CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

- English

- Italiano

- Español

- Français

September 2024 US Employment Report; Solid Report Nods Towards 25bp November Cut

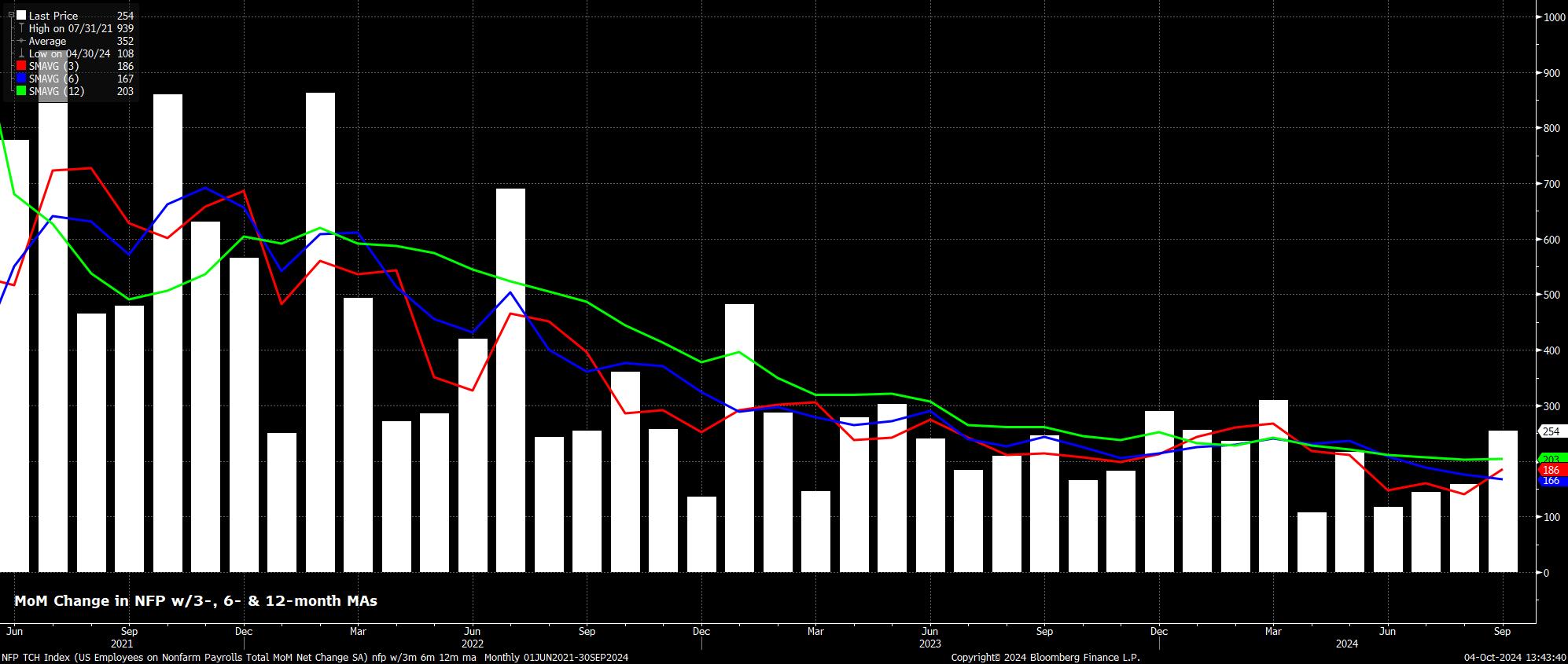

Headline nonfarm payrolls rose by +254k in September, the fastest pace since March, and considerably above consensus expectations for a +150k increase, while also printing to the upside of the always-wide forecast range of +70k to +220k. At the same time, the August and July nonfarm payrolls figures were revised solidly higher, by a net +72k, in turn seeing the 3-month average of job gains rise to +186k. While still below the breakeven rate, said average is now at its highest point since May.

