CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

- English

- Italiano

- Español

- Français

WHERE WE STAND – Guess who’s back, back again? Tariffs are back, tell a friend.

Oh, yes, far from it being a calm Friday to ease us into a long weekend, and long weekend itself, President Trump had other ideas.

Firstly, it was Apple that found themselves in the President’s firing line, with Trump once again expressing his displeasure with iPhones being manufactured overseas, and not in the US. If this situation doesn’t change, and manufacturing doesn’t return to the US, then a tariff of “at least 25%” will be imposed on Apple products. Later, Trump clarified that this would also apply to Samsung and, I assume, to other electronics, though this hasn’t been confirmed.

Shortly after, Trump turned his ire towards the European Union, ranting away once more about the trade deficit that the US runs with the bloc, and “recommending” a 50% tariff on EU imports, starting 1st June, in light of the lack of progress that has been made in trade negotiations between the two parties. Just two days later, though, on Sunday, Trump announced that this 50% tariff would instead be delayed until 9th July.

Clearly, there’s quite a lot to unpack here.

Firstly, I find it increasingly concerning that we have a President who appears to be taking some of his policy ideas right out of Chairman Mao’s ‘Little Red Book’. Last week, it was telling Walmart not to raise prices as a result of tariffs, this week it’s telling Apple where they can and can’t manufacture their products. One wonders who, or what, will be next. This is yet another factor that will likely continue to shake institutional confidence in the United States, while also posing a stiff headwind to business investment. As a firm, do you really have an incentive to go ‘all in’ on the US, when the President may bully you into doing something else at a moment’s notice? Not really.

Secondly, we appear to be back to the ‘governing by social media’ days that not only dominated the first few months of the year, but also which were the standout feature of Trump’s first term. As such, with policy seemingly changing on a whim once more, it’s somewhat harder to argue that peak trade and tariff uncertainty is in the rear view mirror. I still think, though, that we’re unlikely to get back to that chaotic zenith of early-April, especially with the US having demonstrated – largely via the China trade truce – that there is no desire, and no ability, to stomach tariffs at such a high level, for such a prolonged period.

I guess this brings me back to the TACO acronym – Trump Always Chickens Out.

You’d imagine that, even with the weekend implementation delay, this is probably another one of those situations where a 50% tariff on EU imports probably gets walked back more fully, sooner rather than later, in what some might point to being another example of the ‘escalate to de-escalate’ strategy. The problem for market participants, though, is that we can’t immediately jump on that as a trading theme, and need to at least price some probability of the tail risk – prolonged, high tariffs – eventuating.

This explains the predictable risk-off and ‘sell America’ way in which markets rolled into the holiday weekend – stocks slumping, the dollar losing ground against most G10 peers, gold finding solid demand as participants sought shelter, which also encouraged demand across the Treasury curve. A theme which, largely, went into reverse in thin holiday trading conditions yesterday, with equities retracing Friday’s losses, though the greenback remained under considerable pressure.

The S&P 500 future, though, did manage to remain north of the 200-day moving average amid all that. With that, and the high likelihood of a tariff rollback in mind, I’m happy to buy the dip (BTD) for the time being, though one must be aware of the risk that conviction starts to wane a little ahead of earnings from Nvidia (NVDA) tomorrow.

Put simply, TACO = BTD.

Speaking of spoos, though, if – as I think we’d all agree – 4,800 was the strike price for the ‘Trump Put’ in early-April, when the ‘Liberation Day’ tariffs were paused, then I suppose 6,000 marks the strike for the ‘Trump Call’, the point at which complacency steps in, Navarro gets more of a hearing than Bessent, and policy incoherence makes a comeback. Folk familiar with options will know that this strategy has a name, but sadly there’s no way me typing it would get through censorship!

As for the FX space, there is a pretty clear inverse correlation at this point between policy volatility, and the value of the dollar, particularly in an environment such as this where participants seemingly need little excuse to further trim their US exposure. Having been a dollar bull – and wrong! – for a while now, I’m becoming less and less comfortable with that view, and wouldn’t be at all surprised if the market ran down to test prior lows around the 98 figure in the DXY. Very roughly, that would put cable at 1.37, the EUR at 1.15, and the JPY under 140.

Anyway, according to Treasury Secretary Bessent, these moves in the FX space are “other countries’ currencies rising, not the dollar falling”. I mean, please, where the hell do you start with this one?! I’m assuming, given his background, that Bessent knows how the FX market actually works, though it’s amazing to see how one goes from sharp as a tack, to thick as two short planks, the moment they take the oath of office, and political spin becomes the priority.

I’ll wrap up with a word on gold. Probably the most convincing trade idea out there at the moment remains to be long bullion, with haven flows likely to remain healthy, demand from those seeking to diversify reserve holdings still sizeable, and the weaker dollar also providing a nice helping hand. Yes, we’ve come a long way already this year, but I still find it tough to bet against the yellow metal, and wouldn’t be at all surprised to see us take another run towards record highs at $3,500/oz in relatively short order.

