CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

- English

- Italiano

- Español

- Français

Silver Hits Record Highs: Multiple Drivers at Work, Watch for Pullbacks

.jpg)

Over the past week, precious metals markets saw broad-based buying, with silver standing out. On December 1, spot silver surged past $58 per ounce for the first time in history, drawing widespread attention from traders.

Looking at a broader timeframe, as of November, silver has posted gains for eight consecutive months. Year-to-date, it has risen nearly 100%, far surpassing gold’s roughly 61% gain over the same period and significantly outperforming the Nasdaq’s 21% increase.

This strong rally has forced the market to reassess silver’s potential and risks moving forward.

Technical Outlook: Strong Bullish Momentum, Watch for RSI Divergence

After climbing from $37 at the end of August to $54 by mid-October, silver consolidated within this range for several weeks, with bulls and bears taking turns testing control. Last week, bullish momentum intensified, especially on Friday, when intraday gains exceeded 6%, breaking the $54 range high and setting a new all-time high on Monday. Should the rally continue, $60 and $62 may act as potential resistance levels.

It’s important to note that despite the new highs, the RSI has entered overbought territory and shows signs of bearish divergence, suggesting short-term pullback risks.

If profit-taking occurs, previous resistance at $54 and the 61.8% Fibonacci retracement from the late-August uptrend—also near local lows tested multiple times in mid-to-late October around $50—could provide support.

Short-Term Catalysts: Rate Cut Expectations, Short Squeezes, and Order Releases

Silver’s rapid recent gains have been driven by multiple factors: rising expectations of a December Fed rate cut, fast-moving capital inflows, and the release of backlogged orders following CME trading disruptions.

Like gold, silver benefits directly from a looser monetary environment: the market currently prices in nearly a 90% probability of a December Fed rate cut, reducing the opportunity cost of holding a non-yielding asset and attracting trader interest.

Additional drivers include challenges to Fed independence, heightened geopolitical tensions, and persistent U.S. inflation, all supporting silver’s safe-haven appeal.

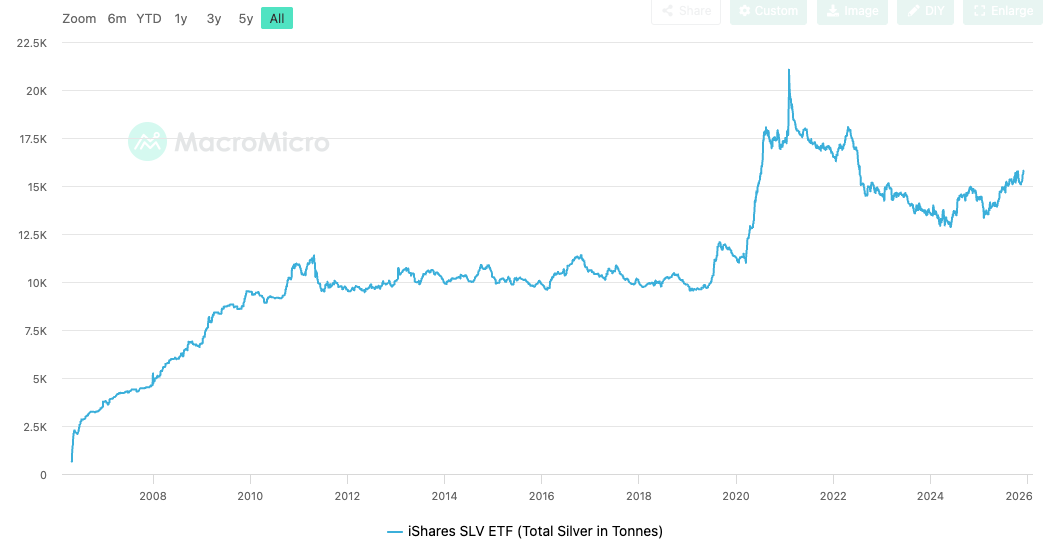

Rapid inflows have further fueled price gains. As of late November, holdings in iShares Silver Trust, the world’s largest silver ETF, exceeded 15,600 tons, reaching the highest level since July 2022.

Silver’s smaller market size compared with gold, combined with higher liquidity elasticity, allows capital inflows to amplify price movements and trigger short-term squeezes.

Moreover, last Friday, CME trading disruptions paused silver futures and options for several hours; once trading resumed, the concentrated release of accumulated orders further accelerated the rally.

Medium to Long-Term Support: Supply-Demand Imbalance and Strategic Reserves

Beyond short-term flows and market sentiment, silver’s industrial role provides strong support for medium- to long-term gains. From photovoltaic cells and EVs to electronics and AI data centers, silver plays a critical role in the energy transition and digital infrastructure, ensuring stable and ongoing demand.

