CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

- English

- Italiano

- Español

- Français

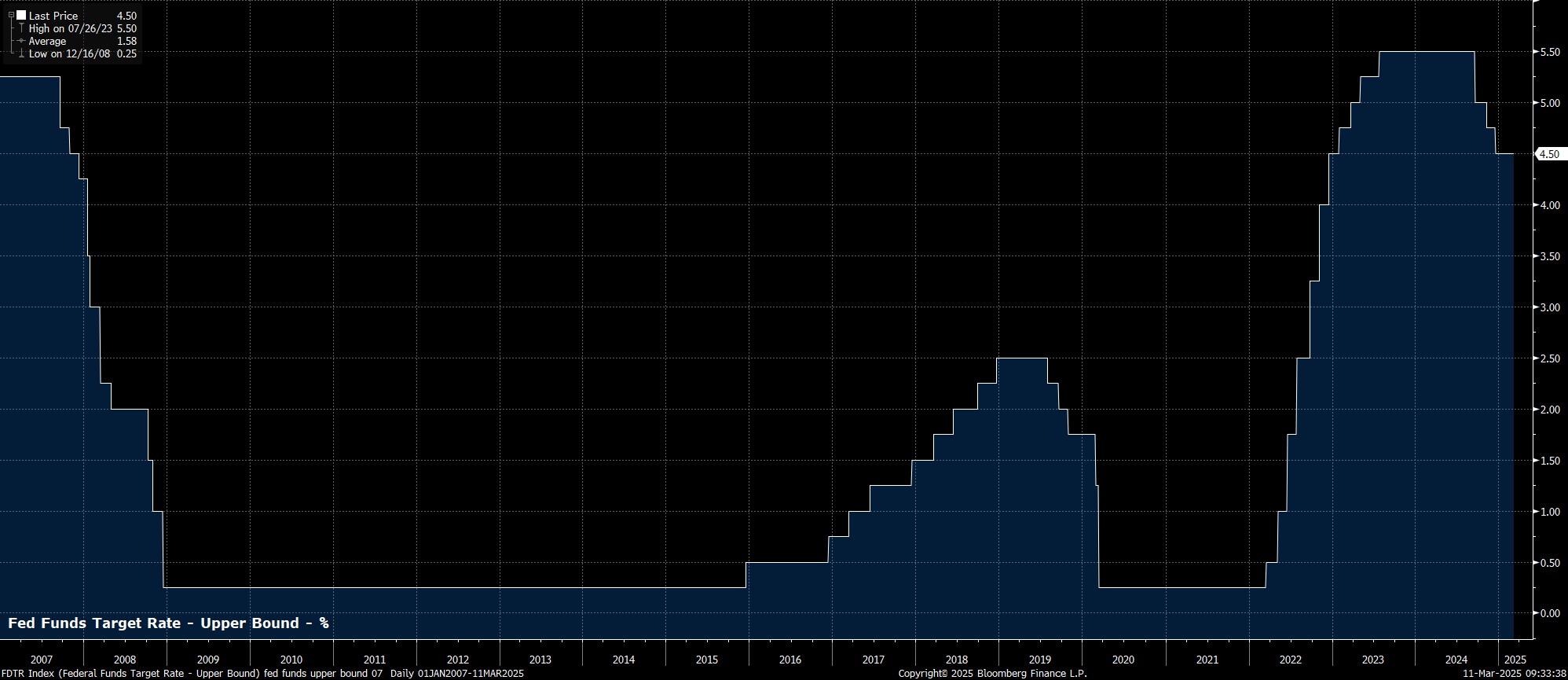

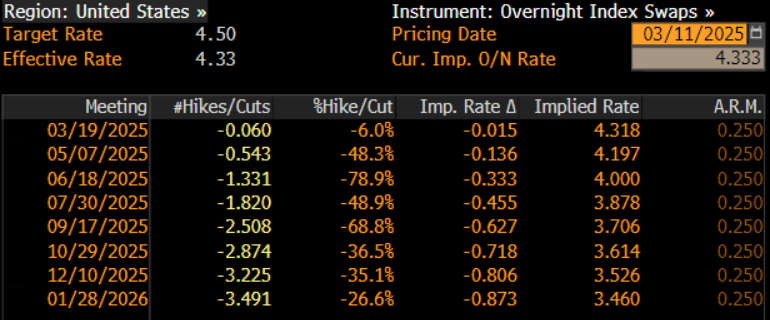

As noted, the FOMC are near-certain to maintain the target range for the fed funds rate at 4.25% - 4.50% at the March meeting, in what should be a unanimous vote among policymakers. Such a decision will extend the FOMC’s pause, which begun at the prior meeting, having delivered 100bp of easing at the back end of 2024. The USD OIS curve, incidentally, prices a modest 5% chance of a 25bp cut at the March meeting, representative of the increasing degree of downside risk presently facing the US economy.

