CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

- English

- Italiano

- Español

- Français

The unemployment rate fell to 5.1% and with it interest rate markets have sold off, taking the probabilities of a 25bp rate cut from 60 to 25%.

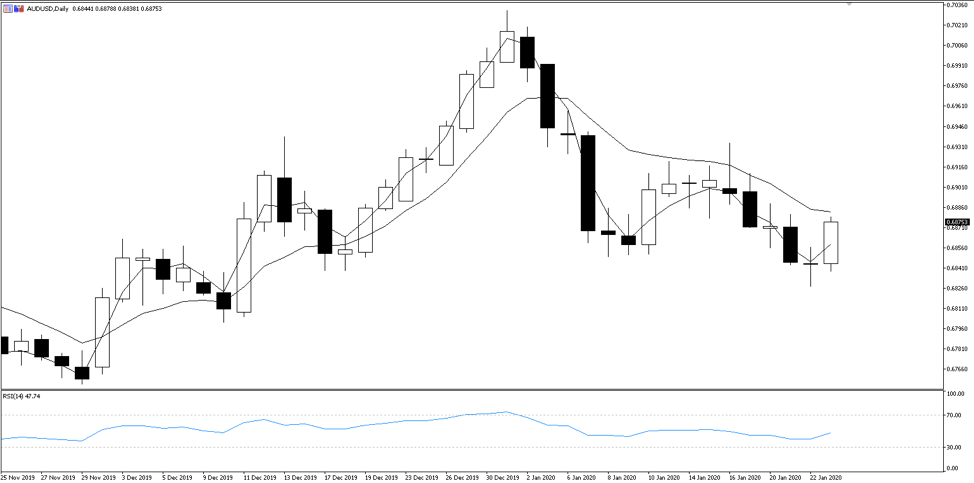

The RBA have made known their focus on the unemployment rate to determine policy. Expectations were for unemployment to hold steady at 5.2%, so the better than expected print gives some optimism that last year’s rate cuts could be starting to ease pressure on the labour market as planned - although that’s a big if. AUDUSD jumped 30 pips on the good news.

AUDUSD trading higher on the day.

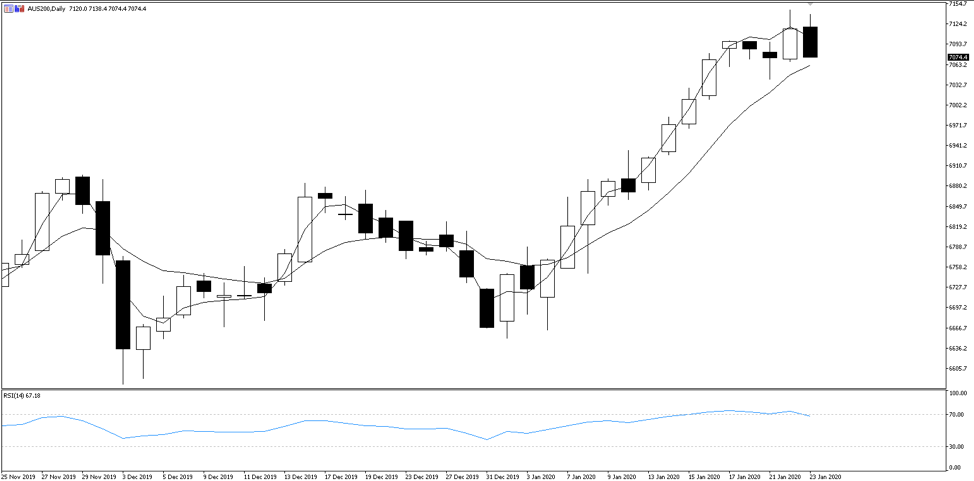

Moving the other way, the AUS200, a market largely propped up by low interest rates, slipped, driven by the reduction in rate cut probabilities. A poor tape across broader Asian equities has also fueled the declines.

AUS200 trading lower today after a record high yesterday.

Note that the participation rate remained the same. That’s 66% of the Australian population either working or looking for work: they’re in the labour market. So on the surface that 28.9k increase in the jobs number reduced the unemployment rate to 5.1%. Great.

But then consider what comprised that 28.9k increase. The number of full-time workers actually declined by a modest 300. It was part-time employment that saw a boost of 29.2k workers. Being December data, this suggests casual, short-term hiring during the Christmas rush.

All the while, the part-time share of employment lifted from 31.4% to 31.8%. Trend underemployment and underutilisation held steady at 8.3% and 13.5% respectively.

So the question here is whether this boost in part-time employment only is enough to hold the unemployment rate lower going forward. Or is ready to blow over and roll the rate back to 5.2% for the January data?

But for now, on balance, it seems a February RBA rate cut is off the cards. That is, unless next week’s CPI reading comes in particularly poor (1.6% YoY expected).

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.