CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

- English

- Italiano

- Español

- Français

A Traders’ Week Ahead Playbook: Pricing Risk in Crude, Gold & FX Amid Geopolitical Tension

Aside from simply positioning outright long of crude or buying crude volatility as a hedge against the unforeseen consequences of the developing conflict – this period of high anticipation on Iran's next move makes the role of pricing risk incredibly challenging, and that will likely see gold finding form and testing $3400 on the reopen. Those positioned in gold longs will want to see a solid close above $3450, given the supply seen around this level over the past 3 months, to feel confident of a test and potential break of the all-time highs of $3500.

Iran don’t need to close the Strait of Hormuz to cause a significant impact on supply

Many will see Iran now a step closer to disrupting logistics and the ease of passage for vessels passing through the Strait of Hormuz (SOH). The weight of money placed in the betting markets for a closure of the SOH to occur this year has risen to a 51% probability, and while this feels too high in my novice thinking, the market may recalibrate its sensitivities towards maritime insurance rates and freight costs – essentially, Iran doesn't need to formally go down this extreme route to inflict economic damage on the world (and its own economy), and while conflict risk premiums have been a factor for 18 months now, by planting enough belief that they could disrupt this key logistical channel, maritime costs could rise to the point that it would have a significant impact on the supply of crude and gas.

The EUR has been the pillar of strength

One would argue the unfolding geopolitical events could pose an upside risk to the USD on safe-haven flows, but after a short period, one could just as easily see Trump’s action accelerating the migration from the USD and into the EUR, where the recent broad strength in the EUR will be put on show this week. Europe does have a high energy import requirement, and the EUR may become increasingly sensitive to the rise in EU natural gas - but offsetting these energy inputs we see France pushing other EMU nations towards greater shared debts, while Germany’s draft 2026 fiscal budget (announced Wednesday) has been a tailwind behind the EUR finding such solid form – notably vs the JPY, NOK and SEK.

US equity futures should open around 1% lower on the weekend news, although the buy-the-dip mantra is still well-engrained into the mindset of investors. Equity investors may look at portfolio hedges over more dramatic de-risking, comforted to an extent by the idea that OPEC does have spare capacity and at this stage, the dynamics do not suggest any real impact to earnings expectations.

A bifurcated Fed

We are not yet at the stage where higher oil prices will have any lasting impact on US inflation or growth – that would take crude at or above $100 a barrel and gasoline continuing to kick for a sustained period. However, it does through conjecture on the inflation argument that is starting to divide the Fed… the ultra doves within the Fed’s ranks – Christopher Waller and Mary Daly - are looking through the impact of tariffs and seeing reasons to cut rates sooner – but a possible energy-related lift to headline inflation is not yet being considered. This will be put on show this week with Fed chair Powell holding his semi-annual testimony to Congress and several of the more centrist Fed voters (such as John Williams, Susan Collins and Michael Barr) also due to speak.

One suspects any of the Fed members offering guidance on the economy will steer well clear of talking about the geopolitical developments, but with an increased discussion on whether the Fed should look through the potential inflationary impact of tariffs any of the centrists showing a renewed bias to cut rates sooner could move the implied US rate setting and by extension impact the USD.

Tariff deadlines creeping up rapidly

It is also worth considering that the deadline for Trump’s 10% reciprocal tariff rate (for most countries) and the proposed implementation date for 50% rates on EU imports are now only 18 days away. Subsequently, while Trump’s primary focus will be on the Middle East, headlines on trade negotiations could soon start to roll in and market anxieties could feasibly build. One suspects if Iran does attack US military bases and the price of crude pushes towards $100 a barrel the probability of an extension to the 9 July deadlines will presumably rise.

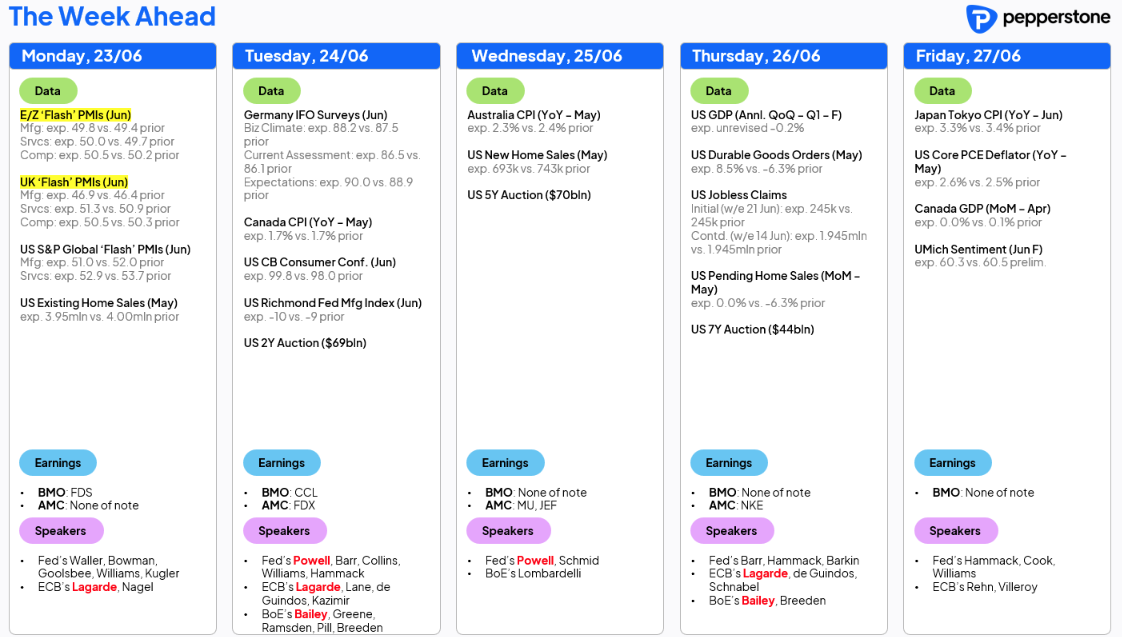

US economic data to navigate

There are a number of data points to consider in the US this week, with personal spending, weekly jobless claims and durable goods worth being on top of. US core PCE is perhaps the marquee release though, where the consensus view is for the Fed’s preferred inflation gauge to come in at 0.1% m/m / 2.6% y/y, putting the 3-month annualised rate at a low 1.6%. With the market's pricing of future inflation well anchored, early cracks emerging in the labour market and housing activity evidently weak, there are reasons for the Fed to consider adopting a dovish shift in the July FOMC meeting and guiding towards a cut in September - a path already priced into the US swaps market.

EU & UK PMIs and inflation in the mix

Elsewhere, PMIs from Europe and the UK could move the dial and reinforce the long EUR trade which has recently gripped the FX markets.

We get inflation data in Australia, where the monthly CPI data is expected to ease a tick lower to 2.3% - an outcome which should only galvanise the implied pricing for a 25bp cut from the RBA at the July meeting. Inflation prints are also seen in Canada, with the swaps market implying a 34% chance of a cut at the July BoC meeting.

Good luck to all.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.