Accompanying the decision to stand pat on policy, the FOMC’s statement is likely to largely reiterate the language used last time out.

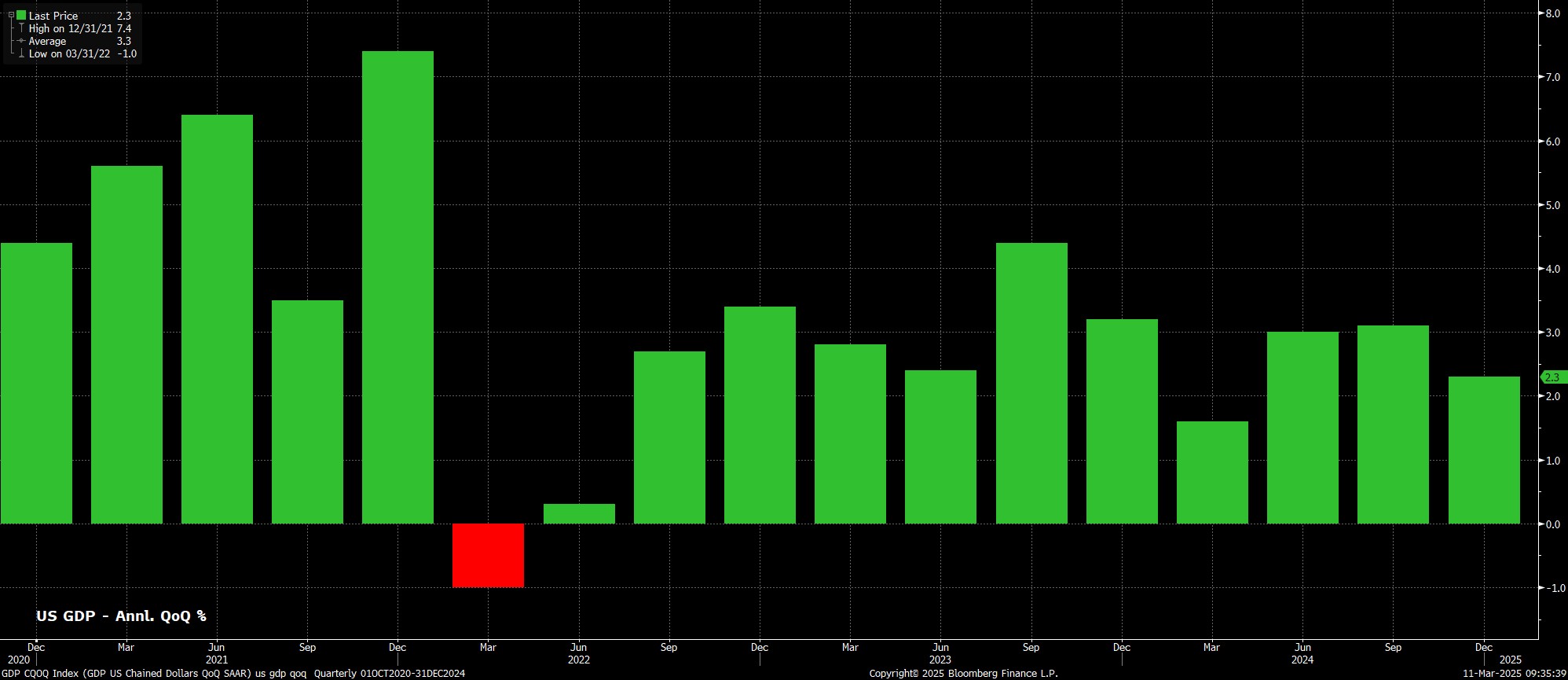

As such, risks to the dual mandate are likely to again be viewed as “roughly in balance”, with policymakers also stressing that they will continue to take a data-dependent approach to future fed funds rate adjustments. Meanwhile, recent economic data gives policymakers little cause to alter their description of current conditions, with a “solid pace” of expansion continuing, unemployment remaining “low”, and inflation still “somewhat elevated”.

That said, the degree of uncertainty clouding the outlook has clearly increased markedly since the prior confab. In January, the committee noted that the economic outlook is “uncertain”, with this language likely to be repeated. The addition of “highly” to this statement, though, if it were made, could be taken as an implicit nod towards a more cautious stance going forwards.