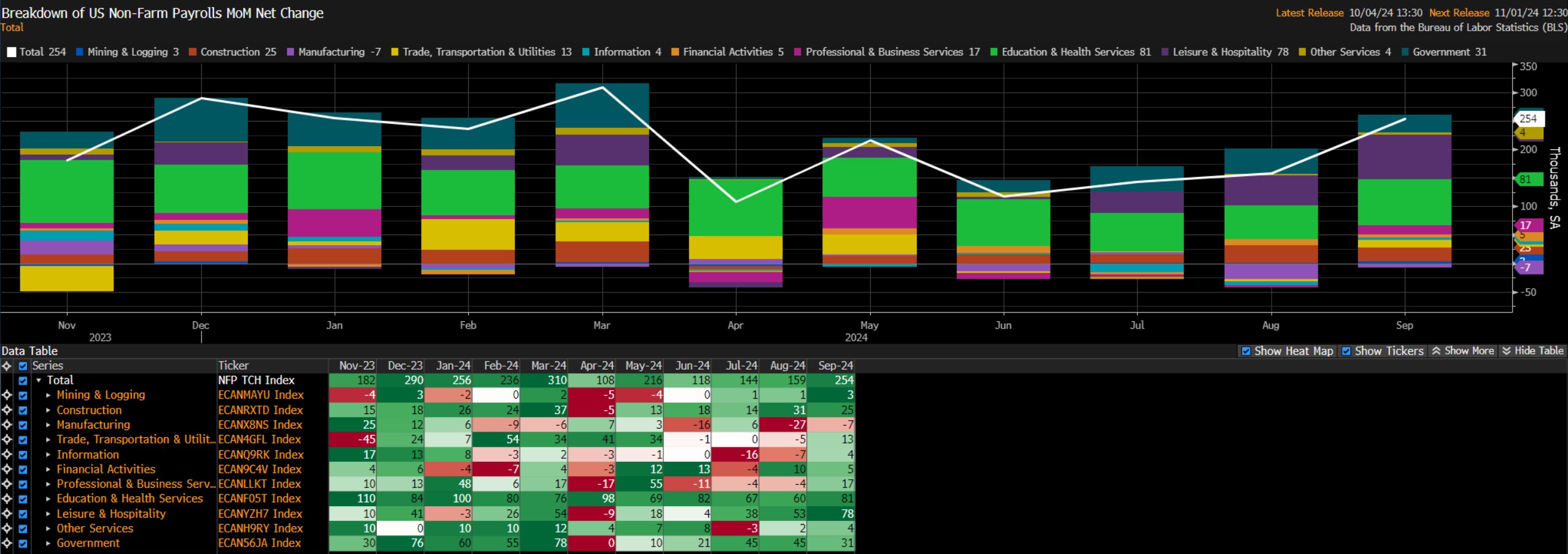

Digging a little further into the data, the sector split of employment growth shows job gains broad-based across most sectors of the economy. The Manufacturing sector was the only one to lose jobs, with employment contracting for a second straight month. Those sectors seeing the biggest job gains remain Leisure & Hospitality, and Education, which have underpinned the majority of job gains in recent months.

