- English

- Italiano

- Español

- Français

Global Markets Outlook: Central Banks, Inflation Data, and Key Event Risks

We close out a week where risky assets found buyers ever present, and given the price action, the risk of even higher levels into year-end seemingly probable.

Looking across the key equity indices, the German DAX was the standout long play, with the EU Stoxx, NAS100, and FTSE100 also carving out impressive gains of 3%+ w/w. While there is increased risk, given the tier 1 economic data points and 4 central bank meetings this week, pullbacks should be well supported.

We can see clear signs that traders have been keen to add risk, with positioning rotating and hard into growth, high momentum, and high beta plays. Within the S&P500 sectors, consumer discretionary was best-on-ground, driven by solid moves in Lululemon, Tesla and Amazon, with Comm Services and Tech also attracting the flows.

Lower quality stocks (higher gearing/weaker balance sheet) and high short interest equity worked well (the Goldman Sachs most short basket closed +7.3% w/w), as the short sellers capitulated, with the S&P500 and NAS100 both hitting yet another all-time high.

In the volatility space, S&P500 20-day realised volatility (vol) has dropped to 7.8%, the lowest level of vol since July, with levels of implied vol (the VIX closed at 12.74%) also at multi-month lows. This low vol environment has been another factor that has compelled shorts cover and encouraged more capital into risk equity. To quantify the implied movement in the S&P500 through to year-end, the options market prices S&P500 31 Dec at-the-money vol at 9.2% which implies a move to 6190 or 100p for options traders betting on upside to breakeven on vol strategies.

In FX markets the USD index (DXY) closed +0.4% for the week, with USDJPY, GBPUSD and EURUSD largely unchanged week-on-week (w/w), with the MXN the standout performer on the week. The AUD and BRL were the weakest plays in major FX, with AUDUSD closing at a YTD low. Gold had a largely uneventful week, closing -0.4% w/w, although news that China bought 160k ounces of gold in November may offer the psychological boost the gold bulls needed.

Rates Review

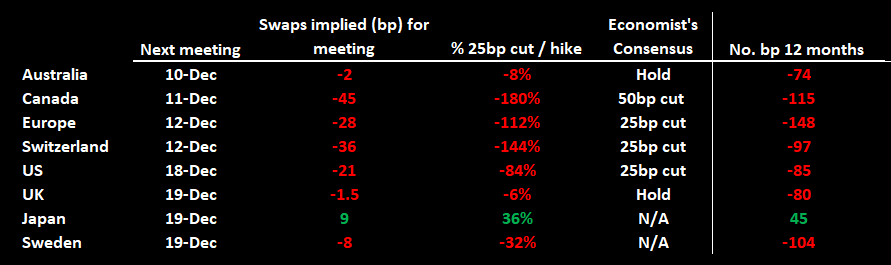

We assess current pricing in the interest rate (IR) swaps market and the central expectation as to the degree of easing/hikes (in basis points) priced for the upcoming central bank meeting, as well as what’s implied over the coming 12-months. IR swaps are actively traded and represent a snapshot of what’s priced that can help guide our risk of a potential reaction in a currency or equity market over a central bank meeting. For example, the market has fully priced a 25bp cut from the ECB, then all things being equal EURUSD shouldn’t react to that outcome and would therefore that it’s steer from the guidance for future cuts.

