CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

- English

- Italiano

- Español

- Français

May 2024 CPI Recap: Another Welcome Report For The FOMC

Headline CPI rose by 3.3% YoY in May, a touch below consensus expectations for inflation to have remained unchanged from the 3.4% pace seen in April. Meanwhile, core CPI – which excludes the volatile food and energy components – rose by 3.4% YoY over the same period, also below expectations for a 3.5% print, and the lowest level in more than three years.

Removing further volatile components, to produce the ‘supercore’ inflation metric, aka core services ex housing inflation, shows a dip to 4.8% YoY, the first decline in the annual rate of supercore inflation since last October.

As has now been the case for some time, however, increasing attention is paid to MoM data, as opposed to annual metrics, as a more precise gauge of underlying price pressures, in particular the 3- and 6-month annualised rates. It is, however, important to caveat, that the FOMC continue to use the PCE inflation figures, as the official gauge of progress towards the 2% target, with the next such report due on 28th June.

In any case, headline CPI was flat on an MoM basis in May, a noticeable drop from the 0.3% pace seen a month prior, and in fact the slowest monthly inflation rate since all the way back in last July. Core prices, meanwhile, rose 0.2% MoM, just a touch cooler the 0.3% pace seen in April. Annualising these figures produces the following:

- 3-month annualised CPI: 2.8 % (prior 4.6%)

- 6-month annualised CPI: 3.4% (prior 3.7%)

- 3-month annualised core CPI: 3.3 % (prior 4.1%)

- 6-month annualised core CPI: 3.7 % (prior 4.0%)

Digging a little deeper into the data, it’s clear that the bulk of disinflationary pressure continues to come from the goods side of the economy, with core goods deflation quickening to -1.7% YoY last month, the most rapid pace in well over a decade. However, in news that is likely to please the FOMC, the pace of services inflation did slow a touch, to 5.3% YoY, perhaps the first indication that stubborn price pressures in this sector are beginning to dissipate, though clearly much further evidence of this will be required to unlock the door to rate cuts.

On the subject of rate cuts, the USD OIS curve repriced significantly in a dovish direction after the CPI figures dropped, with money markets now – as near as makes no difference – fully discounting two 25bp rate cuts this year, compared to pricing around a 50/50 chance of such action before the figures were released.

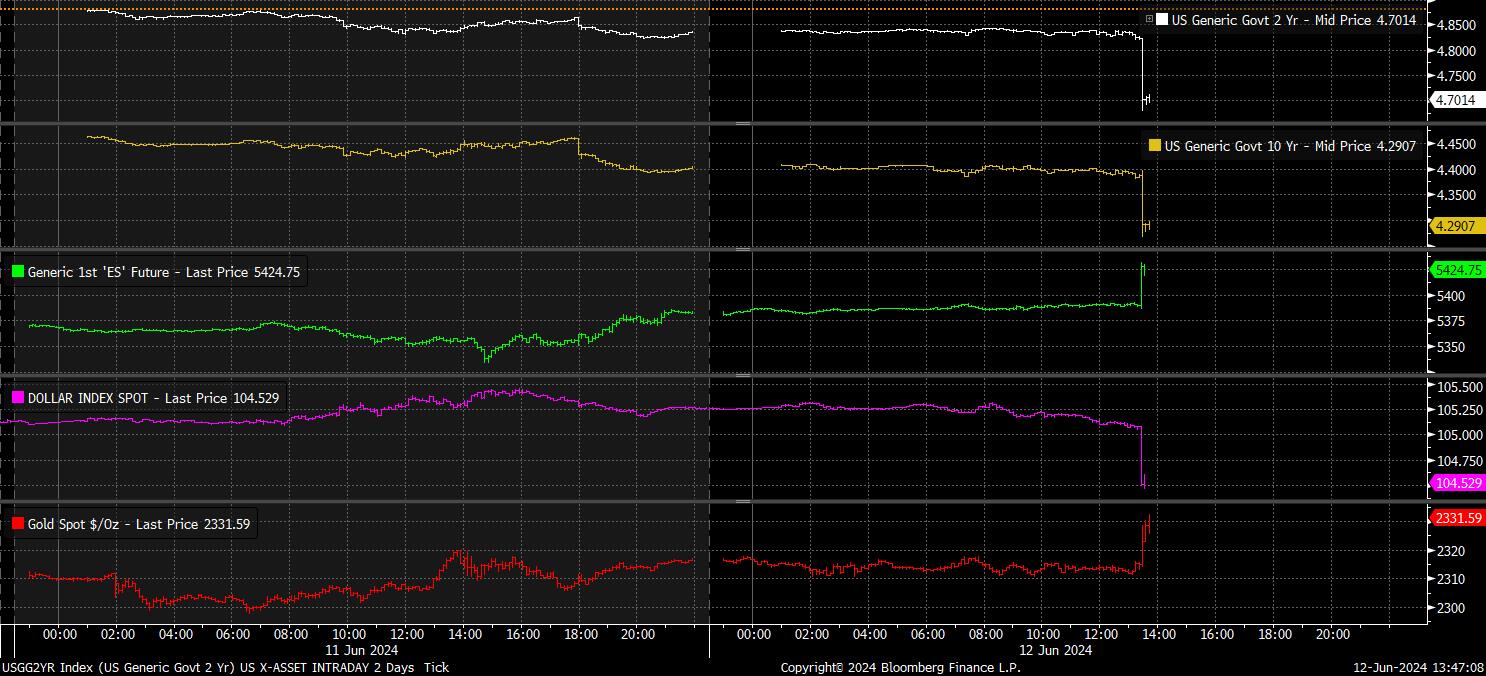

More broadly, markets also enjoyed a significant dovish reaction, with both stocks and bonds rallying hard after the data. The front S&P contract rose to a fresh day high, up around 0.75%, to trade north of the 5,400 mark, while Treasuries rallied across the curve, as 2-10 year yields notched double-digit bp declines. In turn, this posed stiff headwinds to the dollar, with the DXY sliding to test 104.50 to the downside, as all other G10s rose to their best levels of the day. Gold also found some relief in the aftermath of the figures, rallying to a day best, adding around 0.5%.

Overall, of course, one CPI report shan’t significantly change the FOMC’s trajectory, however both the headline figures, and the breakdown of the data, will likely come as further relief to policymakers that the current restrictive policy stance is working to bear down on price pressures. Further data of this ilk will likely be required before the Committee obtain enough “confidence” that inflation is returning towards target for the first cut to be delivered, with September still appearing plausible for such action so long as there are no further upside inflation surprises.

In any case, at today’s FOMC decision, the statement, and Chair Powell at the press conference, should both emphasise a desire to continue giving policy time to work, while reiterating that the next move in the fed funds rate remains likely to be a cut, in turn keeping the path of least resistance leading to the upside.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.