CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

- English

- Italiano

- Español

- Français

WHERE WE STAND – It’s typical, isn’t it?

We finally get a sunny weekend here in Blighty, yet end up spending the whole time glued to headlines emanating from the US-China trade talks in Geneva. Let’s put that down as another weekend forever lost to Mr Market.

As for those talks, at least according to the US side, they appear to have gone well. Treasury Secretary Bessent noted that “substantial progress” had been made, while USTR Greer remarked that they were “very constructive” in nature, and that the differences between the two sides were ‘not as great as previously thought’. Despite all of that, Bessent declined to give any concrete details, instead saying that those would come as part of a press briefing today – how he just loves to keep us all in suspense!

The Chinese side, meanwhile, noted that progress had been made in talks over the weekend, and that the two sides have agreed to setup a ‘trade consultation mechanism’ as soon as possible. In layman’s terms, I think, that means that the “deal” which has been agreed is simply an agreement to hold further talks with the aim of actually reaching a proper trade pact in due course. I hate to use the same pun twice, but ‘The Art Of The Agreement To Talk Some More In The Hope We Do A Deal’ really isn’t especially catchy.

On the whole, though, there do appear to be more questions than answers here, at least for the time being. Of most importance to market participants is likely to be whether the ‘progress’ made over the weekend allows for any changes – pauses, reductions, or rollbacks – to be made to the tariffs that are currently in place, and if so for how long? There is also the issue of further talks, both when they may take place, and what matters may be discussed?

Anyway, the knee-jerk market reaction to weekend developments has been a positive one, with equity futures rallying across the board, Treasuries selling-off a touch, and the dollar gaining ground against most peers. Of note for the technical analysis folk, spoos are now a mere whisker away from breaking back above the 200-day moving average, for the first time since late-March.

As the adage goes, though, the devil will be in the detail here. Greater clarity on what exactly the two nations have agreed, in order to back up the apparently softer rhetoric on both sides, will likely be needed to give markets the required confidence to say that peak trade uncertainty, and tit-for-tat tariffs, are indeed in the rear view mirror, in turn supporting a more durable rebound in sentiment. For the time being, however, given the prevailing uncertainty which remains, I’m inclined to fade this strength in the dollar, and equities, at least in the short-term.

Besides all of that, there are a few things worth noting from Friday’s session, which was on the whole a quiet one, as participants squared up positions in advance of the aforementioned trade discussions.

Perhaps the most notable of these developments was the deluge of Fedspeak that we got as the ‘blackout’ period came to an end. Half of the FOMC speaking on the same day should send a pretty strong message in itself, but when each and every one of those speakers stresses that policy is in a good place, and that there is no rush to ease further just yet, the message becomes even stronger. Rightly, the Fed are firmly in ‘wait and see’ mode for the time being, and will probably remain there for the next quarter or two, despite President Trump continuing to rant away about wanting lower rates. Any cuts before the summer is out remain a very long shot indeed, while the market pricing ~70bp of easing this year still seems overdone to me.

Sticking with monetary policy, BoE Chief Economist Pill was also on the wires into the weekend, noting how the “careful” part of the MPC’s guidance means policymakers are alert to uncertainties on the outlook, while also being “agile” to future economic changes. Rather a hard position to tally, really, with the Bank’s substantially more dovish May economic forecasts, and Pill’s own dissent in favour of holding Bank Rate steady last week. Once again, the ‘Old Lady’ has descended into a rather shambolic state of affairs.

Finally, if ever there was need for another example to prove the adage that ‘the stock market is not the economy’, then Germany provided us with it as the week drew to a close. While the economy continues to plod along in anaemic fashion, and the latest PMIs plumbed multi-month lows, the DAX ended the week at a record high. Don’t ever let it be said that markets aren’t rational!

