CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

- English

- Italiano

- Español

- Français

Trading the Ranges: Key Market Risks and Strategies for the Week Ahead

Looking at the factors throughout the week – Headlines from an excepted meeting/call between Xi and Trump could influence sentiment to an extent. Again, on the fiscal side, the US Senate will crank up its own debate on the “One Big Beautiful Bill” – where passing the act will unlikely be as smooth as passage through the House. US bond traders know that there are just under five weeks until the deadline on 4 July, and with increasing debate about the level of future revenue raised from tariffs, the direction for US 10 & 30-year Treasury yields continues to divide opinions.

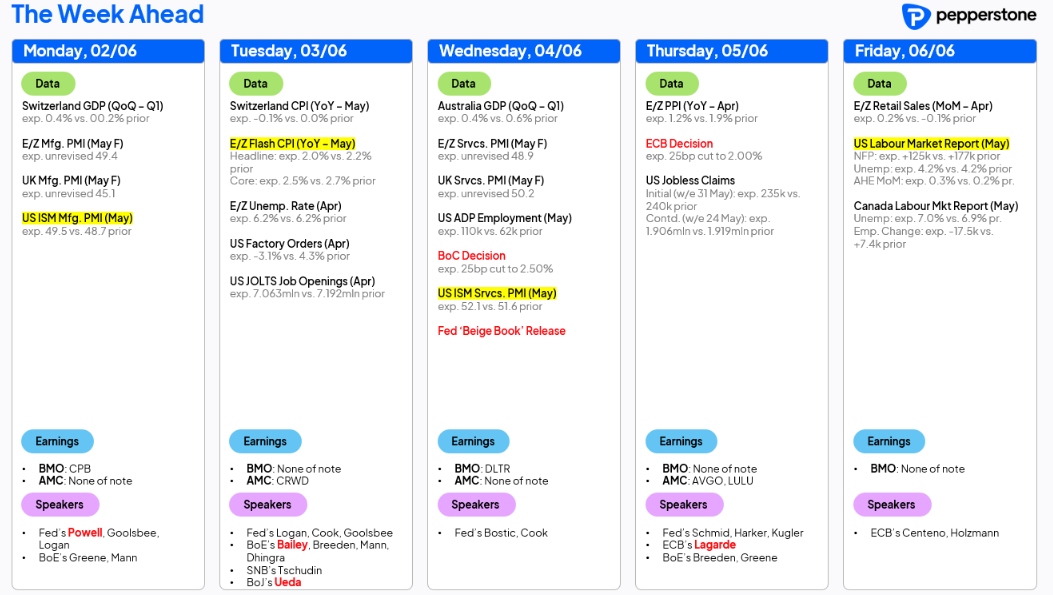

US nonfarm payrolls are the marquee risk this week

By way of the scheduled event risk that could move markets, the central focus in the week ahead turns to the US labour market. The JOLTS job openings report (Tuesday) will be the first labour data point off the rank, with the consensus view that job openings will drop to 7.06m. Digging into the weeds of the report and the layoff rate will be important, notably if we were to see an uptick from the 1% seen in April.

The focus on the US labour market then turns to Friday’s nonfarm payrolls report. The consensus estimate (from analysts) comes in at 125k (estimates range from 190k to 105k), which if 125k were to come in would represent a slowing in hiring, with the 3-month average at 154k and the 6-month average at 193k. Revisions to the prior NFP prints will also matter.

The unemployment rate (derived from the Household survey) is expected to remain at 4.2% - however, after last week’s rise in the continuing jobless claims report – the highest since September 2021 – the risk of an upside surprise to 4.3% or above is there.

Staying Stateside, on the survey/growth side, the ISM manufacturing and ISM services releases have the potential to move the dial. However, given the rapidly evolving news flow around tariff rates, the market is perhaps less sensitive to the fickle survey-based (soft) data points - subsequently, we may need to see a big miss/beat in either survey to see a big reaction in markets.

We also get to hear from the usual raft of Fed speakers – the lineup includes speeches from Christopher Waller and chair Powell, although it may be the Fed members set to speak after the NFP print that the market reacts to most intently – especially if we were to see a significantly weaker NFP print.