Geopolitical strategies further support silver. For example, the U.S. Department of Defense plans to acquire approximately 1,000 tons of silver by 2026—around 3% of annual global production. Australia has also included silver in its critical mineral strategic reserves, bolstering the long-term bullish case.

However, supply elasticity remains limited. Over 70% of global silver production comes from byproduct mines (lead, zinc, copper, and gold), with primary silver mines accounting for just 28%. This means that even if prices surge, output cannot quickly scale unless byproduct metal prices rise simultaneously.

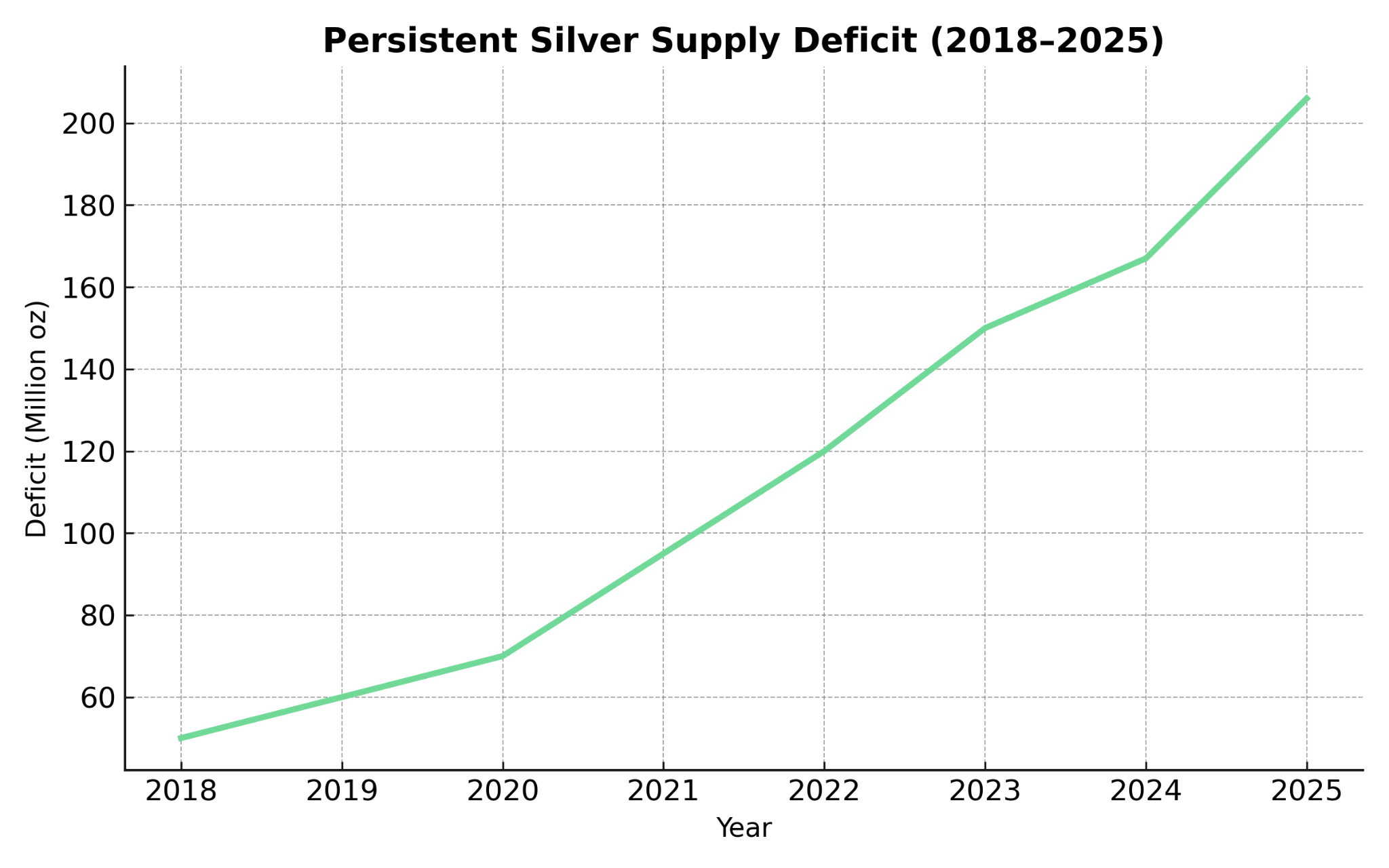

Given constrained supply and growing demand, silver’s deficit continues to expand. According to Crux Investor, the global silver supply gap is expected to reach 206 million ounces in 2025, a trend likely to persist. This structural deficit underpins silver’s long-term bullish narrative.

