CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

- English

- Italiano

- Español

- Français

Trader Thoughts: Trump's Reciprocal Tariffs and Their Implications for Global Markets

Trump, never one to fear being centre stage, will be a constant source of headline risk that could throw markets around, and impact sentiment at a time when many were trying to refocus attention to other market themes.

The announcement on reciprocal tariffs will perhaps garner the greatest level of attention from those who trade news and must explain the why. Many have spent time reviewing the simple/trade-weighted average import tariff rates currently in place by the US’s key trading partners – with a view to better understand what a reciprocal tariff hike from Trump could look like - and which nations have the greatest import tariff rate premium and imbalance to the US’s 3.3% average tariff rate.

Japan, India, Brazil, Vietnam, China and the EU nations are now firmly in the firing line.

Looking for the Positives in the Impending Tariff Announcement

While we saw a negative reaction in US equity/global equity futures and a rally in the USD to the headlines (on Friday) that we're set to see a reciprocal tariffs announcement this week, once we see the intel and dig into the weeds, the market may indeed see the situation in a more optimistic light. We understand that these 'reciprocal' tariffs will be implemented to address structural trade imbalances, but in the process, there could be an element of negotiations set to play out. Subsequently, those nations that may be subject to a new higher tariff rate to US buyers could respond before a deadline by lowering the tariff rate imposed on key US imports.

Voila, this scenario could, over time, be seen as a net positive for global trade and promote a turnaround in market sentiment.

China’s Tariffs Set to Kick In Early in the Week

We also know that China’s 10-15% tariffs announced last week on a range of US imports are set to kick in early this week. Yet, while markets haven’t been overly troubled by this if there is no firm dialogue between Xi and Trump by mid-week, then it may pose more of a risk to the recent rally and outperformance seen in HK/China equities. USDCNH also needs close attention, as the buyers are starting to regain control of the tape and where a rally back towards 7.3500 would likely see the USD appreciate on a broad basis.

