CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

- English

- Italiano

- Español

- Français

WHERE WE STAND – A relatively quiet end to the week, on Friday, at least in terms of data- and news-flow, with markets also remaining substantially thinner than usual, as US participants took a long weekend to enjoy the Thanksgiving festivities.

Nevertheless, the day was highlighted – I use the term loosely! – by the latest eurozone inflation figures. Headline CPI rose 2.3% YoY last month, in line with expectations, while core prices rose by 2.7% YoY, unchanged from the prior print, and just a touch softer than had been expected. The data, though, is unlikely to significantly change the backdrop for the ECB, with a 25bp cut in a fortnight’s time still the base case, even if markets continue to discount around a one-in-four chance that policymakers could surprise with a ‘jumbo’ 50bp cut.

Such a move doesn’t seem particularly plausible at this juncture, particularly when none of the daily barrage of ECB speakers have been seriously countenancing such a move. Instead, debate on the Governing Council, and among market participants, is soon likely to shift to whether the ECB must take the deposit rate below neutral, which likely sits around 2%, towards the middle of next year.

A move to an outright ‘loose’ policy stance could pose some further headwinds for the EUR, particularly with other central banks apparently happy to get back to neutral, and then take a ‘wait and see’ approach. The common currency failed to make a move north of the $1.06 figure at the back end of last week, with rallies continuing to be sold into, though I can’t help but feeling that we might soon be at a point where ‘peak pessimism’ is upon us.

More broadly, the greenback remained on the back-foot as the week drew to a close, with weakness particularly noticeable against the JPY. USD/JPY slipped back below the 150 figure for the first time since mid-October after hotter than expected Tokyo CPI figures saw participants become increasingly convinced that the BoJ will deliver a December rate hike, with 16.5bp of tightening currently priced for said meeting.

The buck also faced headwinds as a result of a substantial rally across the Treasury curve, with the belly outperforming, as 10-year yields fell by as much as 10bp. Some of this likely owes to typical month-end rebalancing flows, while there likely also remains a demand among participants to lock in yield as the Fed continue to lower the fed funds rate.

Meanwhile, in the equity space, the path of least resistance continues to lead to the upside, with the S&P 500 advancing around 0.6% to end the week. This took the benchmark to a monthly gain of just under 6%, its best performance in a year, while also seeing the index notch its 53rd all-time close of 2024, the joint-5th most of any calendar year on record. I remain bullish into year-end, with both earnings and economic growth remaining strong, though remain cognisant of the risk that there is likely to be little fresh money entering the market at this juncture, with instead the final few weeks of the year likely to be dominated by a combination of position squaring, and portfolio window dressing.

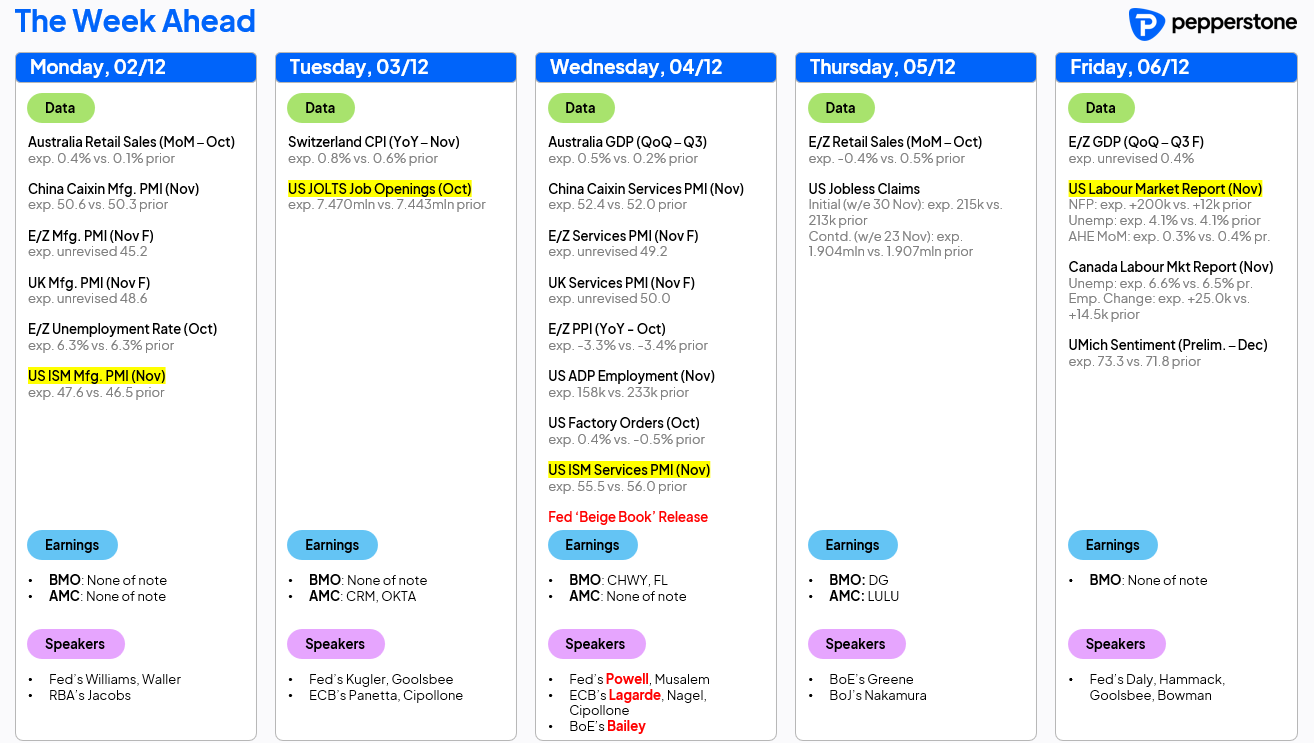

LOOK AHEAD – A busy-ish start to what looks set to be a busy week for financial markets more broadly, wrapping up with the latest US labour market report on Friday.

Before getting to that, though, we begin the week with a plethora of manufacturing PMI surveys, all of which are likely to show the industrial outlook remaining rather dour. Of course, particular attention will be paid to the US ISM figures, most notably the employment sub-index ahead of the jobs report.

A full week ahead calendar is below.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.