CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

- English

- Italiano

- Español

- Français

As noted, the target range for the fed funds rate should remain unchanged at 5.25% - 5.50% at the conclusion of the June meeting, the seventh straight meeting at which rates have remained on hold. Money markets, per the USD OIS curve, price next-to-no chance of a move in rates at this meeting, with the decision to stand pat likely to be a unanimous one among FOMC members. Progress towards the 2% inflation target remains insufficient to unlock a rate cut at this juncture.

On the subject of market pricing, there has been little by way of substantial shift in the OIS curve since the May policy meeting. Markets continue to price around 40bp of easing by the end of 2024, with the first 25bp cut fully priced by the time of the November meeting, which comes just 2 days after the presidential election. Clearly, the market has taken some solace in recent inflation figures, particularly after core CPI fell to a near 3-year low on an annual basis in April.

Despite this, it seems unlikely that the Committee will make any material changes to guidance in terms of the policy outlook. A reiteration of the long-standing guidance that rate cuts shan’t be ‘appropriate’ until policymakers have “gained greater confidence that inflation is moving sustainably toward 2 percent” is the base case, with any deviations from this highly unlikely.

That said, there is a chance that the FOMC alter the language used to describe the economic outlook. While it remains reasonable to describe economic growth as “solid” and job gains as “strong”, the pace of both has slowed notably of late, raising the risks of a modest softening of the language used to describe each variable. Furthermore, on inflation, although there remains a “lack of further progress” towards target, policymakers may seek to add context, noting that progress has ‘slowed’ in recent months.

Of course, of rather more importance than any commentary will be the FOMC’s latest economic forecasts, with the June meeting marking the release of the latest quarterly ‘Summary of Economic Projections’, or SEP.

Firstly, on GDP, there seems little reason for the FOMC to alter their current projection of 2.1% YoY growth this year, despite the substantially slower-than-expected 1.3% annualised QoQ growth seen in the first quarter. While economic momentum is clearly slowing, at least if the latest PMI surveys are anything to go by, the relatively resilient services sector, coupled with a modest pick-up in manufacturing momentum, still makes such a growth expectation appear reasonable.

Some modest forecast revisions, however, are likely when it comes to both inflation, and the labour market.