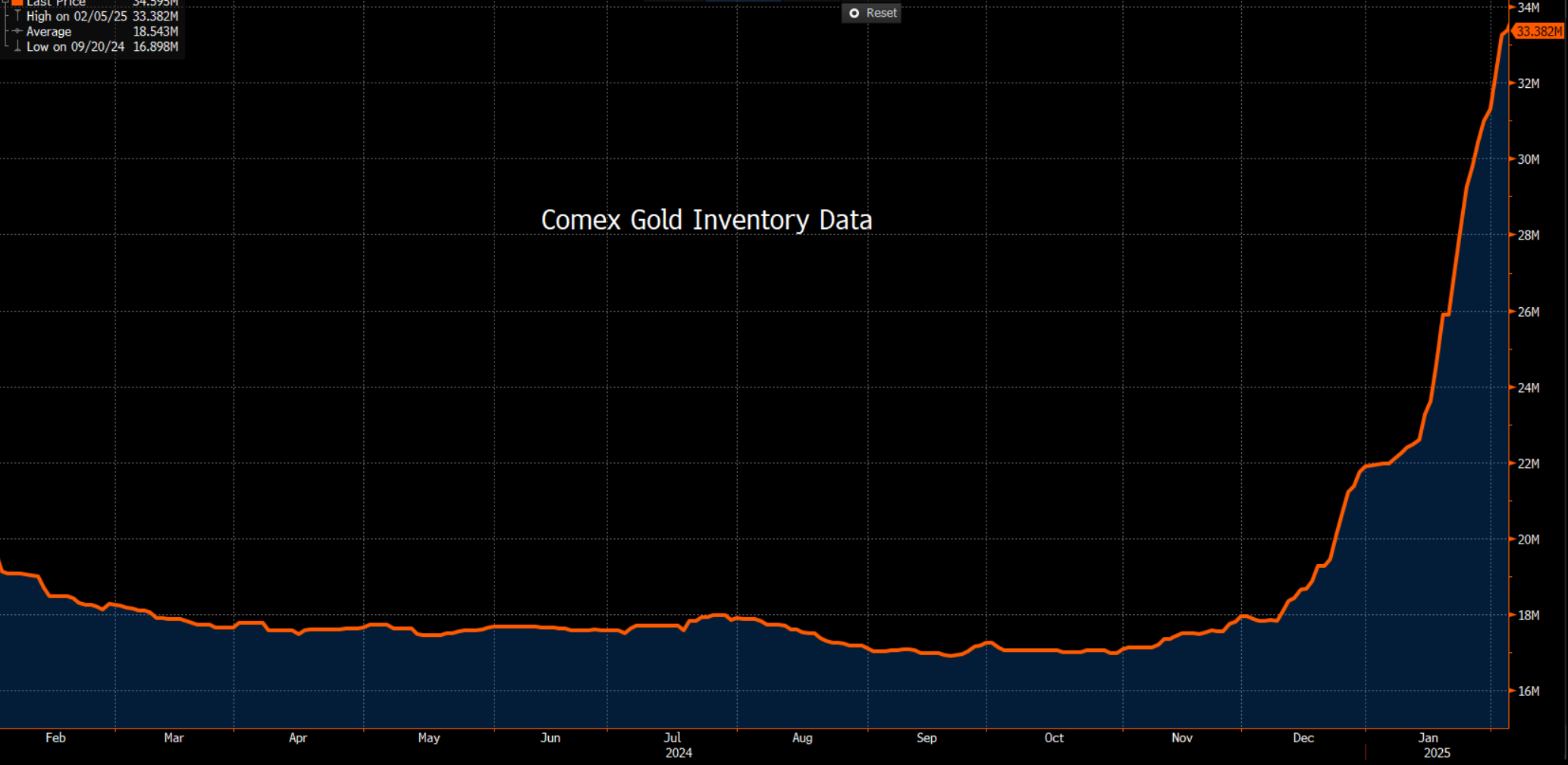

Copper is also one for the radar, with price pushing into $4.59 and the best level since October. The move reflective of concerns of a possible future tariff on US copper imports rather than on better growth dynamics, with metals traders pulling copper to Comex vaults and away from the LME. As such, many in the hedge fund community have been actively trading the CME-LME copper arb - i.e. long CME copper vs short LME copper.

All the Gold to Comex Vaults

Gold traders know the dynamic seen in the copper market only too well, with fears of impending Trump tariffs on gold imports resulting in another 3.28m troy oz of physical gold delivered to Comex vaults in the US last week. The scene in the London markets is clearly precarious, with a significant scarcity of physical gold leading to a spike higher in short-term lending rates and even in the borrowing rates in the GLD ETF. We see that stress in the paper market, with electronic claims trading at a decent discount to spot gold or futures pricing, with counterparty risk clearly on the rise.

