- English

- Italiano

- Español

- Français

Analysis

WHERE WE STAND – Even by the standards of recent Fridays, the end of last week was a pretty dull one.

Not, I must say, that you’ll find me complaining – these days, we should take full advantage of any calm we get, however brief!

Anyway, as for catalysts as the week came to an end, there really weren’t any notable ones. Trade, of course, remained in focus, even if the most notable news flow on that front was reporting that the Trump Admin. are pushing for a minimum tariff as high as 20% on goods from the EU. Once again, this feels like a threat which is firmly part of an ‘escalate to de-escalate’ strategy, especially as the 1st August tariff deadline looms ever larger.

We also had Fed Governor Waller reiterating his dovish stance, essentially confirming that he will dissent in favour of a 25bp cut at the July FOMC meeting. Waller’s argument for an immediate 25bp ‘insurance’ cut appears to centre around the ‘frozen’ nature of the labour market, where firms have slowed hiring, but simultaneously haven’t notably accelerated the pace of layoffs. The issue, here, is that the argument falls apart when one considers that the reason for that labour market inertia is trade uncertainty, and not the cost of credit. To be honest, not that I’d recommend it, but you could probably lower the fed funds rate by 100bp or so, and it wouldn’t really have much, if any, impact on the employment backdrop, unless and until we obtain some certainty on the tariff front.

In any case, there really isn’t any data that points to the need for rate cuts. Friday’s housing starts, building permits, and UMich consumer sentiment figures all came in above consensus expectations, while last week also showed initial jobless claims falling to a 4-month low in the week ending 12th July, as headline CPI accelerated to 2.7% YoY. All of this supports the consensus view among FOMC members, that a ‘wait and see’ approach remains appropriate for now, with the resilient nature of the economy giving policymakers space to stand pat, awaiting further data to ensure that any tariff-induced inflation does indeed prove temporary. My base case is that we get just one 25bp cut this year, probably in December.

As for markets, the price action as we cruised into the weekend was very much akin to watching paint dry. I promise I’m not complaining about that, but it does feel like ‘summer markets’ vibes are starting to set in, with conditions really beginning to thin out as participants swap the desk, for the beach. This sort of a market tends to create relatively tight ranges, and price action that becomes quite technically-driven – a macro strategist’s nightmare! Typically, ‘summer markets’ run until Labor Day, so I suppose we best get used to it.

In any case, the path of least resistance for equities continues to lead to the upside, despite stocks ending the week with modest losses, amid a bout of pre-weekend de-risking. A resilient underlying economy, solid earnings growth, and progress towards trade deals being made should be a strong enough combination to keep the bulls in the driving seat, even if seasonality at this time of year is a bit of a headwind.

Elsewhere, things were also pretty contained. Treasuries found some demand, led by the belly of the curve, though dip buyers were also present at the long-end, as benchmark 30-year yields retreated back under 5%, ending a 3-day run north of that figure, which had equalled the longest such stretch since before the GFC. I wonder if this week’s relatively barren data docket may encourage a few more of those dip buyers to enter the fray, locking in yield before we get to the July FOMC meet, which is the next obvious risk event on the horizon.

The FX space, meanwhile, was more akin to a random walk than anything else, with the greenback – and pretty much all G10s – ending the day near enough where they started it. My base case remains for a slow but steady decline in the greenback over the medium-term, as cash continues to find a home elsewhere amid continued threats towards Fed independence. The repeated failure of the DXY to crack the 50-day moving average to the upside support my bearish stance, and I remain a dollar rally seller here.