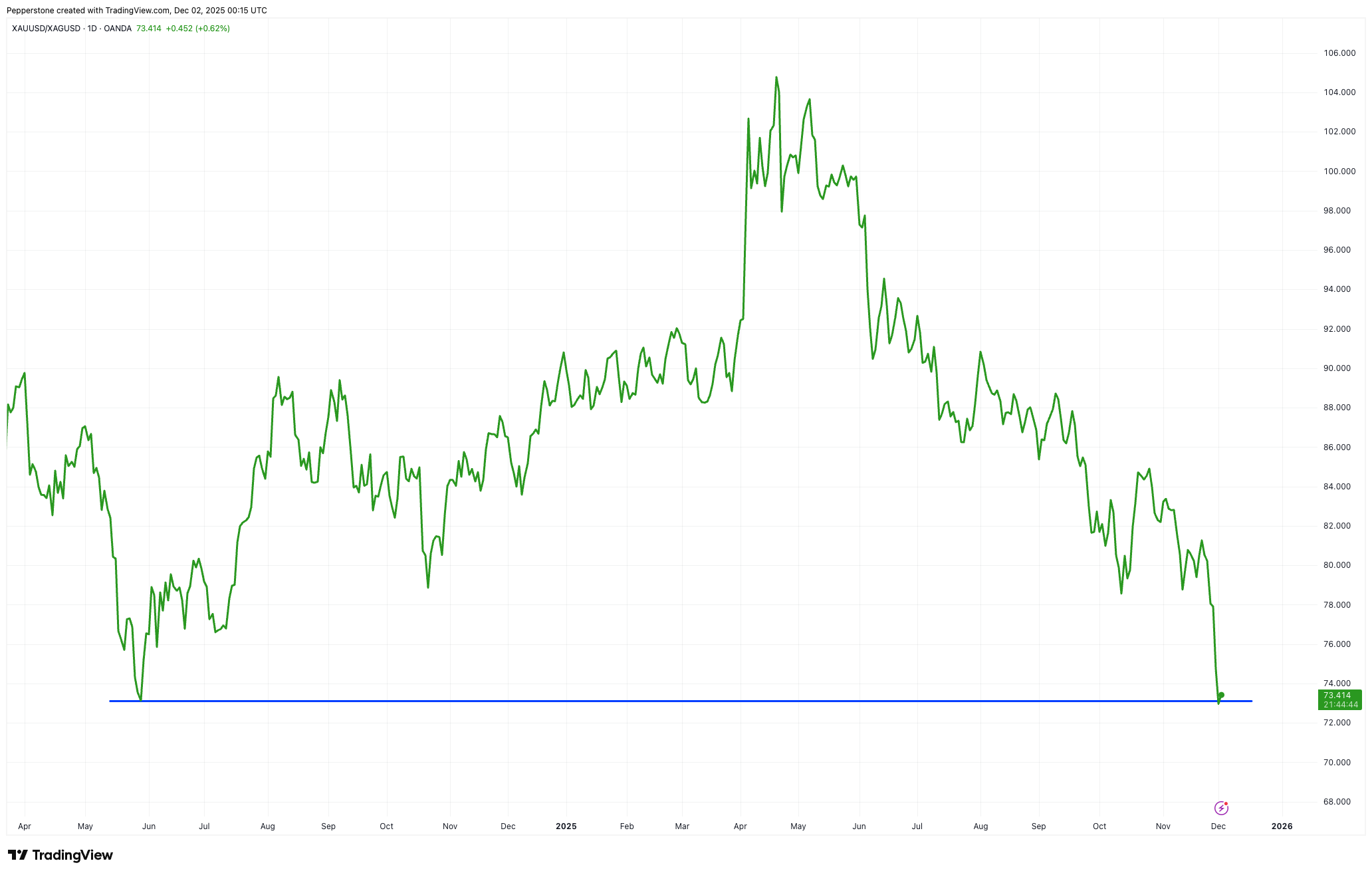

Silver-to-Gold Ratio Declines Rapidly; High-Volatility Caution

Supply deficits combined with short-term capital inflows have pushed silver to record highs. Yet from a valuation standpoint, the silver-to-gold ratio currently stands at around 73—the lowest since mid-2024—indicating a catch-up rally. Coupled with RSI divergence, short-term pullback risks are not to be ignored.

Overall, silver retains medium- to long-term upside potential, but traders should manage positions carefully and avoid chasing prices blindly. In a high-volatility environment, strategie can reflect both trend and volatility considerations:

- Trend-following:Buying dips remains the core strategy under supportive fundamentals, but stop-losses are essential to control risk.

- High-Volatility Strategies:With elevated market volatility, options or structured strategies such as volatility trades or ratio spreads can be considered.

- Hedging and Portfolio Allocation:Using the gold/silver ratio for allocation allows silver to act as a leveraged version of gold while diversifying overall portfolio risk.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.