CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

- English

- Italiano

- Español

- Français

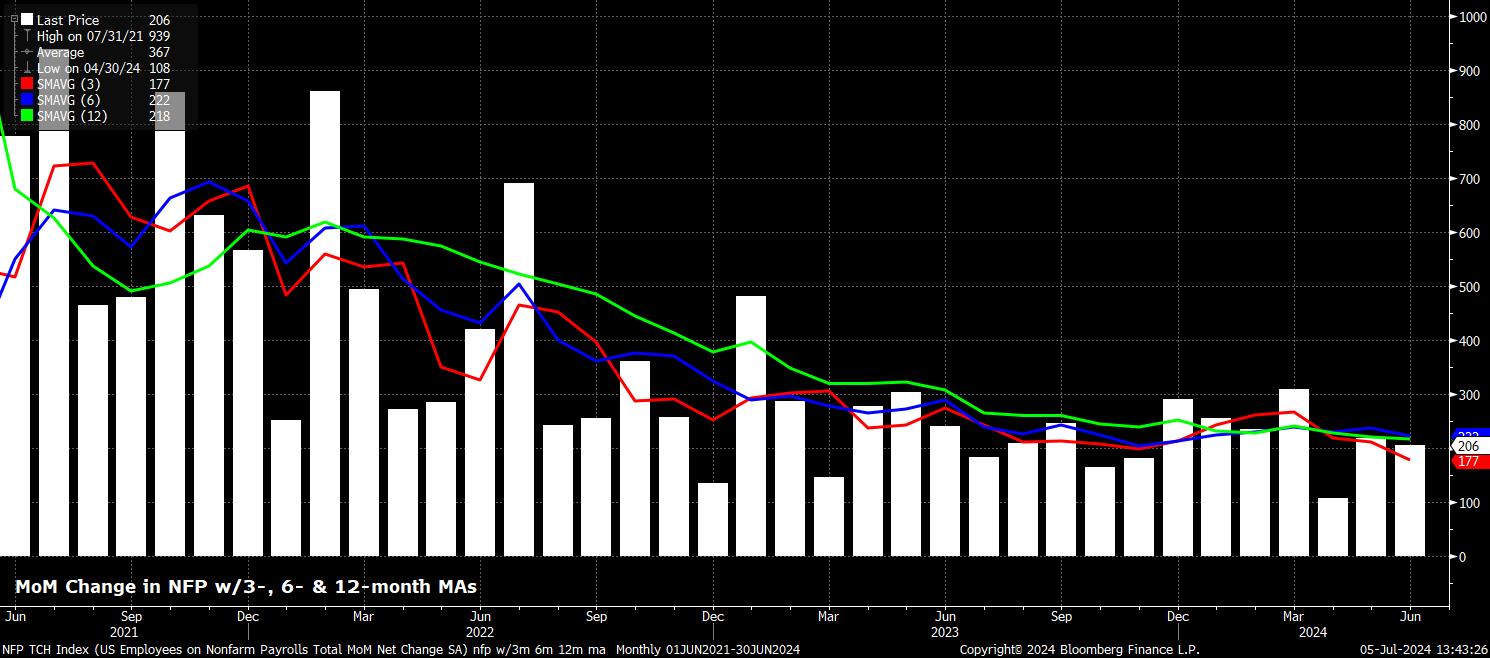

Headline nonfarm payrolls rose by +206k in June, marginally above consensus expectations for a +190k increase, while also being well inside the typically wide forecast range, of +140k to +237k. Meanwhile, April and May’s nonfarm payrolls prints were revised by a chunky net -111k, subsequently bringing the 3-month average of job gains to +177k, the lowest such level since the start of 2021, and well below the approx. 250k breakeven payrolls rate required for job growth to keep pace with growth in the size of the labour force.

Digging a little deeper into the payrolls print, the sectoral split reveals a relatively broad-based plethora of job gains once more, with monthly employment declines seen only in Manufacturing, and Professional and Business Services. On the other hand, as has been relatively common this cycle, Government payrolls underpinned the bulk of the monthly job gain, supported by Education and Health Services, another sector that has delivered strong jobs growth over the last year.

