- English

- Italiano

- Español

- Français

Analysis

The AUD was the best performer last week followed closely by the GBP and was the standout on Friday, gaining 1.3% vs the USD - hitting a high of 0.7877 and the strongest levels since March 2018.

There's no doubt this is also a weak USD story and while US 5-year and 10-year real Treasury yields are climbing higher, traditionally a USD positive, we’re also seeing short-term interest rates finding strong buyers with the yield on 4-week US T-bills approaching zero. This seems to be negatively impacting the USD at a time when the long end has been rising. Take a look at the USDX 4-hour or daily chart and see the flow with a well-pronounced head and shoulders pattern with the neckline at 90.06. The reverse is true in EURUSD, where the neckline comes in a 1.2165, where a break takes the pair in 1.2350/2400.

(USDX – 4hr chart)

Back on the AUD and we can see copper is flying and has blown the $4.00 p/lb level away. Industrial metals continue to tell a story of inflation and are offering support for the AUD, as the Aussie remains a vehicle for trading inflation expectations. Westpac’s Bill Evans also caused a stir in the Aussie rates market on Friday with the house call that 10-year Aussie government bonds will hit 1.9% (from 1.55%) this year. Although they also raised its 10-year US Treasury call to 1.8%, which is well ahead of consensus. I guess they’re buying into the inflation narrative too, but the lift in forecast pushed up Aussie 10-year bond yields +7bp at 1.43% and subsequently put a bid into the AUD.

I would argue that NY Fed President John Williams who was interviewed on CNBC, detailing that the recent rise in yields is “not a concern, instead it shows optimism” is important – for those thinking the Fed is going to step in front of the move in yields then Williams’ comments suggest it isn’t on their radar at this stage, which is modestly USD bullish. Either way, AUDUSD closed not too far off its session highs, so his comments haven’t been felt too intently in high beta FX.

AUDUSD aside, the trade-weighted AUD is now at 64.000 and the highest since March 2018. Importantly, the currency strength is not affecting Aussie inflation expectations, with 10-year breakevens at 1.95% and eyeing a break of 2% - a level it has struggled with over the past five years. Aussie funding markets are tightening, and swaps are moving up at quite a clip, despite the RBA recently going above and beyond with its asset purchase program. There doesn’t seem much the RBA can do about this move at this stage and as they recently detailed if it weren’t for its QE program the AUD would be 5% higher than current levels.

It’s really all about staying in lockstep with the Fed so as not to create a misalignment in policy. They need to believe the economy continues to evolve and terms of trade push higher. They can manage its relative appeal but that’s about it, the Fed are the price maker.

Staying with the Fed and while the market will be sensitive to fiscal negotiations and whether we’re ultimately looking at $1.5t or $1.9t in fresh stimulus, it’s a big week ahead with so many core Fed speakers due on the wires. The core focus will be on speeches from Clarida, Powell and Brainard, where the risk is they maintain a dovish outlook, subsequently pushing the DXY into the neckline and keeping the AUD bid.

(Fed speakers – Times in AEDT)

(Source: Bloomberg)

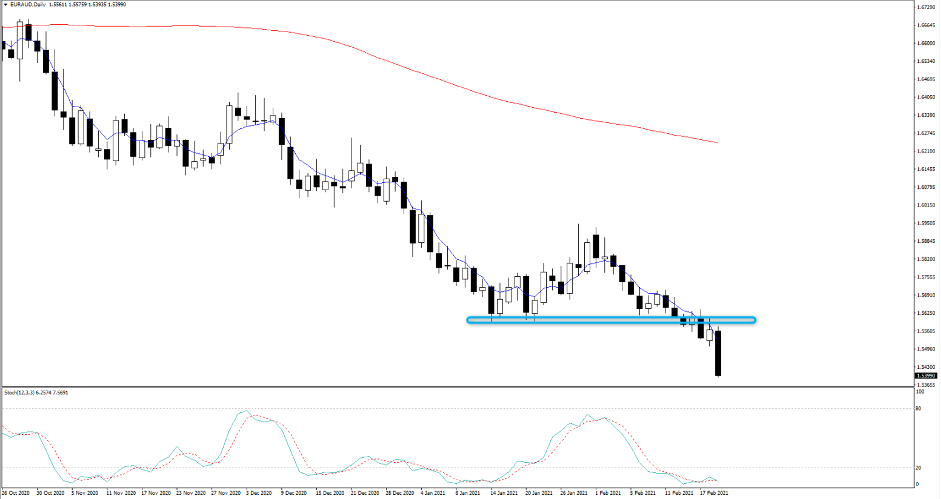

While AUDUSD looks strong and pullbacks should be confined to 78c, perhaps the better trade is long AUDCHF and short EURAUD. This may be a reflection that the funding currencies are on offer as rates start to move higher and we know that it’s going to take something fairly special for the ECB and SNB to ever move on rates.

(Top pane – EUR vs Aussie 2y2y swap differentials, lower pane – EURAUD)

(Source: Bloomberg)

Either way, AUDCHF now trades at the strongest levels since May 2019 and EURAUD through 1.5400 and the lowest since late 2018. EURAUD will be sold into any strength in this sentiment and backdrop, where the risk to shorts on a more sustained basis is a solid equity drawdown, which one should be mindful of. However, in the absence of the VIX pushing towards 30% and while rates are selling off, then the AUD is likely to outperform the ‘funding’ currencies. If we get EURAUD 12-month forward rates moving higher, then we could be talking about carry as an emerging theme too and that could give the AUD rally a new tailwind.

(Source: Bloomberg)

If I were managing a Treasury desk and had decent EUR exposure I’d be looking at my hedging strategies pretty closely right now.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.