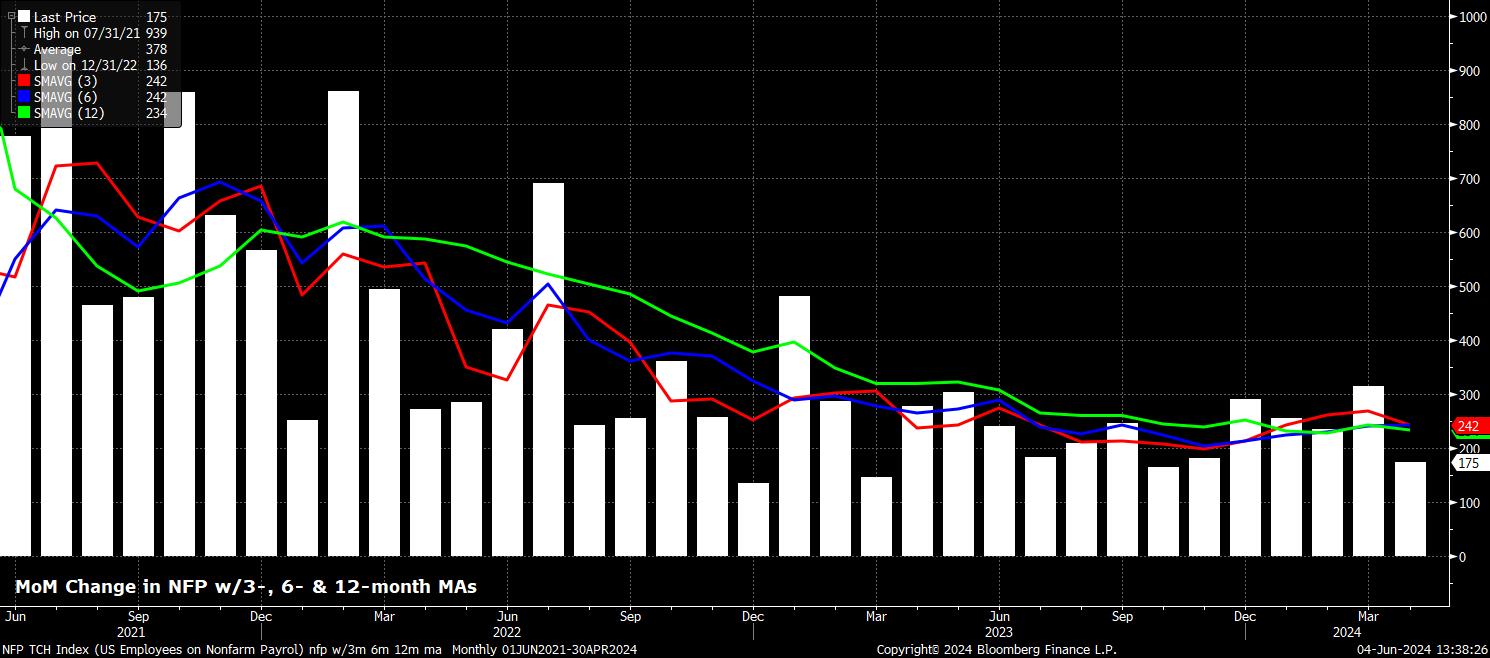

On the latter, while the May jobs report is due on 6th June, before the FOMC meet, data at the time of writing points to a clear slowdown in hiring, with the 3-month average of payrolls growth having slipped to 242k in April, just a touch below the ‘breakeven’ pace – the rate of job growth required to keep up with growth in the size of the labour force. Meanwhile, unemployment has begun to tick higher, having risen back to 3.9% in April, equal to the highest since early-2022, as labour force participation remains just shy of cycle highs at 62.7%.

A subtle upward revision, to forecast 4.1% unemployment this year, seems reasonable, particularly with leading indicators pointing to a further slowdown in hiring as the year progresses.

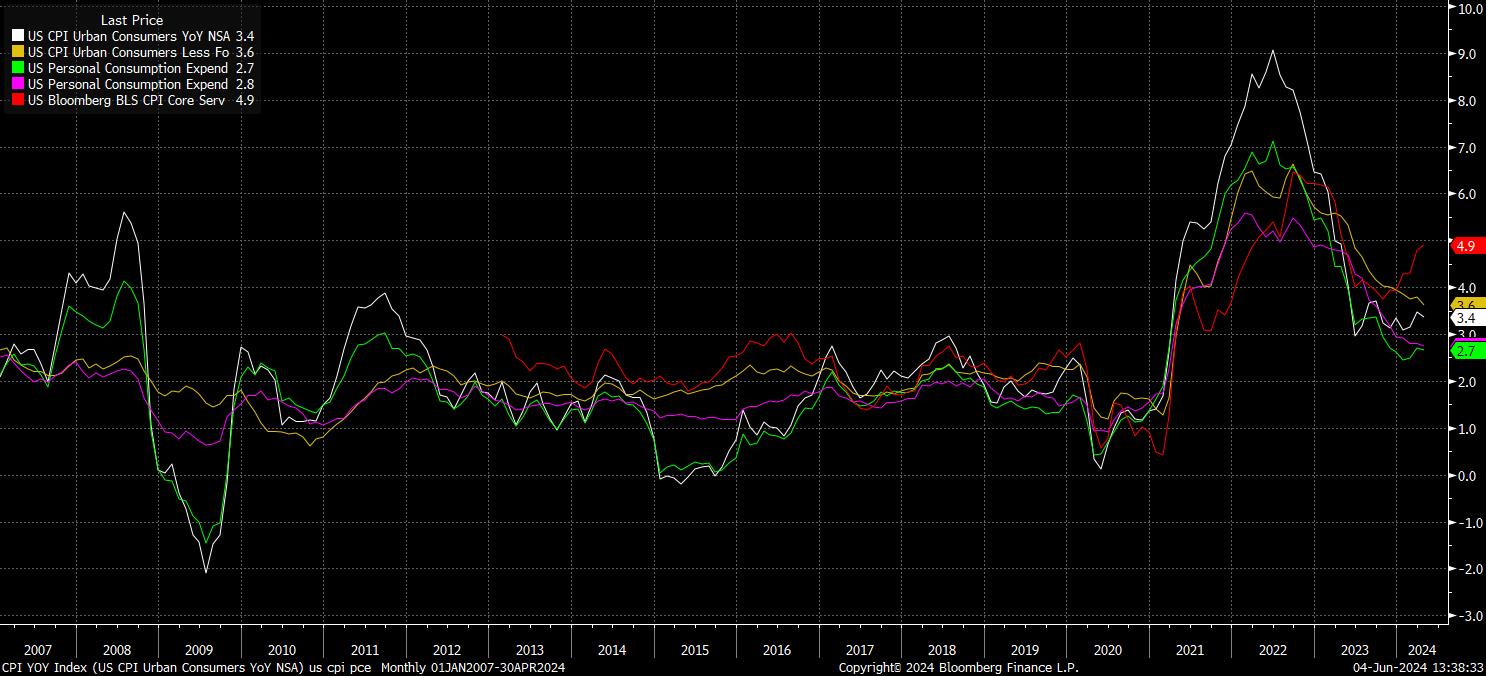

Turning to inflation, while recent data has been somewhat more pleasing for the FOMC, who are likely to particularly welcome both core CPI and core PCE having fallen to almost 3-year lows on an annual basis last month, the impact of hotter-than-expected price metrics in the first quarter of the year must still be reflected in the updated SEP.

