CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

- English

- Italiano

- Español

- Français

Leading indicators paint a rather mixed picture, and continue to point to a significant divergence in the fortunes of the services and manufacturing sectors. This is true not just in terms of growth, but also inflation, with the bulk of current price pressures emanating from the former side of the economy.

Looking at the US – comparable measures for other DM economies paint a similar picture – it’s clear to see how bleak the manufacturing outlook appears. This week’s ISM survey for the sector showed all components of the index below 50 (implying contraction) for just the third time since the turn of the century, with the headline index slumped to its lowest level since the pandemic began.

Meanwhile, in the services sector, although momentum is clearly waning, a modest pace of expansion continues to be recorded, presumably as consumers run down excess savings balances, thereby limiting the detrimental impact of rising prices on output for now.

Other areas of the economy are also holding up surprisingly well, given the 500bps of Fed hikes delivered over the last 18 months. Both existing and new home sales remain resilient, and are beginning to rebound after a slump towards the tail end of last year, while various measures of consumer health – including the CB’s confidence survey, UMich sentiment gauge, and simply retail sales – all remain at healthy levels; the former, in fact, printed a 1-year high last month.

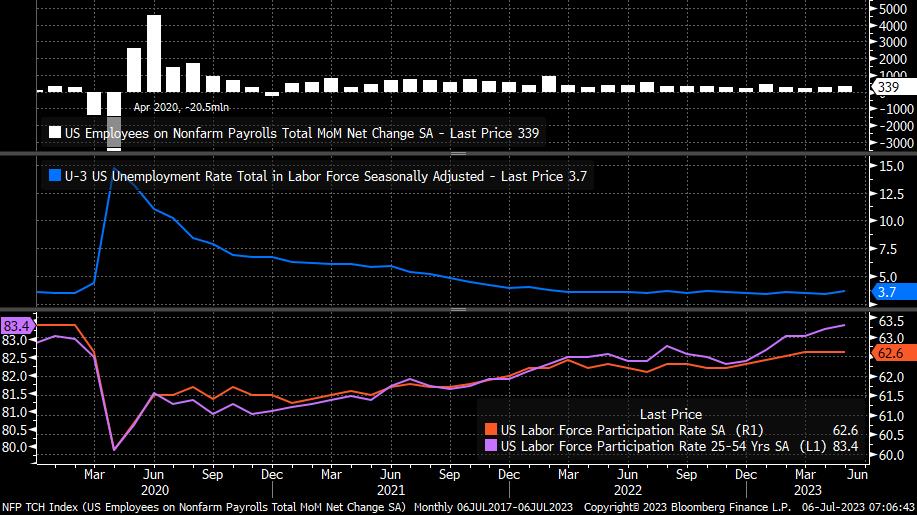

Of course, one couldn’t provide a macro outlook without considering the labour market. While the latest US jobs data won’t arrive until the end of the week, there have been few signs of cracks emerging up to now - headline nonfarm payrolls have risen every month since the end of 2020, unemployment remains close to historical lows, while labour force participation has also risen substantially, particularly among the prime age segment (25-54yrs old).

