CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

- English

- Italiano

- Español

- Français

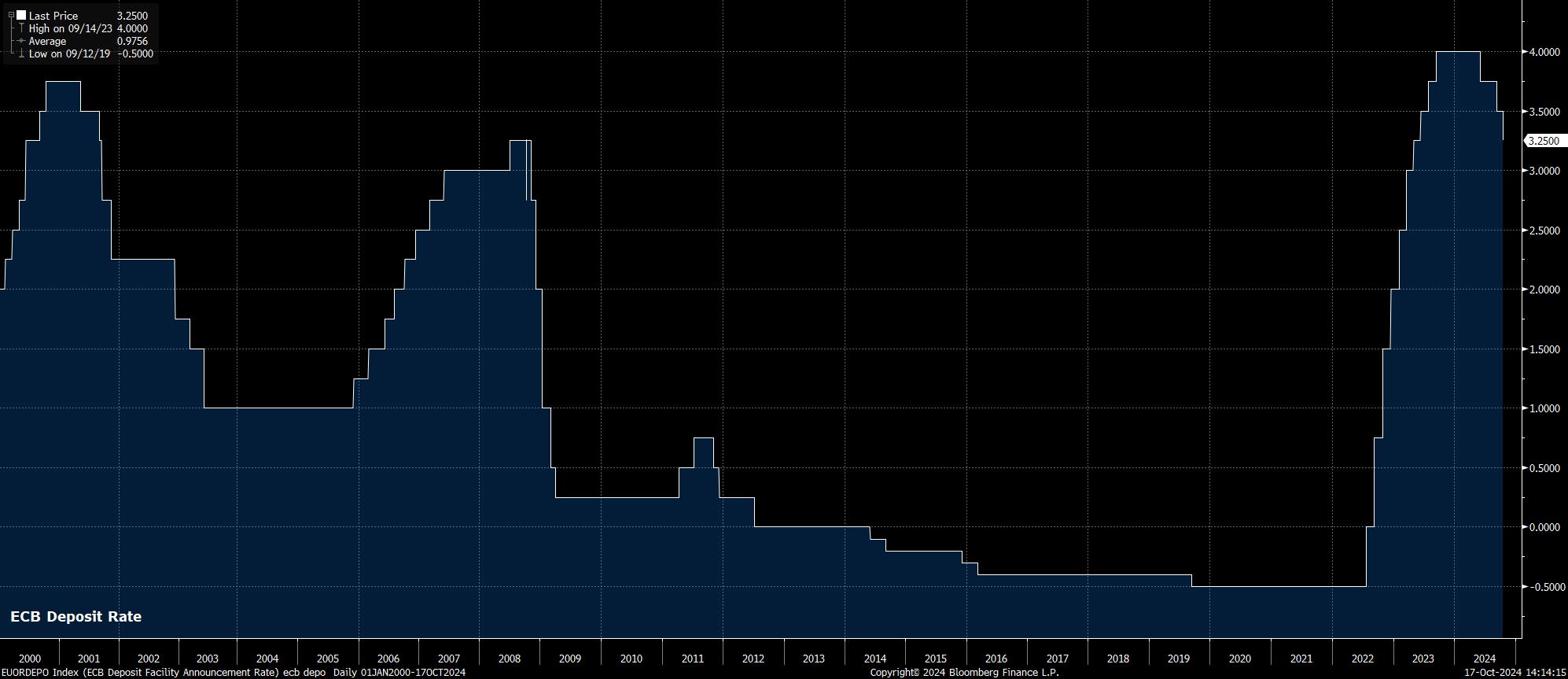

As noted, and had been fully priced by the EUR OIS curve, the ECB’s Governing Council delivered a 25bp cut, just five weeks after the last such reduction, marking the first back-to-back cuts in a decade, and taking the deposit rate to 3.25%, its lowest level since last June.

Of course, today’s reduction, coming just five weeks after the last 25bp cut, comes as disinflationary progress is made considerably quicker than the Governing Council had previously expected, and as downside risks to the economic outlook grow increasingly prominent. The policy statement nodded towards this rapid disinflation, noting that policymakers now see inflation at 2% “in the course of” 2025, as opposed to the second half of 2025, as had previously been guided.

Meanwhile, elsewhere in the statement, accompanying the much-anticipated cut was guidance with which participants are now incredibly familiar. Again, policymakers noted plans to follow a “data-dependent and meeting-by-meeting approach”, while also reiterating that the Governing Council is making no pre-commitment to a pre-determined rate path.

President Lagarde, at the post-meeting press conference, reiterated this guidance mentioned above, while also noting policymakers’ belief that the disinflationary process is “well on track”, with all indicators since the September confab “heading in the same direction…downwards”. Meanwhile, Lagarde also noted that today’s decision was unanimous, while also confirming that only a 25bp cut was up for discussion, lessening the already-low likelihood of a larger 50bp cut at some point this cycle. Furthermore, risks to the economic outlook – unsurprisingly – continue to tilt to the downside, while risks to the inflation outlook were also said to point “a bit more” in the same direction.

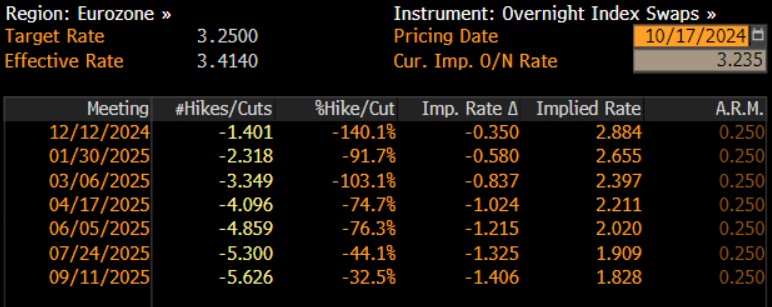

While policymakers stick resolutely to the ‘data dependency’ line, participants have already made up their minds as to what’s coming next, with another 25bp cut in December still fully priced in. Further out, the curve sees the deposit rate falling to 2% by next June, which seems a reasonable pace at which to expect the ECB to remove policy restriction for the time being.

In reaction to the ECB announcement, eurozone assets were largely unreactive, though the EUR later slumped in reaction to considerably better than expected US retail sales figures. EGBs, meanwhile, were unmoved, while European equities continued to linger close to day highs.

_e_z_intra_2024-10-17_14-23-43.jpg)

Overall, policymakers will be hoping that today's move, which comes just five weeks after the previous rate reduction, serves to insulate the eurozone economy against these risks, and ensures that the current economic contraction implied by the latest PMI surveys remains relatively shallow.

Taking into account both the statement, and President Lagarde’s press conference, the base case remains that the ECB will deliver another 25bp cut at the December meeting, followed by further such cuts at every meeting in early-2025 until the deposit rate reaches a neutral rate of around 2% next summer. Participants will also pay close attention to whether Lagarde opens the door to the prospect of larger, 50bp cuts, though said 'jumbo' moves seem unlikely for now.

Such a pace of easing would, broadly, be in line with that of the ECB’s G10 peers, though the dismal economic outlook likely means that the path of least resistance will continue to point to the downside for the EUR for the time being.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.