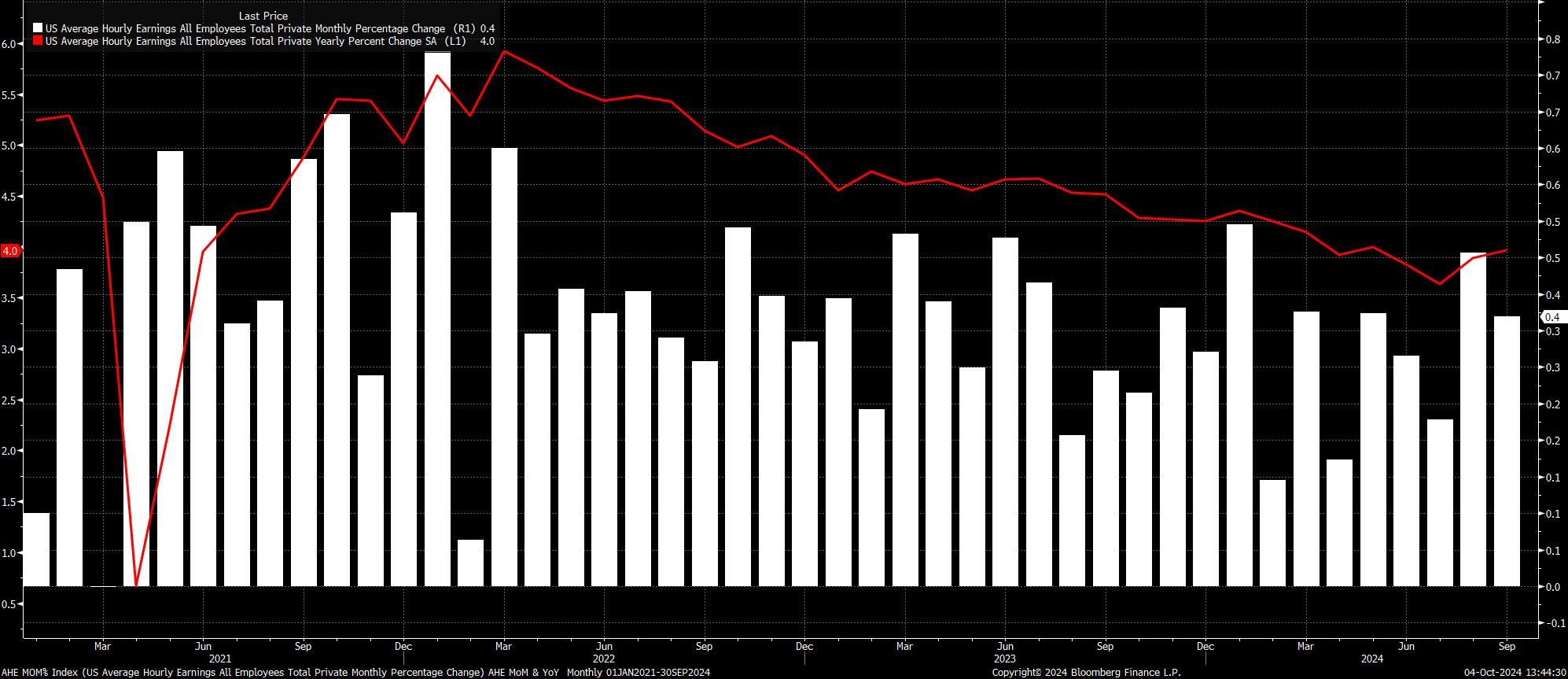

Sticking with the establishment survey, the labour market report showed that earnings pressures remained relatively cool. On an MoM basis, average hourly earnings rose by 0.4% MoM, unchanged from the pace seen in August. In turn, this saw the annual rate quicken to 4.0% YoY, the fastest rate since May.

Such a pace of earnings growth, however, is one that remains broadly compatible with a sustainable return towards the 2% inflation target over the medium-term. It is also unlikely to worry FOMC policymakers, who have already obtained sufficient confidence in such a return to target, as demonstrated by last month’s ‘jumbo’ 50bp rate cut.