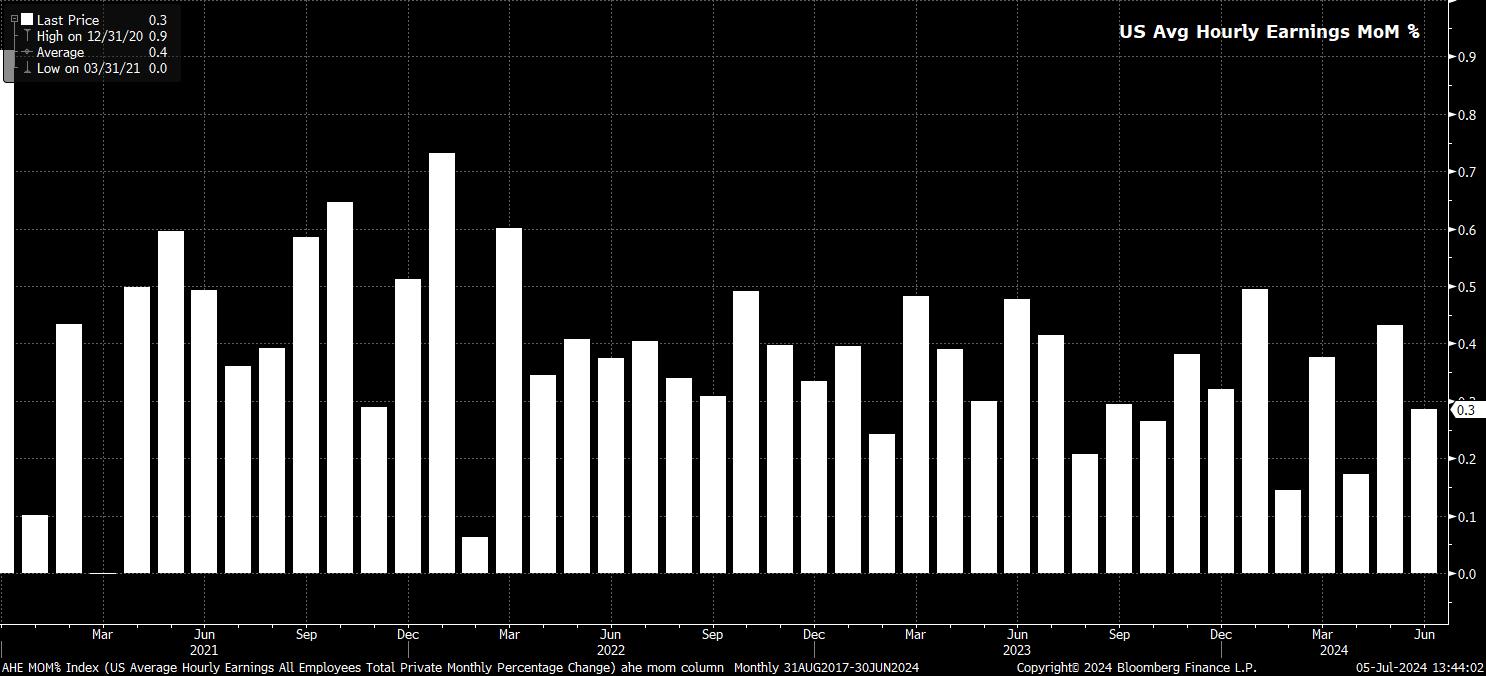

Sticking with the establishment survey, the jobs report also showed average hourly earnings rose by 0.3% MoM in June, bang in line with consensus, and a modest slowdown from the 0.4% MoM pace seen a month prior.

Such an increase also saw the annual pace of earnings growth dip, to 3.9% YoY, from a prior 4.1%. This decline should, at the margin, provide the FOMC with some additional confidence that disinflationary progress back towards the 2% target will continue to be mate, while also being consistent with a continued gradual loosening in the jobs market.