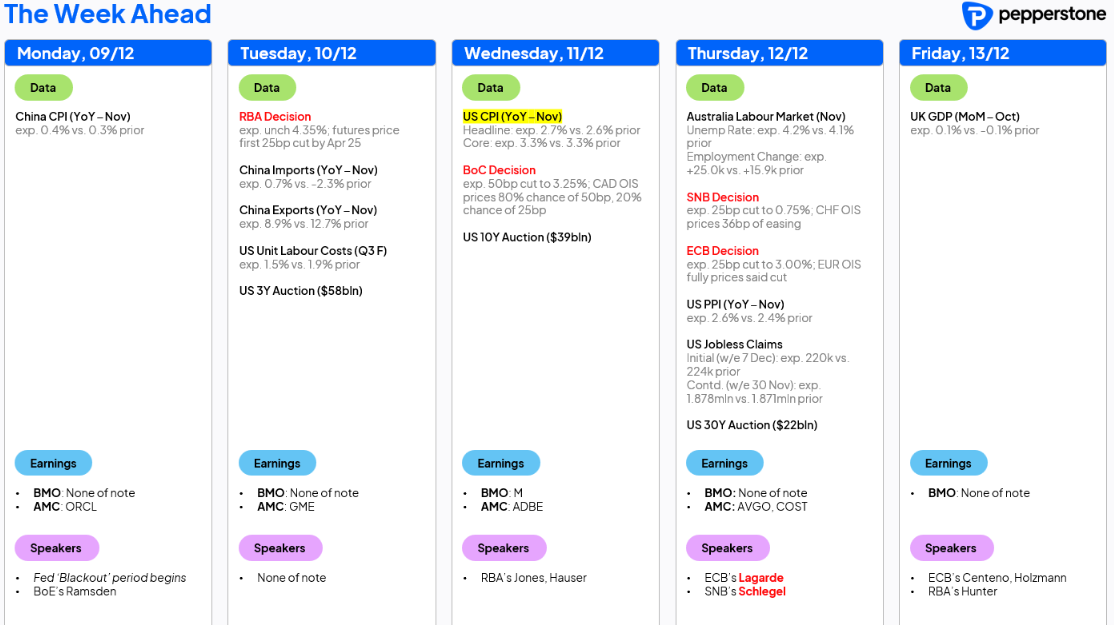

A big week of event risk to navigate It will be a lively week ahead with event risk all over the shop, so the risk manager in all who choose to be active in the markets this week will need to be aware of the landmines, and consider the potential for movement over the news, and where the skew in directional risk lies. Looking at the calendar, we see 4 G10 central bank meetings (RBA, BoC, ECB, and SNB), US CPI and PPI, Aussie employment, China CPI, and trade data. In Japan, we get Q3 GDP (final), and the Q4 Tankan report.

Breaking the risk down by region

The US

Friday’s US nonfarm payrolls report was a goldilocks outcome for risk, with the lift in the U/E rate to 4.2% pushing the implied probability of a 25bp cut from the Fed next week to 84%, while the 227k jobs created in November kept concerns of a cooling labour market at bay. With the Fed looking more closely at the labour market (over inflation), and with recent speeches from the likes of Christopher Waller essentially lowering the bar to a cut next week, this week’s US core CPI print would need to be above 0.4% m/m to have people really questioning a cut next week.

A hot US CPI print may not necessarily derail a cut at next week’s FOMC meeting, but it would affect the level of implied cuts priced for FOMC meetings from March 2025 onwards and this is where the USD may take its directional steer. We also need to remember that it’s the elements from the CPI basket that feed into the core PCE deflator calculation that are of most interest, as this is what the Fed set policy too. In this regard, the inputs from the PPI print that also feed into core PCE will also be of importance.

Australia

The RBA won’t cut rates this week, but after last week’s weaker Q3 GDP print, the tone of the statement will be monitored closely. Aus IR swaps are torn on the idea of a February 25bp cut and price this as a lineball call, and as new data emerges the market will massage expectations on whether the RBA commence easing in February or April. Thursday’s employment report will therefore take on more significance than usual, with a weaker employment print likely pushing the implied probability of a 25bp cut in Feb to around 75%.

AUDUSD closed a YTD low, and rallies will likely be sold on the week with the upside likely capped at 0.6470.

Canada

The Bank of Canada (BoC) meet on Wednesday and looks set to cut rates by 50bp with the IR swaps market pricing an 80% chance of this outcome. A 50bp cut could still negatively impact the CAD, and push USDCAD into and above 1.4200, but a lesser 25bp cut would likely cause the bigger – more CAD-positive - reaction. A 50bp cut with a statement suggesting they are closer to their perceived trough rate (or the low point in the cutting cycle) could see traders reverse bearish CAD exposures in a quick fashion.

Europe

The ECB will almost certainly cut rates by 25bp to 3% on Thursday (Friday 00:15 AEDT), although one could argue they should cut by 50bp given the recent economic data flow. The fact we see a small premium for a 50bp cut suggests if we do get a 25bp cut we could see a small positive reaction in the EUR, although the bigger reaction will come from the ECB’s guidance and the appetite for future cuts. The market continues to look ahead at how far the ECB could take the rates, with the central view that the trough rate in the cycle is closer to 1.75%.

Switzerland

For traders holding CHF positions, Thursday’s Swiss National Bank (SNB) meeting must be on the radar, with IR swaps market split in its view of a 25bp and 50bp cut. This indecisive pricing will likely result in an initial spike higher/lower in USDCHF and the CHF cross rates – Great for those who have a strong conviction on the likely outcome and want to punt the meeting, but for others, this is a risk that will need to be carefully considered whether to hold exposures over the event. Japan With the market having reacted to hawkish press reports and paring back expectations of a 25bp hike at next week’s BoJ meeting to a 1-in-3 chance and seeing January as more likely time for a hike. This week’s Q3 (final) GDP and Q4 Tankan data will need to be significantly strong enough to bring the hike firmly back on the table. The BoJ will look most closely at the Tankan report and the outlooks offered by large and smaller manufacturing and service enterprises. They may also want to see the next CPI print, which is due on the 20 Dec and after next week's meeting.

China

Throughout the week we see China CPI, trade balance, and credit data (new yuan loans, aggregate financing). We also navigate headlines from China’s Central Economic Work Conference (11-12 Dec), although expectations of any market-moving fiscal policy announcements are low, and authorities will likely bring out the big guns post-tariff negotiations with the Trump Administration. On the week USDCNH interests, where a retest and potential upside break of 7.3145 (3 Dec high) could weigh on AUD, NZD, and CAD. On the equity side, I have the HK50 index on the radar, with the index finding 19,770 a tough level to break – subsequently, an upside break here could be worth chasing.

Outside of the G10 FX complex, we should see the Brazilian central bank raise the Selic rate by 75bp and Mexico’s Nov CPI print. However, the central focus will be US CPI, which sets us up for next week's FOMC meeting, as well as the 4 major central bank meetings.

Good luck to all.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.