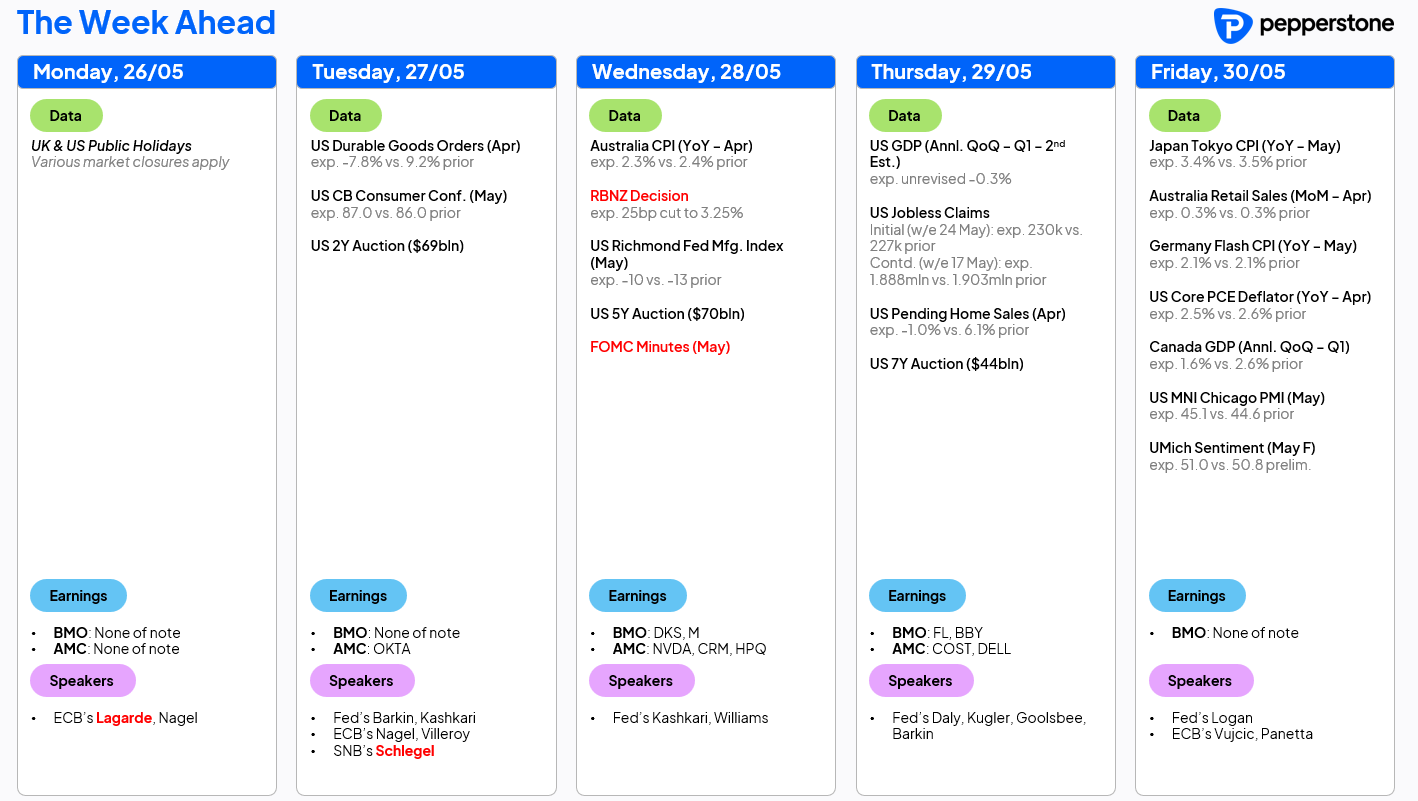

LOOK AHEAD – A considerably lighter docket lies ahead this week, which is of course holiday-shortened after the long weekend on both sides of the pond yesterday.

Earnings from Nvidia (NVDA) standout as the most notable event risk to be navigated, especially with options tied to the stock pricing a punchy +/- 6.8% move in the 24 hours following the earnings release. Naturally, one would expect some spillover impact here on other AI-related names, as well as on the benchmark indices at large, with NVDA being the second largest stock in both the S&P 500 and Nasdaq 100.

Besides that, the data slate is devoid of anything particularly interesting. The second estimate of Q1 US GDP should be rather unremarkable, while the April PCE figures are highly unlikely to materially move the needle in terms of the FOMC policy outlook. The same also goes for the latest consumer confidence, durable goods orders, and jobless claims reports.

We do get minutes from the May FOMC this week, though, which will likely reinforce the ‘wait and see’ approach with which we have now all become very familiar. The usual round of Fed speakers will hit news wires as the week goes on, while Wednesday should see the RBNZ deliver a 25bp cut, which markets fully discount.

Besides that, a chunky slate of Treasury supply awaits with 2-, 5- and 7-year auctions scheduled. One would expect these to proceed significantly more smoothly than the dismal 20-year sale last week, though the sales will be closely watched given ongoing jitters over the US’ fragile fiscal footing.

As always, the full week ahead calendar is below.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.