CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

- English

- Italiano

- Español

- Français

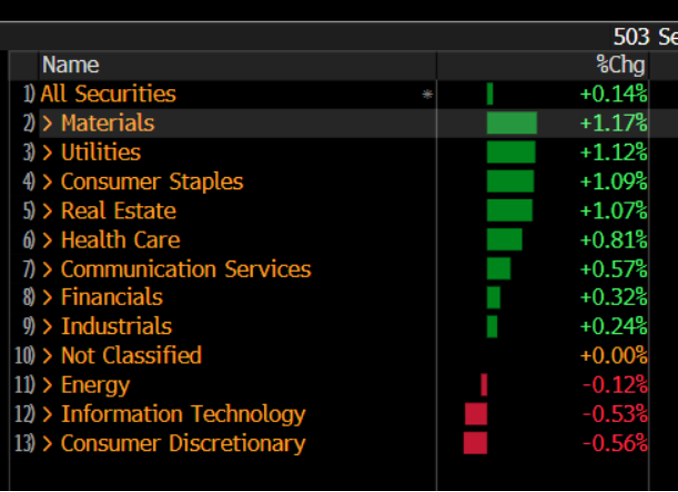

The S&P500 cash closed at 5187, having found supply kick-in at the 5200 level, with S&P500 futures reversing off 5226. Looking under the hood though and breadth was ok (65% of stocks closed higher) and we see signs of movement with materials finding better flow, and utilities also firing up, while tech and discretionary sectors – the star performers in the prior session - closed lower.

We’ve seen several individual pieces of news flow relating to companies like Walt Disney (weak subscriber growth), Apple (revealing a new AI-focused iPad), and Reddit (upgraded Q2 sales guidance to $240m-$255m), which have caused some pocked of volatility. We also saw headlines around ‘US to remove licenses for supply of chips to China’s Huawei’ which did no favours to Intel and Qualcomm, but shares were already finding sellers into the headlines, and this just kept the momentum skewed lower.

After being upbeat on names like Meta, Nvidia and Amazon in the prior session, the sellers have won out today - but little news the upside momentum never really got traction, which would then feed the options 0DTE market makers, who would hedge their exposures (by buying the stocks in question). The market will always go where it wants to go, but flow and sentiment are the prominent drivers on an intraday basis, and they were lacking today – tomorrow they could easily come back – price action will reveal all and it’s what we react to.

Calm conditions were seen again in the US bond market, where a 3yr Treasury auction went off to average demand, but with limited news (US consumer credit was weak at $6.27b), there was little to drive and the wash-up was yields modestly lower across the curve, and on any other day this could have been the reason many would give for why stocks should be higher and the USD lower.

On this point, the USD staged a rally from the open of US cash equity trade, with the DXY rallying from 105.05 into 105.45, driven in part by EURUSD falling from a session high of 1.0787 to 1.0748, and just below Monday's low. AUDUSD hit a low of 0.6587 post-RBA meeting before chopping in a range of 0.6624 to 0.6588. A number of AUD longs taking some of that positioning off the table after the RBA didn’t provide the explicit roadmap that takes us to hikes in August, and Aussie rates pricing now sees a more sanguine 1-in-5 chance of a hike in the August meeting. It feels right to have some degree of hiking expectations backed into the Aussie rates curve – Gov Bullock said they discussed hikes at this meeting - and this pricing will move dynamically to the upcoming Aussie data - Wage price index, employment data, and next month's CPI print will be looked at closely.

Looking ahead today we get the Riksbank meeting, so SEK exposures will need to be managed. Economists see a slight skew in a 25bp cut, while SEK swaps price a higher probability of easing, so one could argue the bigger move in the SEK comes if the Riksbank leave rates on hold (than what we’d get if they do ease).

The BoE steps up tomorrow with traders still pricing the first cut in August. GBPUSD looks to trade heavy into the meeting, with EURGBP also pushing higher and eyes a break of 0.8600, with many positioning for dovish risks - the commentary aside, one minor development for GBP shorts would be if BoE member Ramsden joins Dhingra in calling for cuts, leaving the voting split at 7-2. The dynamics unfolding in UK services inflation does offer the bank some increased flexibility on policy relative to other central banks, such as the Fed and RBA.

A touch of red is seen in the commodity space, and with limited tier 1 news to drive we see copper, gold, and crude a touch lower on the day. A look at the intraday tape of gold, we see a range of 2329 to 2310 with a slight downwards bias - but a hard one for the day traders and the moves intraday lacked any real duration to allow short-term trader to hold positions.

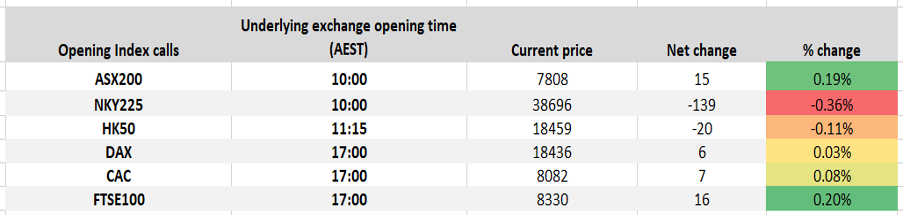

Pepperstone’s current index opening calls

Turning to the Asia open our opening calls are mixed, with the ASX200 opening 0.2% higher at 7808, so the bulls will naturally want to hold the big figure. The NKY225 looks to underperform with a flat open eyed in HK. The sector leads from the US may support the ASX200 given the weight towards materials names, but BHP looks set to open 0.4% higher, with CBA’s ADR +0.2%.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.