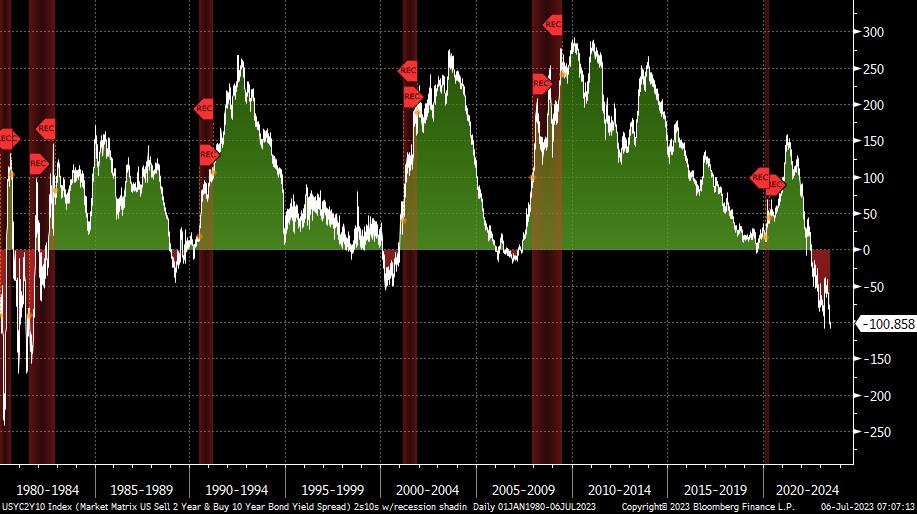

However, despite all the positive data, plenty are still waiting for the economy to roll-over, and are positioned for it to do so. Markets continue to ring alarm bells about the future health of the economy as well, with that age-old recession indicator, the yield curve, remaining deeply inverted.

In fact, the 2s10s segment of the Treasury curve has bear flattened for 8 straight weeks now, with market participants both pricing the ‘higher for longer’ outlook the Fed have laid out (via higher front end yields), but also signalling the risk of over-tightening tipping the economy into a recession (shown via lower long-end yields).

Nevertheless, as the above shows, while curve inversion – which, incidentally, is about to celebrate its one year anniversary this cycle – appears to hold some predictive powers in terms of the occurrence of recession, the timing of said slowdown hinges on when the curve begins to re-steepen. Given that re-steepening appears some way off at present, especially with FOMC officials continuing to signal at least two further hikes to come, the Treasury market seems to be saying that the economy has plenty of fuel left in the tank for now.

Nevertheless, if one were looking to position for an eventual economic slowdown, there are many ways to play such a theme; even if, as I expect, we could continue to ‘muddle along’ at current, or slightly slower, rates of growth for some time to come.

In the equity market, defensive sectors (such as utilities and consumer staples) are likely to prove more resilient than their cyclical counterparts in the event of a sharp slowing in economic momentum, reversing some of the significant underperformance that has been seen YTD. Not only would a rotation occur under the hood of major indices, such a defensive bias may also lift indices with a heavier weighting towards said sectors, such as London’s beleaguered FTSE 100.

As for other markets, there are also various ways to play the theme of an economic slowdown. In the rates space, bets on looser Fed policy are likely to increase if/when economic data begins to turn south, expressed either via STIRs, fed fund futures, or via Treasuries themselves, especially at the front end. It is, in fact, demand for front end bonds in such an eventuality that would likely drive the yield curve re-steepening discussed earlier, and lead to economic warning lights flashing even brighter.

Elsewhere, in the commodity space, a more defensive tone should aid gold – along with the aforementioned expected decline in Treasury yields – while a drying up in demand is likely to exert downward pressure on crude prices, despite ongoing Saudi/OPEC+ output cuts in an attempt to put a floor under the market.

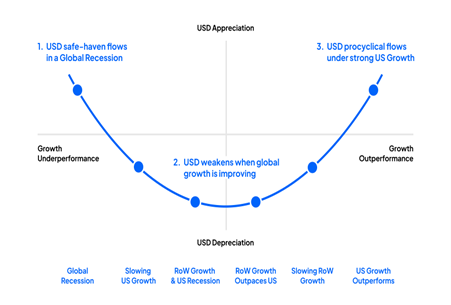

Lastly, but by no means least, in the FX space, any weakening in economic momentum would likely see the traditional havens of the JPY and the CHF find demand, with any rally in the former potentially exacerbated by the closing out of carry trades which have been so in vogue over the first part of the year.

Meanwhile, the USD would also likely find demand, as market participants move to the left-hand side of the so-called ‘dollar smile’, a theory which explains how the greenback tends to gain ground in times of global economic stress.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.