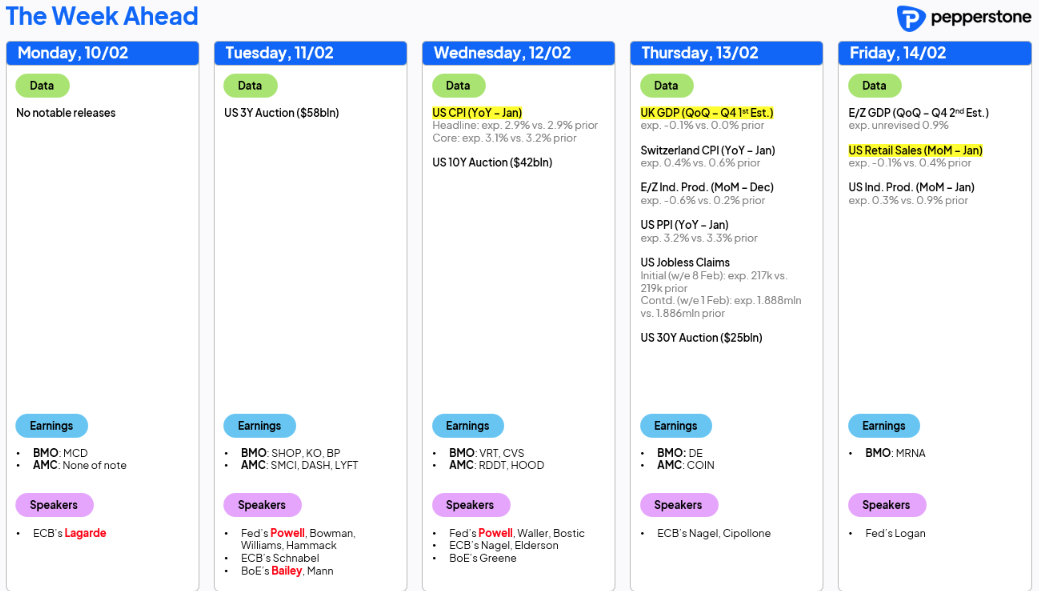

US CPI the Marquee Data Risk This Week

Tariff risk aside, the focus falls on the US data flow, and notably on Tuesday’s US core CPI release. After an outsized reaction in US Treasuries, the USD and S&P500 futures on Friday to full 100bp jump to 4.3% in the University of Michigan 1-year inflation expectations survey, it’s clear the market has become just that bit more sensitive to right-tail risk and higher price pressures.

With the median estimate from economists calling for US core CPI to come in at +0.3% m/m, a core CPI print that rounds up to 0.4% m/m may negatively impact risk and see the USD well bid. Conversely, a core CPI below 0.2% m/m could see the market's pricing for the next Fed cut brought forward from September to July, with relief buying seen in US equity with broad USD selling.

Fed chair Powell will testify to the Senate on Tuesday and again to the House on Wednesday. I suspect increased interest will fall on Powell’s second testimony to the House, given it comes 90 minutes after the US CPI print – so, if the CPI print proves to be an outlier, then Powell may be probed by House representatives on the significance of the inflation outcome and how it would affect the Fed’s thinking.

US PPI and retail sales will also garner attention from traders – but again, it may take a sizeable beat/miss vs consensus expectations to get markets pumping.

UK Q4 GDP a Possible Market Mover

There is little tier 1 data to worry traders too intently in Europe, the UK, China, Japan and Australia, with UK and EU Q4 GDP perhaps the highlight from these regions. GDP is not a data point I have trouble holding positions over, given the overly backwards-looking nature of the release – but given growth in both regions is so anemic, and UK GDP is expected to contract on the quarter, the GBP and EUR could be more sensitive this time around. GBPJPY looks especially interesting, with the spot rate closing at the lowest level since September 2024, with rallies likely to be limited and sold through the week and I remain skewed for lower levels.

ASX200 Traders Eyeing CBAs’ Earnings

In Australia, the countdown is on to the 18 Feb RBA meeting and the clear prospect of the first rate cut since 2020. With limited economic data out this week to influence market pricing on near-term rate cut expectations, the focus locally turns to ASX200 1H25 corporate reporting with JB Hi-Fi, CSL and CBA the highlights on the calendar this week.

CBA (set to report on Wednesday) will be the single-greatest risk from earnings to the ASX200, not just because it has the largest weighing on the index, but with NAB, WBC and ANZ all reporting 1H25 numbers in May, CBAs earnings could influence the share prices of the other banks too.

Local insto’s are all in on CBA, and it’s not hard to understand why, as the quality of the business is there for all to see. Valuation remains the primary concern for those wanting to put new money to work in the name and given the strong rally into earnings one suspects the bar to please the market is sufficiently elevated. That said, as long as 1H25 NPAT comes in around $5.1b, margins improve as expected, and the asset quality shows limited signs of deteriorating then pullbacks in the share price should be shallow, and depending on how the macro news flow impacts broad sentiment, CBAs share price and the ASX200 can push further higher.

So, another big week for traders, with tariff headline risk and US CPI the obvious landmines to navigate.

Good luck to all.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.