CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

- English

- Italiano

- Español

- Français

WHERE WE STAND – Participants were, rightly, unperturbed by Friday’s US labour market report, with the data providing plenty by way of noise, and almost nothing in terms of signal.

Headline nonfarm payrolls rose by just 12k in October, though the figure was skewed sharply lower by a handful of one-off factors, including ongoing strikes at Boeing, and the impact of Hurricanes Helene and Milton, which arrived shortly before, and during, the survey week respectively. In fact, the number unable to work due to weather was north of half a million, the highest since the BLS begun to collect such data during the ‘70s.

Those hurricanes also skewed the average hourly earnings figures higher, to 0.4% MoM, due to weather-related job losses disproportionately impacting those on lower incomes. Unemployment, though, held steady at 4.1%, primarily due to differences between how the establishment and household surveys classify those temporarily unable to work.

In any case, there’s little value to be extracted from the distorted October jobs report, and the figures will likely do little to materially alter the FOMC policy outlook, with Powell & Co. set to deliver a 25bp cut come Thursday.

As mentioned, markets seemed to care relatively little about the jobs figures, with the post-payrolls moves fading within a couple of hours. Jobs day certainly isn’t what it used to be!

A chunky sell-off across the Treasury curve was the most obvious takeaway from Friday’s action, though there was certainly little by way of explicit catalyst for such pressure. Some may point to this being an example of the ‘Trump Trade’, though pre-election polls have continued to narrow, hence I find this thesis a little hard to believe. Whatever the cause, benchmark 10-year Treasury yields rose 10bp on the day, closing the day just shy of 4.4%, at the highest level since July.

At risk of sounding like a ‘stuck record’, yields at these levels, especially with 2s at 4.25%, should prove too alluring for buyers to resist, once electoral uncertainty is out of the way.

In any case, Treasuries trading softer helped to fuel some healthy dollar demand as the week wrapped up, with the DXY climbing further into the 104s, albeit ending just off weekly highs. Pre-election hedging might be helping the buck here, though continued US economic outperformance should see the path of least resistance continued to lead to the upside for the dollar, even once the election has been and gone.

Unsurprisingly, Friday’s biggest loser was the JPY, which remains not only the cleanest G10 rate proxy, but which also continues to be battered by political uncertainty amid protracted coalition negotiations in the ‘land of the rising sun’.

As for equities, major indices wrapped up the week with decent gains, as the tech sector led the broader market higher, after strong earnings from Amazon and Intel after Thursday’s close.

While I remain a longer-run equity bull, the case for short-term downside is a relatively convincing one, particularly in the instance that an election result is not known for a protracted period after the polls close. Still, I’d be viewing any significant dips as buying opportunities, with my bull case of strong economic growth, solid earnings growth, and a forceful ‘Fed put’ to underpin sentiment, remaining intact.

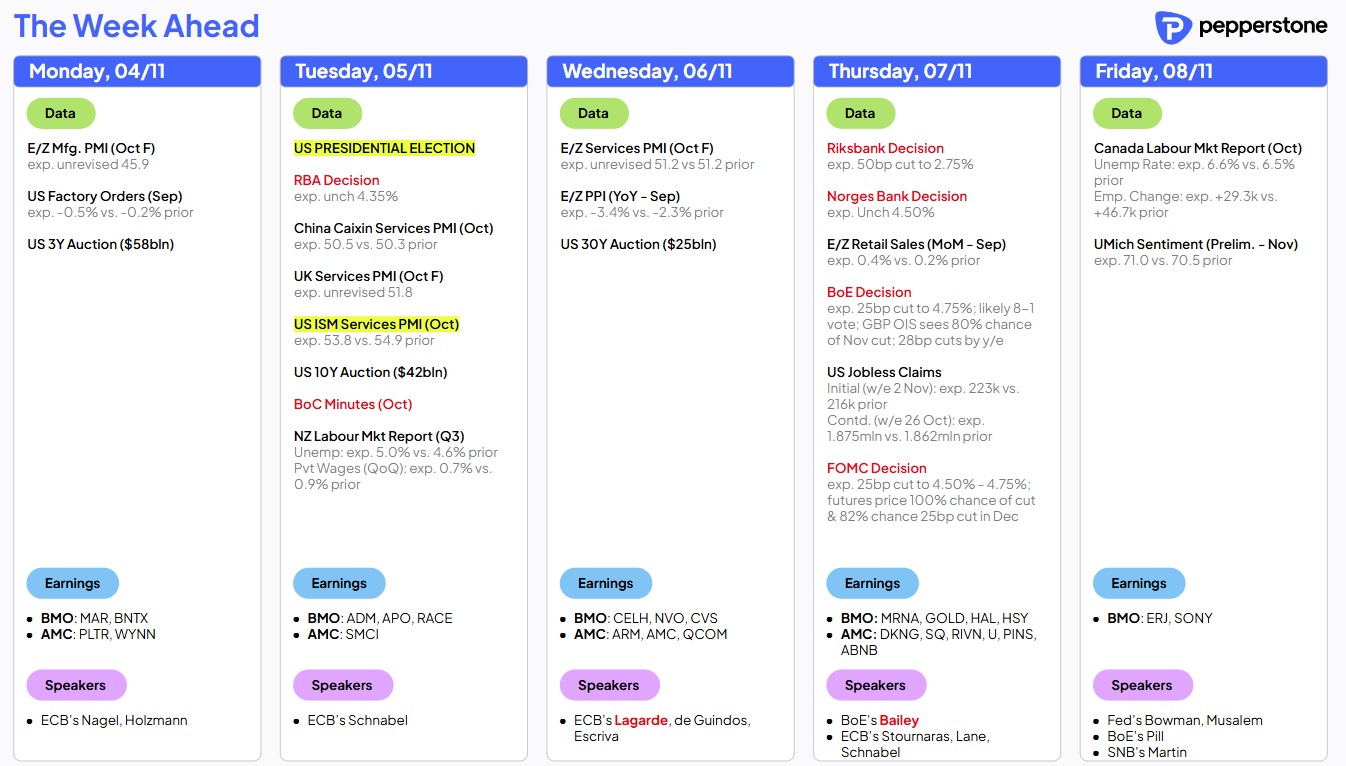

LOOK AHEAD – A quiet docket awaits today, though in truth almost all market participants already squarely focused on tomorrow’s presidential election. Some further hedging, de-risking, and position squaring could well be seen as election day looms large.

As for today’s events, this morning’s final eurozone manufacturing PMI survey shan’t materially move the needle, nor is this afternoon’s US factory orders figure likely to either. Today’s 3-year US supply could be of interest, though, particularly after last week’s 2- and 5-year sales both notched sizeable tails.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.