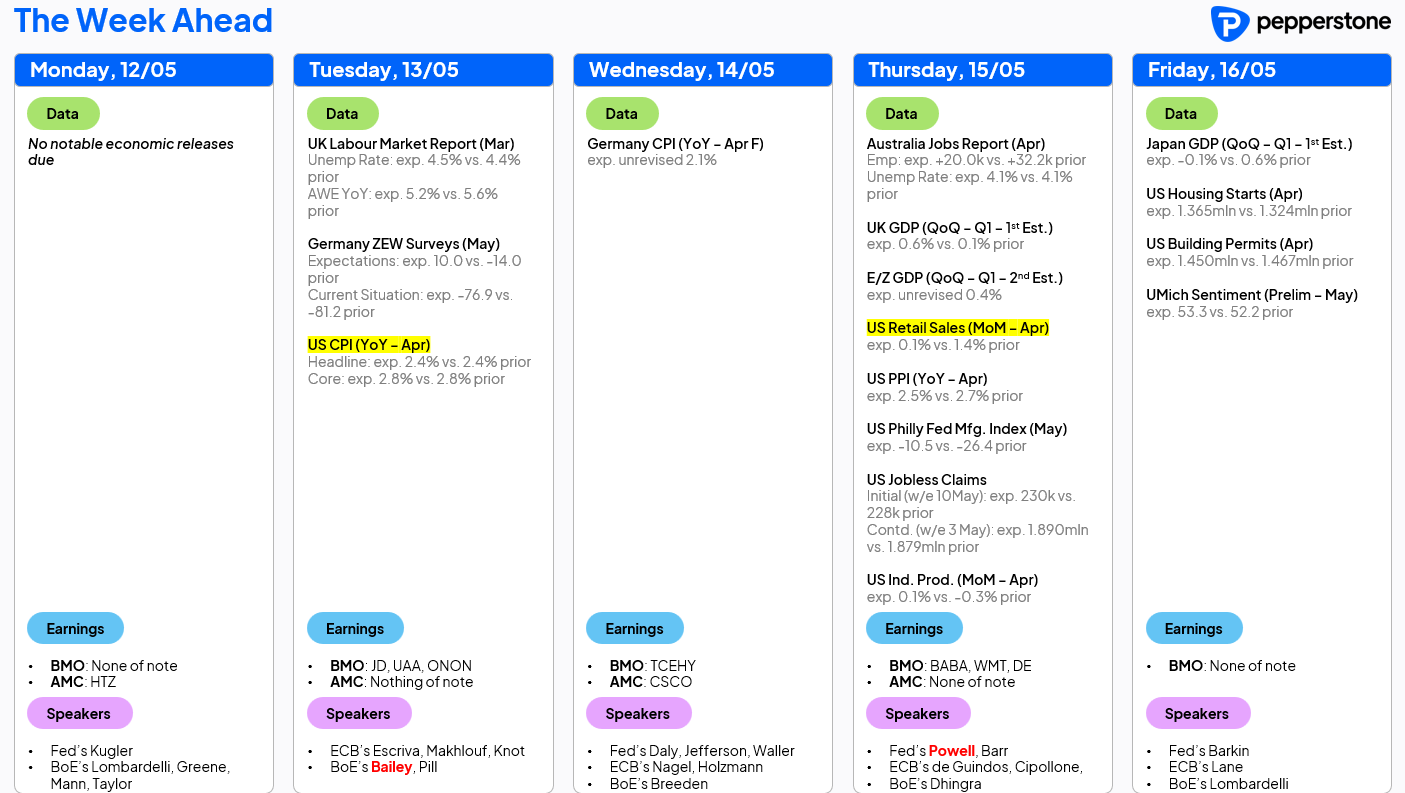

LOOK AHEAD – A much more barren data docket up ahead this week, though focus will naturally remain primarily on trade and tariff developments.

We do, though, have a few interesting releases out of the States, including April’s CPI and retail sales figures, both of which will be closely watched, though it’s likely too soon to see any impact of tariffs showing up in these reports just yet. On that note, Friday’s UMich sentiment survey, which has fallen off a cliff in recent months, also bears close attention, though it seems consumer sentiment may have, at least for the time being, bottomed out.

Here in the UK, the week ahead brings our latest update on the state of the labour market, though the usual health warning regarding the unreliability of the ONS’ data collection continues to apply. Unemployment, though, is seen having risen to 4.5% in the three months to March – yet, somehow, the BoE’s Chief Economist didn’t think a rate cut was needed last week, give me strength!!

The docket also brings a smattering of Q1 GDP figures, the bulk of which are likely to have some degree of positive skew in them by virtue of US importers attempting to front-run tariffs which the Trump Administration have now implemented.

Elsewhere, Q1 earnings season is as good as over, with the pace of reports slowing markedly, though commentary from retailers such as Walmart nonetheless does bear some watching. Sadly, the same can’t be said of this week’s docket of central bank speakers, which is again a jam-packed one, highlighted by comments from Fed Chair Powell on Thursday, and BoE Governor Bailey tomorrow.

As always, the full week ahead calendar is below.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.