- English

- Italiano

- Español

- Français

Analysis

USD, HK50, and EU Equity Market Reversals: Key Risks & Trading Strategies for April

The wash-up has been a more calm affair across macro markets, at least in the daily net and percentage changes, with the close-to-close change (on the day) masking some degree of chop in the intraday price action – a fair outcome given the event risks mentioned haven't really offered any major surprises, while the lower impact nature of the economic data won’t influence the Fed’s thinking or offer any new steer to the two big risks to markets: Stagflation or recession risk.

Flow-based Effects to Influence the S&P500?

Another factor which may have influenced the US equity tape and injected some hesitation to initiate new positioning comes from the fact that we could get distortions from S&P500 March futures expiration and ‘Triple Witching” in the session ahead.

S&P500 March futures expiration kicks in today, and while the bulk of the new positions have recently been traded in the June contract, we will still see some set to automatically roll their positions today. Compounding the potential flow-based effects is ‘Triple Witching’, with over $4.5t of notional open interest set to expire in S&P500 index options, ETFs and single stock equity options.

Whether the flow-based effects that arise from options dealers hedging their deltas and managing their inventory of accumulated hedges result in outsized moves in equity and index volatility is yet to be seen, but it will lead to high volumes in futures and equity and possibly lead to price moves that won’t be easily explained by the news.

The bulk of outstanding S&P500 index options from traders have been skewed towards long puts, so dealers are modestly short gamma - a dynamic which typically leads to higher volatility (dealers hedge moves lower in the S&P500 through shorting S&P500 futures and buying the futures when the index rallies). However, with the S&P500 consolidating since 10 March, many of the outstanding options that funds have accumulated to hedge equity downside risk have decayed and lost value, which raises the risk of dealers lifting their hedges and covering their short S&P500 futures inventory.

It could well be a nothing burger, but if we do see intraday volatility in the S&P500 (and futures) on limited news, this dynamic will likely be a factor.

Whether OPEX has pinned the US equity market on the day, or whether it was the absence of any major new news to entice a dominant trend, the result has been some whippy price action in S&P500 cash and futures, and a small net change lower in the S&P500 cash, with 65% of S&P500 companies closing lower, Tech and materials have underperformed, while energy and utilities have worked well on the day.

US Treasuries have closed 1bp lower across the curve, in what has been a very orderly affair, as has been the case in US rates and swaps markets, with 2bp of additional implied cuts added to the December FOMC meeting, implying we could see 68bp of cuts this year.

The USD Pushing Consolidation Range Highs

In FX markets we see some signs of a potential turn in the USD with the DXY +0.4%, and after the 6% sell-off from the 13 Jan, we see the DXY in a consolidation phase, with price now pushing into the range highs of this recent consolidation phase.

EURUSD is naturally key in driving moves in the DXY and traders have been better to sell here, with the EURUSD spot rate bleeding lower from 1.0917 to 1.0815, with the buyers stepping back in through US trade and lifting rates by 40p or so.

It seems the market has lost some confidence to bid EURUSD into 1.1000 and the spot rate seems to be carving out a 1.0950 to 1.0800 range. As we head into the 2 April Trump reciprocal tariff announcement, there is an increased risk that market players trim back on USD shorts and look to run a more neutral position.

The RBA Set to Cut Rates Days After the Federal Election?

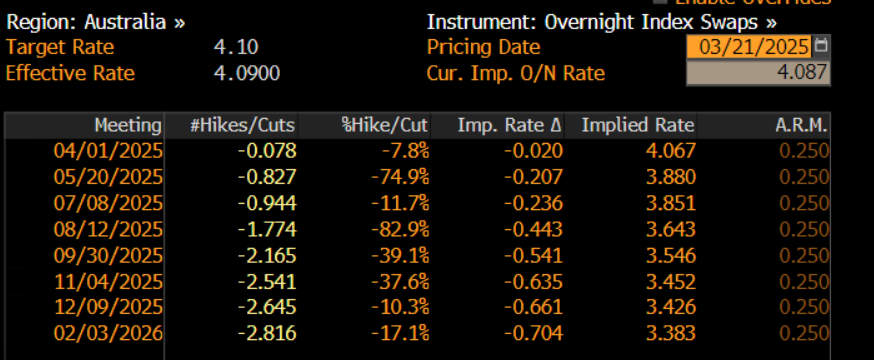

We’ve seen good flows in AUDUSD and NZDUSD, with both spot rates seeing solid moves lower through Asia and into early US trade. After yesterday’s poor Aussie jobs report Aussie interest rate swaps imply 19bp of cuts (or a 70% chance of a 25bp cut) for the 20 May RBA meeting and 62bp of implied rate cuts through to December.

While interest rate pricing is dynamic and subject to the forces of supply and demand, it does make life interesting as we could feasibly see RBA rate cuts just days after the federal election. I’m sceptical that the election will drive notable volatility in the AUD or ASX200, at least not initially – but a Dutton-led minority govt – should it play out - would lead to a perception of reduced government spending and fiscal support. Given how influential the ALP’s fiscal policy has been in supporting Australia’s GDP and labour market, should we move into a dynamic of reduced govt spending – which is typically the case in minority govts – then increased evidence of economic fragility will require a far greater involvement from the RBA to boost consumption and support economics.

Turning to the Asia equity open, our opening calls suggest a flat open for the ASX200 and underperformance from the HK50 index, with expected selling in Alibaba and Tencent at the heart of that move lower. After the 32% rally from 13 January, the momentum has come out of the HK50 bull trend, and we question if the wheels are falling off, with the index potentially subject to a broad liquidation of now-extended positioning. One to watch, as the risk of a more cautious stance from traders kicks in as we head into the major April tariff risk events.

Good luck to all.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.