on yield curve control and negative rates.

In US trade tonight we get US CPI, with expectations that headline falls 0.8% MoM, so that may influence the Treasury market and the USD as a consequence.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.