- English

- Italiano

- Español

- Français

Analysis

Brent crude remains a key focal point and a source of directional risk for broad markets. On the day, an early rally into $76.14, with price pushing above the 24 Sept pivot high, was met with a wall of sellers and supply, with price pulling back into $73.58, before finding a renewed bid and closing +1.5%. A 3.89m barrel build in the DoE’s weekly US crude inventories, amid weaker gasoline demand, a trigger for longs to part close, with calls that OPEC+ will leave production unchanged – these fundamental factors have triggered some selling in the near-term, but while President Biden is reportedly attempting to deter Israel from targeting Iranian bases, the geopolitical headline risk remains firmly entrenched and the street remains ready to act should new news present itself.

The intraday reversal in crude was a partial signal for gold longs to take some off the table, although one would argue the 4bp to 5bp rise in US Treasury yields (across the curve) and the subsequent 0.4% rise in the DXY was also a key factor in pushing the yellow metal 0.2% lower on the day. The USD was treated to a modestly hotter ADP payroll, but the market looks more intently at its positioning ahead of today’s US services ISM and tomorrow’s US nonfarm payrolls (NFP) - with sizeable two-way risk in markets derived from the NFP outcome, it seems prudent for the more tactical-focused traders to reduce USD shorts and US Treasury longs into the key labour data.

EURUSD looks heavy into US payrolls, and while shorts will be feeling quietly confident of further downside, those positioning for downside really need a break of the 50-day MA (1.1044) to accelerate the selling pressure for a test of the big support level at 1.1002 (the 11 Sept low). USDJPY continues to attract big trader flows, with Japan’s new PM, Shigeru Ishiba, having a strong say on his disdain for future rate hikes, in turn, promoting a weave of fresh selling in the JPY. With central bank independence such a critical factor in one’s confidence in being overweight a currency, the involvement of big government in monetary policy is rarely a positive affair, and the JPY has been sold off hard on the day.

Are we seeing the resurgence of JPY-funded carry positions?

Certainly, you can make that case, with MXNJPY and COPJPY gaining an impressive 3% on the day, with a better performance in US tech equity. However, with cross-asset volatility still elevated, and with geopolitical risks still very much prevalent, it takes a brave soul to really go hard on getting stuck into carry here.

Certainly, anyone betting on a more aggressive hiking cycle from the BoJ than what was priced into Japan’s interest rate futures/swaps markets has been frustrated at the calls from PM Ishiba and this is a clear factor pushing the JPY lower.

US equity has held up well on the day, with dip buyers stating their case amid some signs of traders unwinding downside hedges. S&P500 futures traded below Tuesday's low of 5733, and the price action-focused traders would have then been on notice for a clearer signal on follow-through after the bearish reversal seen in the prior daily. That wasn’t to be, and the buyers stepped in pushing the futures market higher and negating the bearish daily reversal, with the S&P500 cash market closing flat on the day. Breadth was lacklustre, with 44% of S&P500 companies higher on the day, with energy and tech putting in the points, while the staples and consumer distortionary sectors closed lower by 0.8% - notably led lower by weakness in Tesla and Nike.

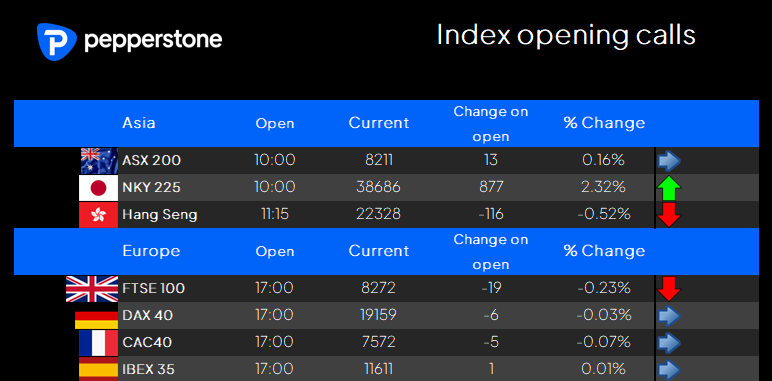

The moves in US equity don’t really offer Asia too much to work with, with our opening calls looking well dispersed. The NKY225 will outperform on open, with futures reacting strongly to the weaker JPY, and we watch to see how the banks fare, as it may give us some steer on the durability of any newly adopted carry positions.

The ASX200 looks to open 0.2% higher, and index longs will naturally want to see a firm close above the 8200, while also hoping for a rise in SPI futures towards 8300.

The Hang Seng looks to take a breather on open, with modest downside called for the cash equity open, although this shouldn’t surprise given the index has had a parabolic since 11 September and traded like a small cap equity name – whether trading the HK50, CN50, CHINAH or the various China ETF’s (FXI for example) these are tough markets to chase here. Conversely, many will see the huge inflows and incredible volume and see them as simply too hot to short. Either way, it wouldn’t surprise to see these indices close 3% lower on the day on profit taking, but saying that it also wouldn’t surprise to see the momentum-focused funds buy any sort of weakness on open leading to another 3%+ close higher. The fact is, if swimming in these waters, positioning sizing is paramount.

Good luck to all.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.