- English

- Italiano

- Español

- Français

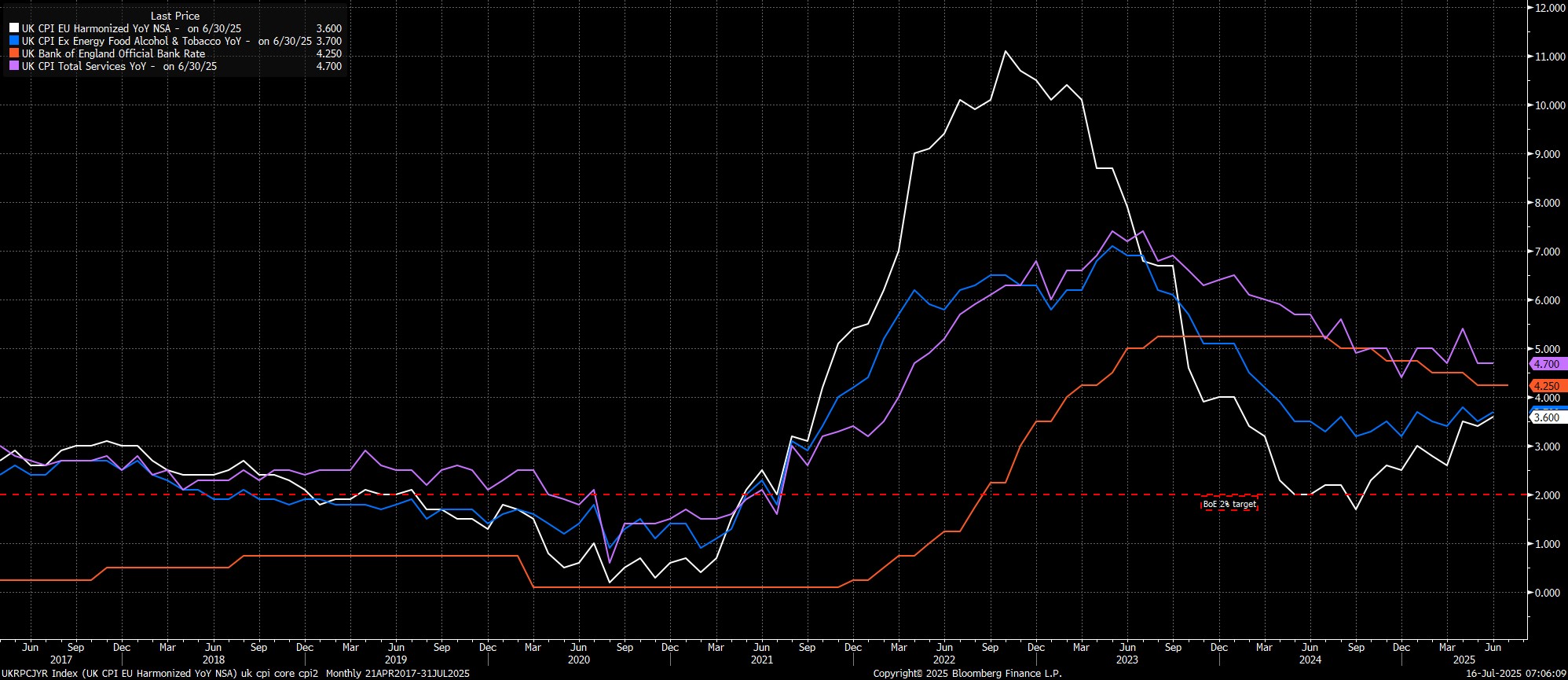

Headline CPI rose 3.6% YoY in June, considerably above the BoE's 3.4% forecast, and the fastest annual pace since last January. Meanwhile, measures of underlying inflation also pointed to firmer price pressures, with core CPI rising 3.7% YoY, and services prices rising by 4.7% YoY, the latter also being above the BoE's latest forecast.

In terms of the details of the report, headline inflation was boosted by a further rise in food prices, as well as an unfavourable base effect from fuel prices, both of which being factors that the MPC may decide to look through.

Despite the firmer than expected figures, further Bank Rate reductions remain on the cards, with a 25bp reduction at the next meeting, in early-August, still the base case, even if one or two MPC members may now be increasingly jittery over the risk of price pressures becoming embedded within the economy.

These jitters are likely to prevent any language changes for the time being, with the MPC seemingly set to stick with a 'gradual and careful' approach to policy easing for the time being, amid concern that we may not be past the peak when it comes to price pressures. This is despite the employment backdrop souring rapidly, with an increasing degree of slack quickly emerging.

Today's data, though, is likely to prevent the MPC from pivoting to supporting growth, and the labour market, for the time being, at least not until policymakers become more confident in CPI being on a path to return to 2% in a sustainable fashion. Slower, and later, cuts are now likely, with my base case flipping to just two 25bp reductions over the remainder of the year, in August and November.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.