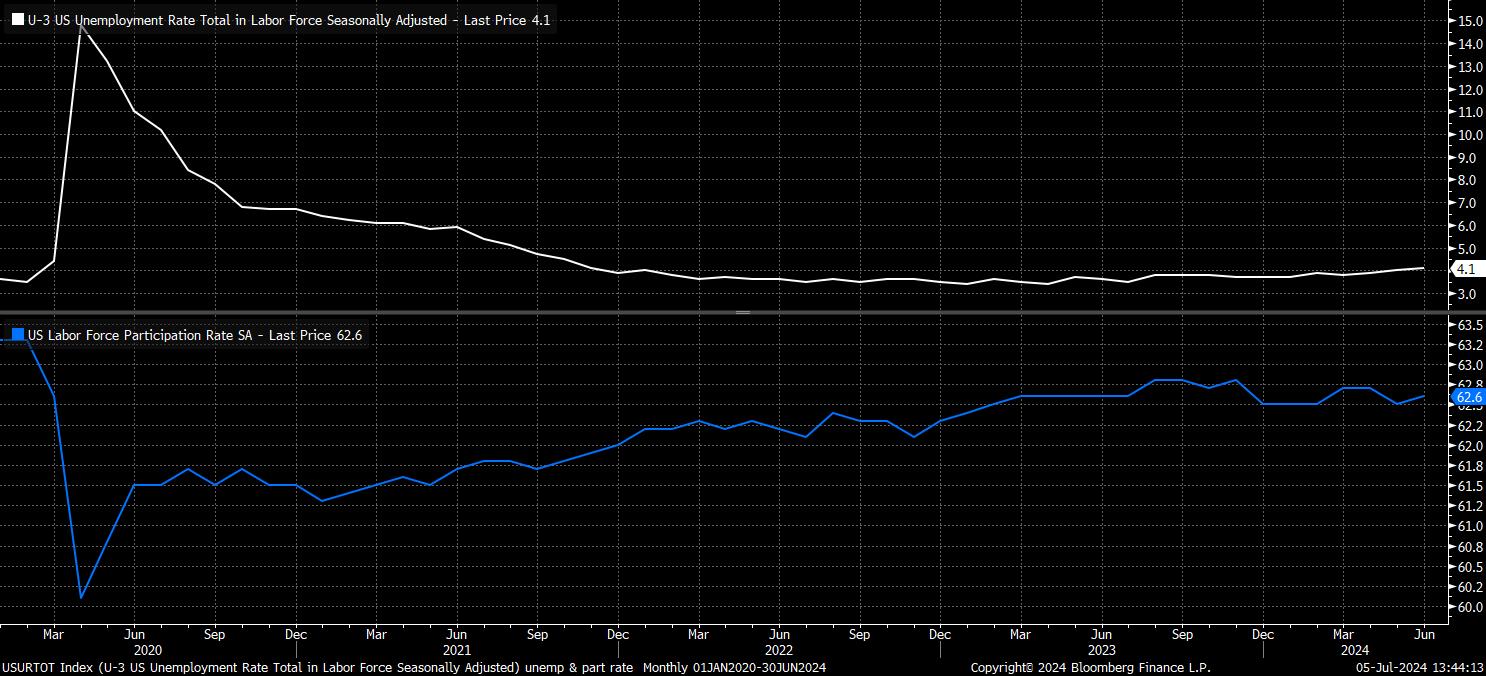

Meanwhile, turning to the household survey, and measures of labour market slack. Headline unemployment rose to 4.1% in June, compared to consensus expectations for joblessness to have remained at 4.0%. Nevertheless, this rise in unemployment came alongside a rise in participation, with the participation rate, as expected, ticking 0.1pp higher to 62.6%, albeit remaining well within the range seen for much of this cycle.

This dynamic, perhaps, makes the rise in joblessness a little less concerning than it otherwise would be. Of course, ongoing volatility in the household survey, primarily a function of increased immigration, may also be somewhat distorting the figures.

