CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

- English

- Italiano

- Español

- Français

Terminal rates - what are they and how can they help FX traders?

One of the more watched interest rate settings in markets is the so-called ‘terminal’ interest rate – the point in the interest rate futures curve that reflects the highest point of future rate expectations – said differently, where the market feels a central bank could take its key policy rate by a specific date.

For those who really want to understand fed funds futures far better, this research piece from the St. Louis Fed is good - https://files.stlouisfed.org/files/htdocs/publications/review/97/11/9711dt.pdf

As an FX trader, I am not too concerned as to the exact pricing in the rates market, a basis point here or there is no great issue - I loosely want to know what is priced by way of future expectations. This lends itself to more fundamental, tactical or thematic trading strategies and obviously day traders won’t pay too close attention, although, it’s worth considering that when rates are on the move you do see higher intraday volatility and that is a factor they have to operate in – where one of the core considerations for any day trader is ‘environment recognition’ and the assessment of whether we’re seeing in a trending or mean reversion (convergence) day.

We also see terminal pricing correlated with FX and equity markets – certain if we look at the relationship between fed funds futures April contract and USDJPY we can see the correlation.

Some will just use the US 2-year Treasury, as this is the point on the US Treasury curve that is most sensitive to rate pricing. The good thing about the fed fund's future though is we can see quantitatively the degree of rate hikes being priced for a set date.

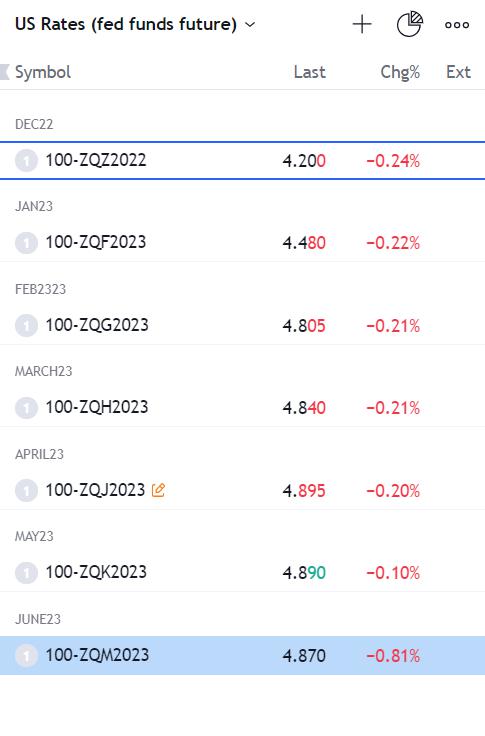

Using the logic expressed in the St Louis Fed research piece we can see that the market sees the highest level where the Fed hike rates is March – subsequently, this is priced off the April contract, and currently, this sits at 4.90%.

Using 4.9% as our yardstick, interest rate traders would make a call if the expected fed funds effective rate was either priced too high, or indeed too low and could push above 5% - if new economic data emerged that suggested the Fed needed to go even harder on hiking than what is priced, and the terminal rate moves above 5% then the USD will find a new leg higher. Conversely, if the market started to trade this down to say 4.70% to 4.5% then the USD will find sellers – and notably USDJPY is the cleanest expression of interest rate differentials.

For TradingView users we can use this code in the finder box - (100-ZQJ2023). I put these codes into a watchlist and add a section' for heightened display. Again, this tells me where the peak pricing/expectations are in the interest rate curve. You can see the corresponding codes needed for each contract.

Terminal rates matter – if we're to see this trending lower, most likely in 2023, then it may be one of the clear release valves the equity market needs – for those looking for the Fed to pivot – the terminal rate will be one way to visualise it.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.