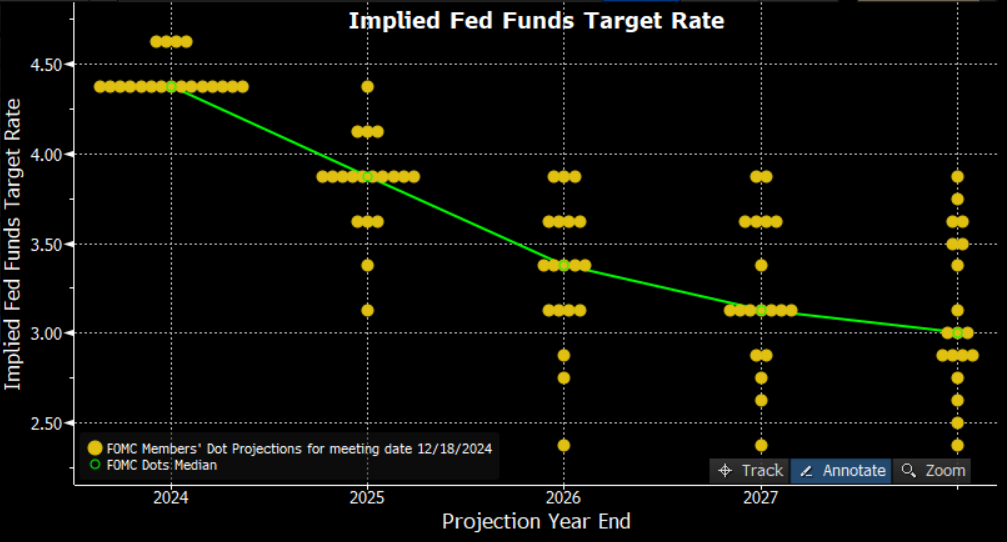

Meanwhile, the March meeting will also see the Committee unveil their latest round of economic projections, including an updated ‘dot plot’.

Last time around, in December, the dots pointed to a median expectation of 50bp of cuts in both 2025, and 2026, though the broader economic, and political, environments were clearly very different when these projections were made. Furthermore, as Chair Powell noted at the press conference, only “some” participants had factored President Trump’s potential policies into their projections when they were made.

In any case, the most plausible scenario is for at least the 2025 median to remain unchanged, continuing to signal 2x 25bp cuts being delivered this year, a marginally more hawkish path than the ~80bp that money markets presently discount by December.

While leaving the dots steady is probably the easiest option for an FOMC seeking not to rock the boat, it is also the most likely option from a mechanical perspective – it would take 5 members at the current median to nudge their dot lower in order to shift the median down to 3x 25bp cuts, which feels a tough ask in the current environment of bumpy disinflation, coupled with upside inflation risks.

Despite that, whatever the dots may say, it seems highly likely that Chair Powell will downplay their importance at the post-meeting press conference, as has been the case for some time now. One questions, given that cold water is poured on them as soon as they are published, what the value of them is in the first place, though in the current climate clearly the last thing that policymakers would wish to do is to tie themselves in to a particular policy path.

On that note, the Committee’s updated economic forecasts should probably also be taken with a pinch of salt. While, this time around, all participants will need to factor in the Trump Administration’s policy proposals when formulating their views, said policies are near-impossible to accurately model, particularly when the policies in question appear to change numerous times a week.

That said, on the subject of trade in particular, the most obvious macroeconomic impact will likely be for the economy to experience a slower pace of GDP growth, coupled with a period of higher inflation, even if said period proves ‘temporary’ in nature.

As a result, the Committee seem likely to nudge their expectations for GDP growth lower, particularly in the short-term, as the economy adjusts not only to a more protectionist trade policy, but also as DOGE cuts seem set to significantly reduce the degree of federal government expenditure. In fact, downside growth risks are already beginning to materialise, with PMI surveys being propped up only by elongated supplier delivery times as firms attempt to front-run tariffs, and with consumer confidence having just notched its biggest MoM decline in almost four years.

Of course, policymakers must grapple with how much pass-through there will be from the recent slump in ‘soft’ surveys, to comparable ‘hard’ economic data. Given the vagaries associated with this, and the ever-changing nature of government policy, the dispersion around the latest forecasts is likely to be even greater than usual.

Meanwhile, inflation expectations are likely to be revised a touch higher in the short-term, though achievement of the 2% PCE inflation aim will still be pencilled in by the end of the forecast horizon. As Chair Powell, and numerous other policymakers, have recently noted, the disinflationary trajectory remains intact, though is likely to remain bumpy for the time being.

Finally, unemployment expectations should remain broadly unchanged throughout the forecast horizon, despite the unexpected uptick in joblessness seen in the February labour market report.