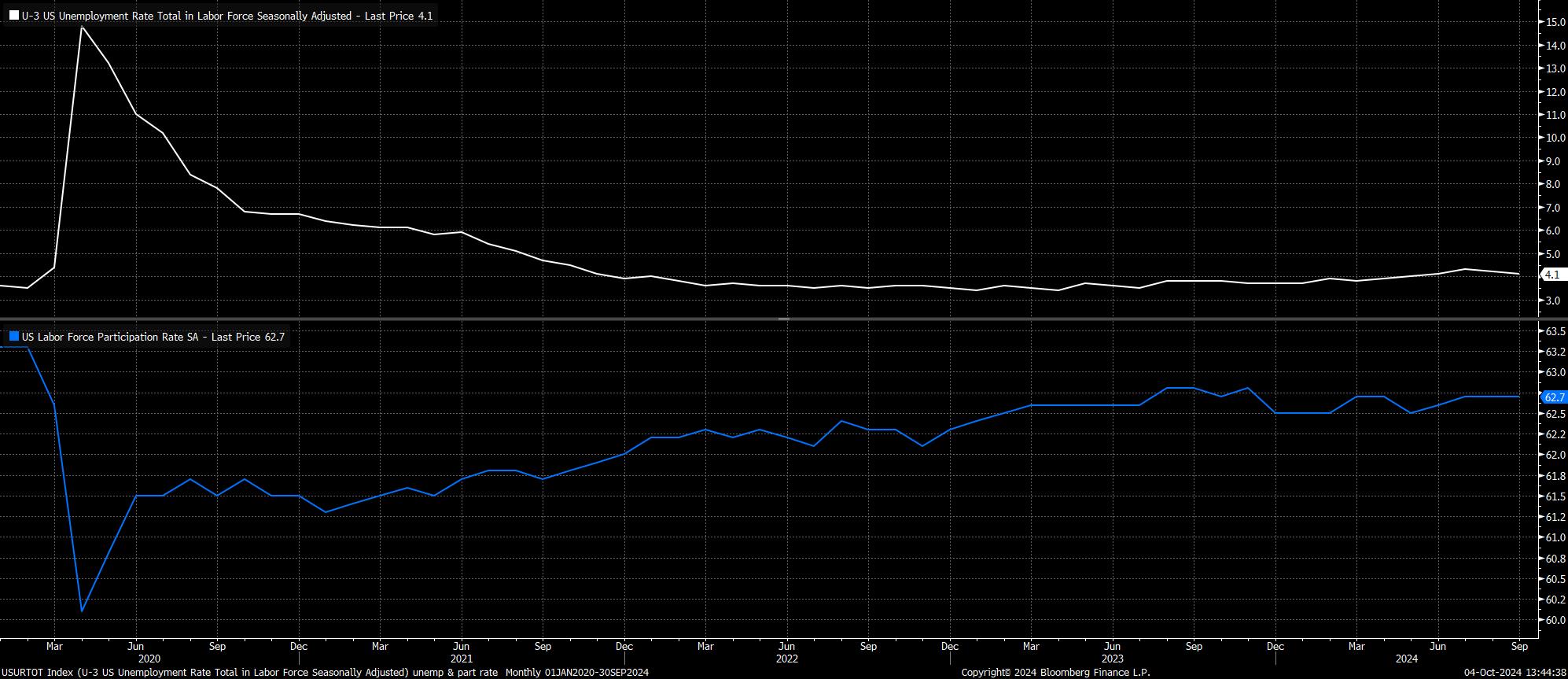

Turning to the household survey, unemployment unexpectedly fell to 4.1%, its lowest level since June, and a further pullback from the 4.3% cycle highs seen back in July.

Meanwhile, other measures of labour market slack pointed to conditions remaining relatively tight, with underemployment falling 0.2pp to 7.7%, as participation held steady just shy of cycle highs, at 62.7%.

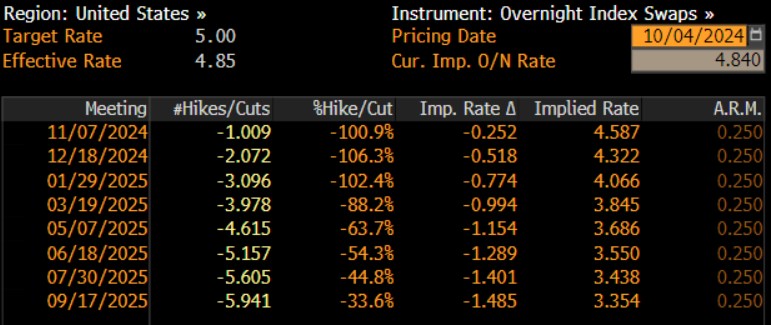

Unsurprisingly, given the much stronger than expected data, market-based rate expectations underwent a significant hawkish repricing. Having, pre-payrolls, discounted around a one-in-four chance of a 50bp cut at the November FOMC meeting, the USD OIS curve now implies just a 5% chance of such an outcome. Further out, around 10bp of easing has been priced out, in total, by year-end, with the OIS curve pricing just 51bp of cuts by December.