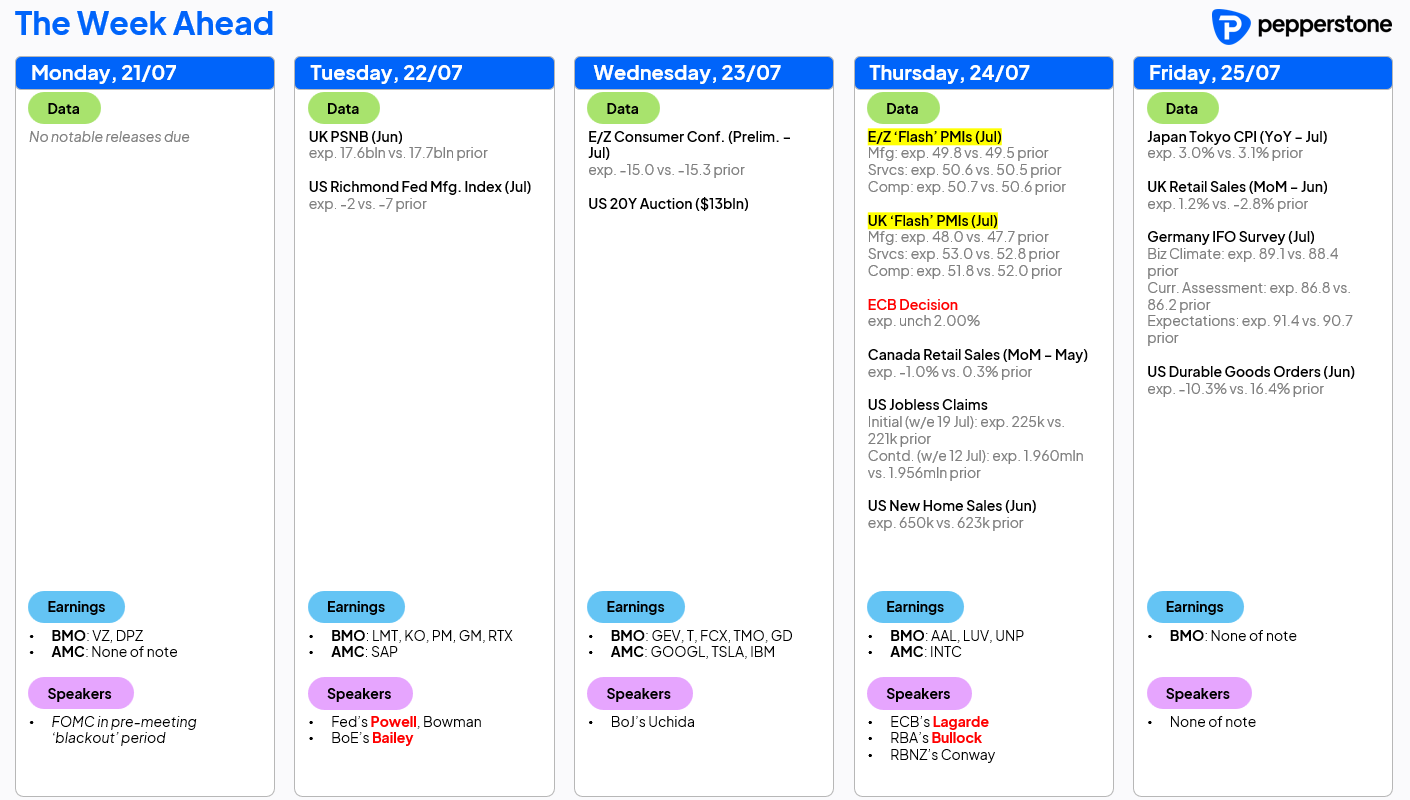

LOOK AHEAD – As alluded to, the week ahead really doesn’t bring the most exciting economic docket that one has ever seen. In fact, for the first three days of it, I struggle to find anything at all to get especially excited about.

The July ECB decision, on Thursday, is arguably set to be the highlight of the week, though policymakers are near-certain to stand pat, holding the deposit rate at 2.00%. Guidance should also be unchanged, as the Governing Council stick with a ‘data-dependent’ and ‘meeting-by-meeting’ approach, sticking with that age old European tradition of not wanting to rock the boat too much before disappearing on a 2-months long summer break!

On the data front, July’s ‘flash’ PMI surveys are the most notable release, and should show a modest improvement in output in both the manufacturing and services sectors across DM. Elsewhere, the latest UK borrowing and retail sales stats are due, as well as the July IFO sentiment surveys from Germany. Friday’s US durable goods orders figure, meanwhile, should be entirely ignored, with the data having been horrifically skewed by a surge in Boeing orders in May, thus providing little-to-nothing in terms of signal.

Finally, earnings season continues this week, with reports from Alphabet (GOOGL) and Tesla (TSLA) the standout releases, both coming after the close on Wednesday. Thus far, 83% of S&P 500 firms to report, have surprised to the upside of consensus EPS expectations.

As always, the full week ahead docket is below.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.