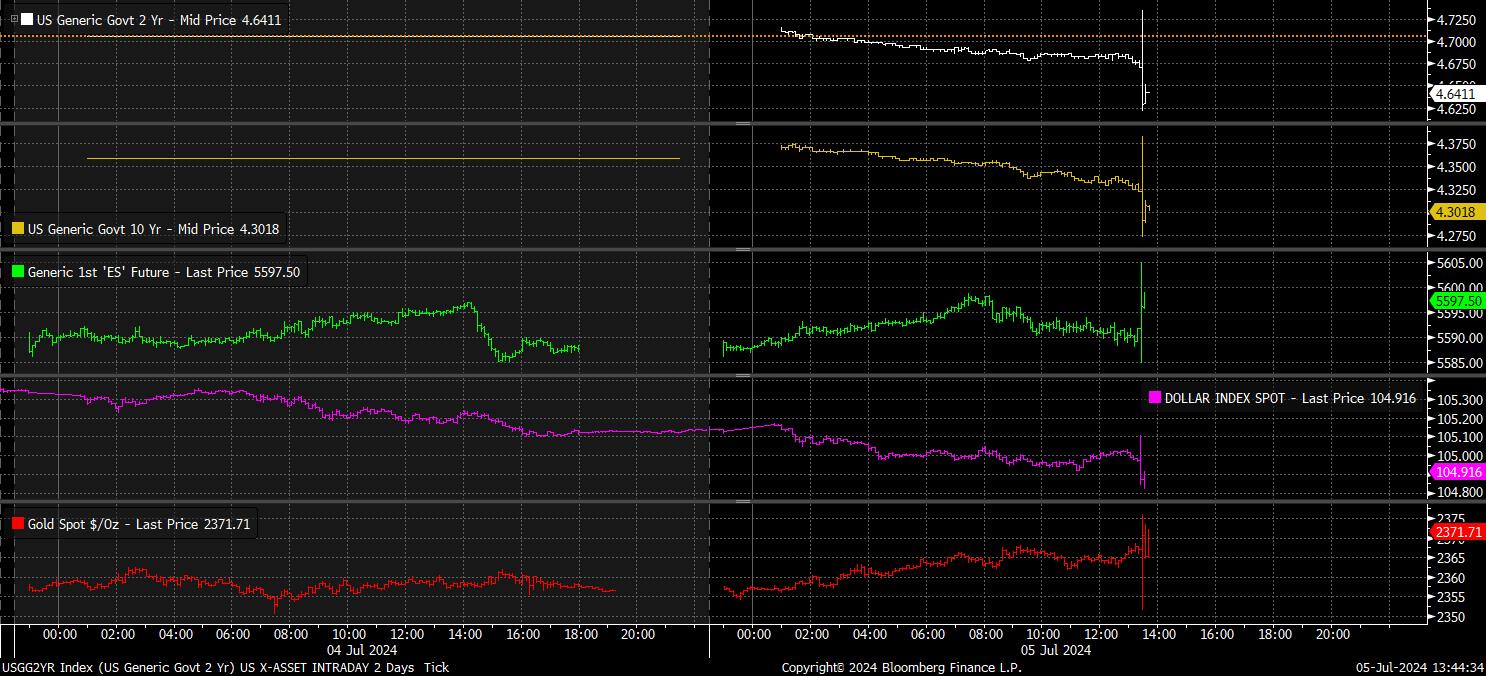

Despite the unexpected rise in unemployment, market-based expectations for the path of the fed funds rate remain broadly unchanged. The USD OIS curve continues to discount around a three-in-four chance of a 25bp cut by September, while continuing to fully price such a move by November, and seeing around 45bp of easing in total by the end of the year.

The cross-asset market reaction was similarly subdued, besides some knee-jerk volatility as the NFP print crossed news wires, with lower-than-usual levels of liquidity owing to many participants taking an extra-long Independence Day weekend break likely also contributing to this relative calm.

In any case, stocks did pop higher as the print dropped, likely on the potential dovish implications of higher unemployment, though gains faded rapidly. The same can be said of Treasuries, which initially rallied by around 5bp across the curve, before that advance pared similarly quickly, though the front-end did outperform a touch. Elsewhere, the FX space was subdued, with marginal USD weakness – only to the tune of around 20 pips against most G10s – disappearing in a ‘blink and you’ll miss it’ style move, while gold was also ultimately unchanged.

On the whole, the policy implications of the June employment report are likely to be relatively limited, particularly with the inflation side of the FOMC’s dual mandate continuing to take precedence. Obtaining greater ‘confidence’ in a return towards the 2% target remains the primary condition that must be met before a cut is delivered, though ‘unexpected’ labour market softness may elicit a policy response in advance of this. I continue to pencil in September for the first 25bp cut to be delivered.

In any case, there remains a clear desire among FOMC members to deliver a cut, likely sooner rather than later, hence the ‘Fed put’ remains forceful, and flexible, in nature. This should, in turn, continue to support risk assets, with the path of least resistance for equities continuing to point to the upside, leaving dips remaining shallow, albeit with stocks now needing to navigate the looming risk of earnings season, kicking off next Friday.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.