CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

- English

- Italiano

- Español

- Français

There's a number of key set-ups on the radar today which I flag in my Navigating Markets video, so this may be of interest. Do take a look and if you find it useful, subscribe to get notifications when they are released.

The fact that it is moving higher is all we need to know. The FOMC minutes were a sideshow, although we did initially see USD selling, married with moves seen in interest rate expectations being priced out of the rates markets - specifically into the 2024/25 parts of the Eurodollar futures curve.

The 10yr Treasury dropped 5bp to 1.31% - a huge story in global macro and this continues to support the high-flying tech stocks, while meme names are now attracting better short interest. Can this vibe of buying bonds continue with US CPI a major event risk next week, amid expectations of a year-on-year print of 4.9%? The equity expression of lower interest rates has been to be long NAS100 and short US2000 (or long tech and short banks) and this may reverse if overbought US Treasuries turn around and yields head higher. By all accounts, many want to put on Treasury shorts (price down and yields higher) but they're just too worried to step in front of this freight train. When (if) it goes, long banks and short tech will work and the US2000 will find a better tone, but until such time names like Amazon, Apple and Microsoft will find buyers on shallow dips.

Gold remains a client favourite, but the trade for Gold longs has been to trade it from the long side in EUR terms (XAUEUR). Whilst it can complicate the process, we can max out the returns by effectively buying an asset in the weakest currency, or conversely we can go short in the strongest currency. This boosts the P&L effect. That can be tough, as currency trading can be hard enough let alone trading Gold too – but the effect, if you can get both on point, can be very good for the account P&L.

At this point, XAUEUR is trending higher but needs to clear 1530 and we’re seeing better sellers emerge.

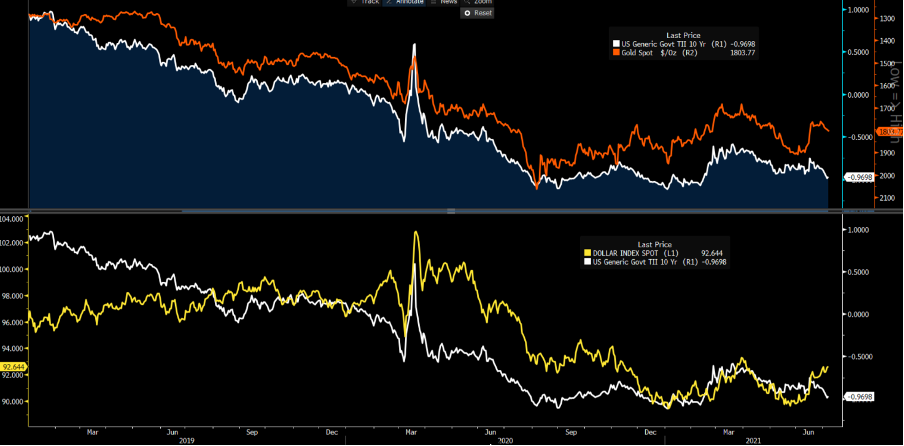

Top pane – gold (inverted) vs 10yr real rates

Lower – USDX vs US 10yr real rates

(Source: Bloomberg)

A basic overlap of real (inflation-adjusted) US Treasures and Gold (in USD terms) suggests the yellow metal is ‘cheap’, while one could argue if real Treasury rates were the driver (the independent variable) that the USD could face downside risks. This is a very simplistic approach, as I would argue the market is anticipating upside risks to US real rates and are therefore not prepared to lump into gold longs and USD shorts on these grounds – but it's interesting that this once strong correlation has broken down.

Trade of the day

(Source: Tradingview)

I’ve been pushing this set-up in the Navigating Markets video – but Link (Crypto) is shaping up nicely. We recently saw the downtrend break and since then price has consolidated with daily ranges contracting. We’ve seen a couple of attempts from the bulls to push this through 20.00 but fail to have the impetus to start a trend higher. I want to wait for some upside momentum to come into the price, but a firm break of 20.00 would be powerful. This is like a coiled spring, but I like the shape and structure to this and feel when this goes it could be a solid long for 26.00, potentially even 27.50 over time.

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.