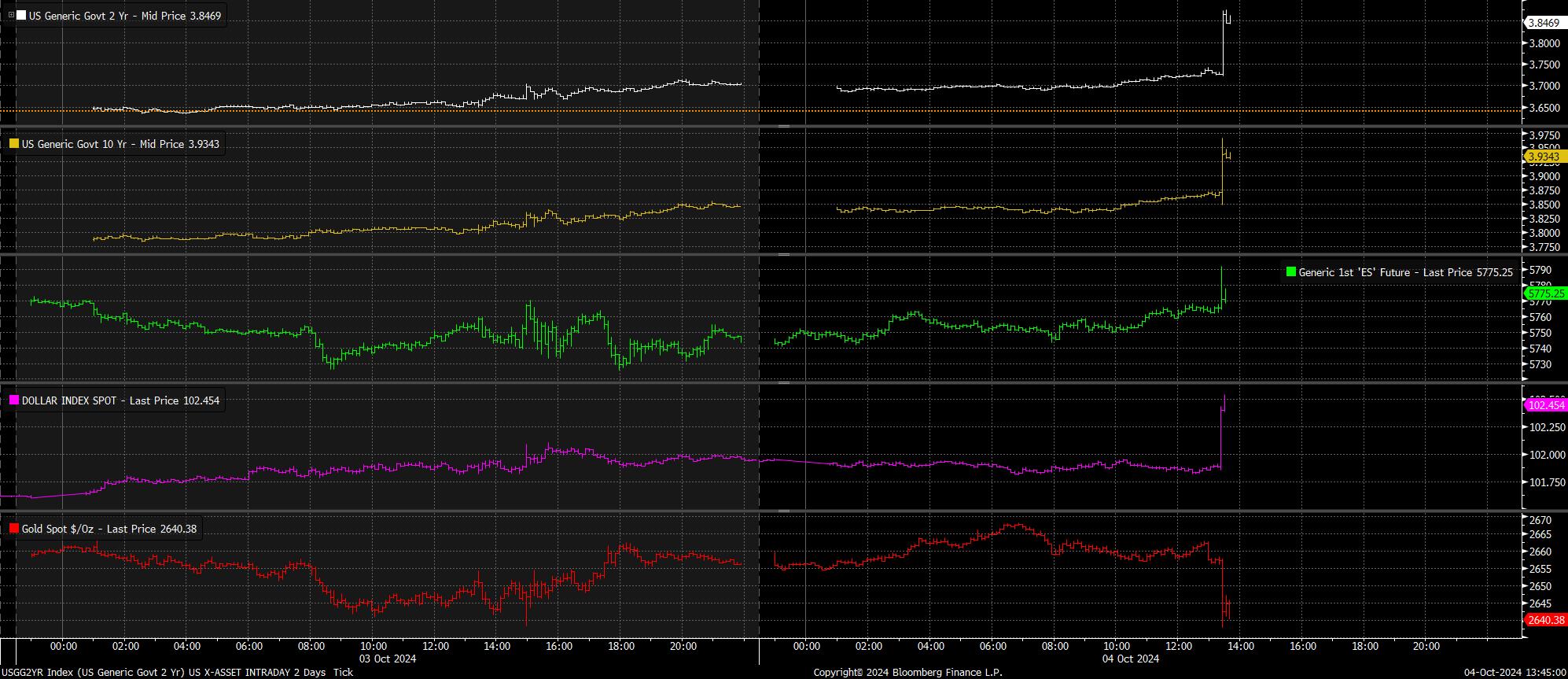

Unsurprisingly, this hawkish repricing sparked a fairly significant cross-asset reaction.

This was most obvious in the Treasury complex, where the front-end of the curve sold off aggressively, with 2-year yields rising as much as 15bp, north of 3.85%. The curve as a whole bear flattened, with 10s and 30s rising by 9bp and 5bp apiece, taking the 2s10s spread back into single digits.

Meanwhile, the dollar benefitted from the rates sell-off, with the DXY extending recent gains into a fifth straight day, rising north of 102.50. Key levels gave way across the G10 space, with the EUR dipping south of 1.10 to a 7-week low, while cable briefly surrendered the 1.31 handle, the Aussie slipped under the 68 figure, and USD/JPY rose north of 148.

Equities also advanced, with payrolls sparking a ‘good news is good news’ reaction, as participants focused on the macroeconomic picture painted by the report, as opposed to any potential hawkish policy implications. The front S&P future gained around 0.7%, while the Nasdaq traded over 1% higher.

Overall, though, despite the much stronger than expected figures, this report is unlikely to materially alter the FOMC's policy outlook.

While focus remains squarely on the employment side of the dual mandate, Chair Powell's recent assertion that the Committee is "not in a hurry" to cut quickly, along with today's incredibly solid data slate, means that a return to a more normal cadence of 25bp cuts is likely at the November meeting, and at each meeting beyond that, until the fed funds rate returns to a neutral level next summer. That said, the data-dependent FOMC will respond if labour market conditions weaken, with larger 50bp cuts on the table particularly if unemployment rises north of the 4.4% median forecast for this year and next.

For sentiment, the forceful 'Fed put' should see the path of least resistance continuing to lead higher for equities over the medium-run, though conviction in the short-term could well be somewhat lacking, owing to ongoing geopolitical risks in the Middle East.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.