The ECB to cut rates, the BoC to keep rates at 2.75%

Away from the US, we navigate the EU CPI, which is released two days before the ECB Meeting on Thursday – eyeing rates pricing, a 25bp cut is fully discounted, while the ECB’s terminal rate is priced at 1.55% - this implies two more 25bp cuts and a solid debate on a possible third in this easing cycle. The Bank of Canada meet on Wednesday and should hold interest rates (IR) at 2.75%, although it wouldn’t surprise if they did pull out a 25bp cut - an outcome CAD interest rate (IR) swaps ascribe a 22% probability to.

In Australia, we get the RBA’s May meeting minutes on Tuesday, followed the day after by Q1 GDP where consensus expectations are for a 0.4% q/q print, which would take the annualised rate to 1.5% y/y (from 1.3% in Q424). With AUS IR swaps implying a 71% probability of a 25bp cut at the July RBA meeting, the Q1 GDP print would need to come in above 2% to derail a July cut in the market’s eyes.

The trading environment: How to trade the markets this week:

On the equity index front, the technical set-ups (on the daily & weekly timeframes) portray consolidation in the price action and range compression in nearly all the major cash equity and futures markets – while cognisant of the risk that needs to be managed this week, I suspect these ranges will remain the play this week, but I am open-minded and reactive should an index break out to set up a possible trend.

The HK50 index is front and centre in this regard, as the HK equity market was the worst performer of the major equity bourses last week, closing (on Friday) on the recent range lows.

A closer focus on the S&P500 highlights that the 20-day MA has been the level where dip buyers have supported through pullbacks of late, while rallies have been sold into 6000 (in the S&P500 futures) – a ceiling that defines the range highs and one that longs want cleared if they’re to get a run at the all-time high of 6168.

Those set in short positions in US equity will want to see the S&P500 futures close below the 20-day MA and 5828, the 23 May low and double top neckline.

In the equity volatility (vol) space, the cash VIX closed on Friday at 18.57% - the 14th percentile of the 12-month high-to-low range and bang on the 12-month average. S&P500 1-week at-the-money implied vol settled on Friday at 15.6% - again, in line with the 12-month average and a level that equates to an implied move over the week (with a 68.2% confidence level) of-/+2.2%. In this trading environment of low realised and implied equity vol and consolidation in the price action, for those that focus on the higher timeframes (4-hour & daily), these conditions favour mean reversion and range trading strategies. It is also an environment that compels long/short tactical trades – long NAS100/short HK50 screens well.

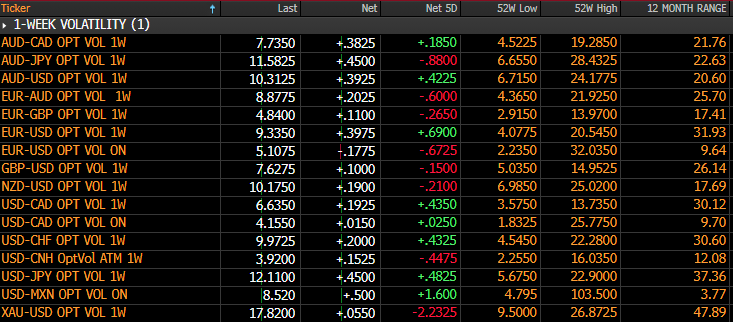

In FX markets, the DXY gained 0.3% last week, with EURUSD closing -0.1% w/w, GBPUSD -0.6% w/w, and USDJPY +1% w/w. The 5-day % changes have been well contained and have resulted in the 1-week realised volatility range across the G10 currencies all falling below the 35th percentile of their respective 12-month ranges.

FX 1-week implied volatility (vol)

AUDUSD is perhaps the poster child of the tactical mean reversion/range trade played in G10 FX markets, with AUDUSD 1-week realised vol (RV) at the 17th percentile of the 12-month range, and compression in Bollinger Band width – subsequently, traders have been actively selling rallies into 0.6500 and buying into range lows of 0.6350.

With US JOLTS, ISM manufacturing/services and NFP out this week we need to consider the risk to the USD, as we do on a cross-asset basis. While we consider US rates pricing and market positioning, I would argue the USD and US equity would face a bigger sell-off on weak data than any potential rally on hotter data.

In commodity markets, gold closed the week -2%, as did iron ore futures, while Brent crude settled -3.5% w/w. Gold 1-week RV remains relatively elevated at 15.7% (the 33rd percentile of the 12-month range) with 1-week implied vol priced at a premium at 17.76% - equating to an implied move (with a 68.2% level of confidence) in the week ahead of -/+2.5% or $83, putting an implied range for the week ahead of $3371 to $3206.

Good luck to all.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.