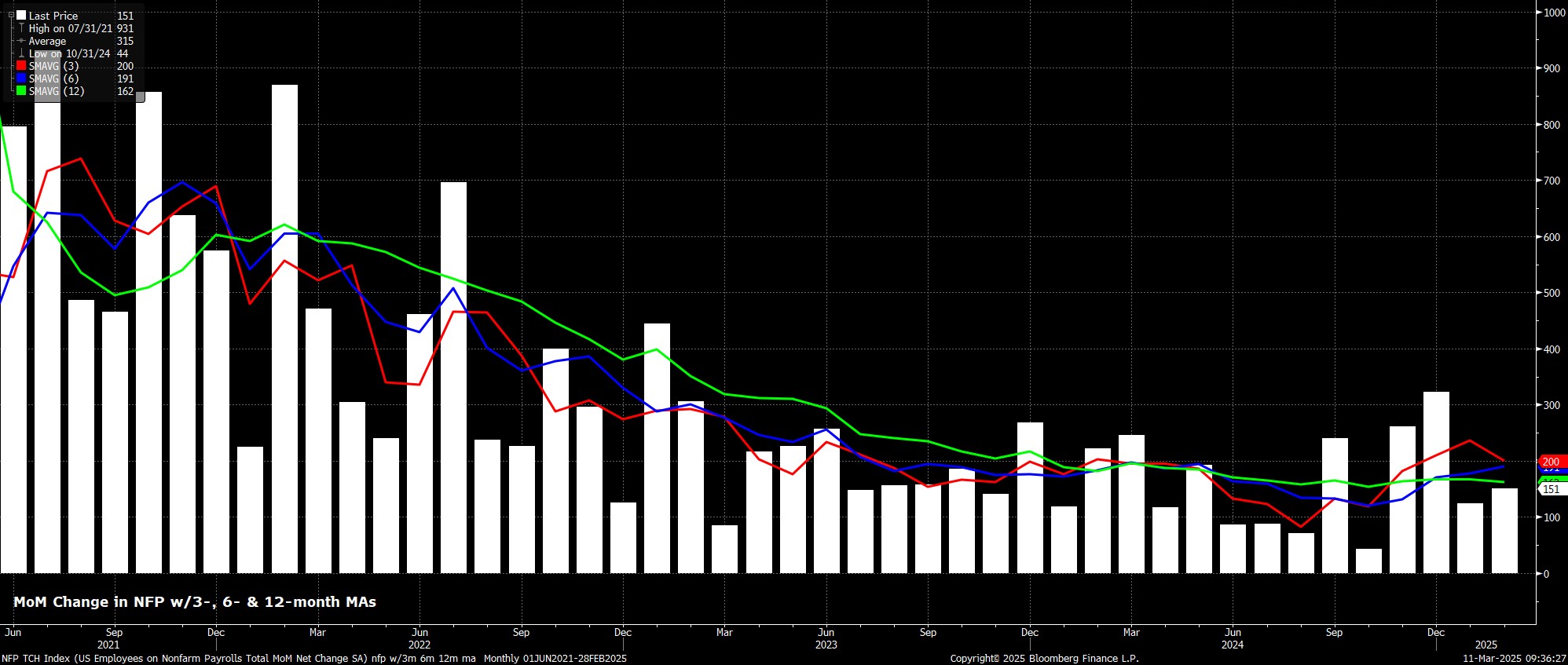

Fundamentally, the labour market remains strong, with the 3-month moving average of job gains running at around double the breakeven pace, though aforementioned ‘government efficiency’ cuts, and decline in confidence, pose notable downside risks, albeit ones that are likely too uncertain to model accurately at this stage.

Chair Powell will comment on all of the above at the post-meeting press conference, where Powell will seek not to rock the boat, or add to the present degree of economic uncertainty, while also once more reaffirming that he won’t permit policy to be overtly influenced by those in the Oval Office.

More broadly, Powell will likely stick to his recent script, noting that the economy remains in a ‘good place’, and that as such policymakers have ‘no need to hurry’ in making further adjustments to the fed funds rate. Monetary policy is, again, likely to be described as “moderately restrictive”, and as continuing to exert downward pressure on price pressures.

Perhaps the most interesting remarks may be those on the issue of quantitative tightening, which seems likely to be wrapped up relatively soon, perhaps as early as the next meeting in May, as hinted at in the January meeting minutes.

On the whole, while participants will have plenty to digest at the March meeting, it seems highly unlikely that the decision, commentary, or projections will materially move the needle in terms of the policy outlook. Put simply, there has not been enough disinflationary progress made in order to unlock another rate cut, while there is too great a degree of uncertainty muddying the waters in order for the Committee to have a high degree of conviction in their updated economic projections.

Nevertheless, the direction of travel for rates remains lower, even if any cuts in the first half of the year – barring a material deterioration in labour market conditions – seem unlikely at this stage. Plotting a careful, slow, and deliberate course back to neutral remains the priority for Powell & Co, while preserving the progress made thus far, even if the daily barrage of economically incoherent headlines from 1600 Pennsylvania Avenue has now made that task significantly more complex.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.