Hence, the 2024 core PCE projection will likely be nudged higher to 2.7%, from 2.6% in the March SEP, though both headline and core inflation metrics should still be foreseen returning to 2% by the end of the forecast horizon; even if, in reality, risks are skewed towards the inflation target being achieved considerably sooner.

Altogether, these forecast revisions are likely to result in a hawkish adjustment to the FOMC’s June ‘dot plot’.

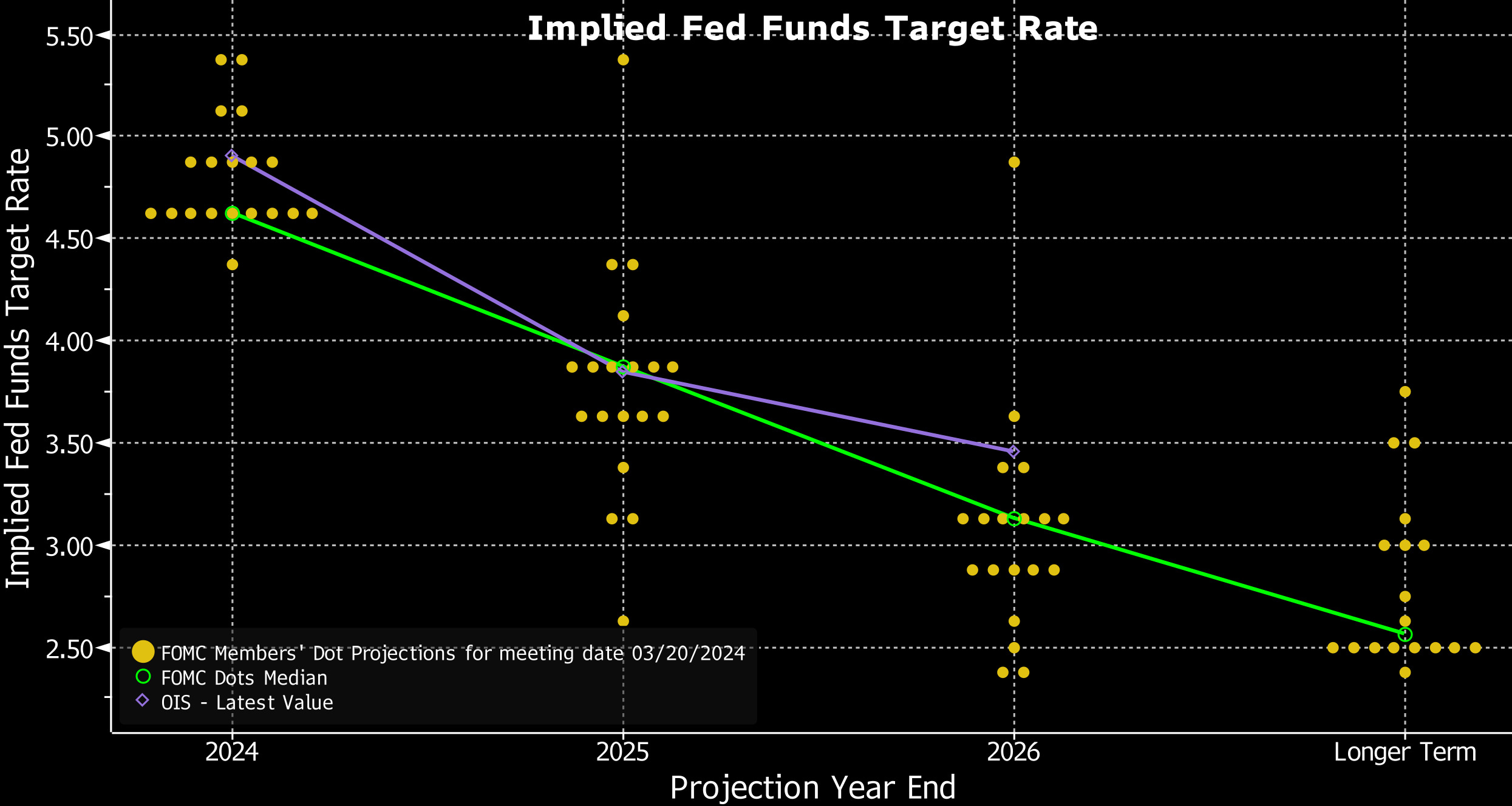

In March, the median ‘dot’ pointed towards a total 75bp of cuts being delivered this year. Given that the halfway mark of 2024 has now been reached without a single cut having been made, and with progress towards the 2% inflation target considerably slower than policymakers would desire, an upward revision seems likely here, with the median instead likely to shift in a hawkish direction, and signal just 50bp of cuts this year, a rounding error away from the policy path markets currently price.

In any case, it would take just one FOMC member currently pencilling in three cuts this year to shift their individual ‘dot’ to two cuts for the median to also shift 25bp higher – all else equal.

Further out, the 2025 median may also be revised a touch higher, lest the FOMC seek not to point towards 100bp of easing – i.e. a cut every quarter – next year. There may also be a modest upward revision to the ‘longer-run’ dot, currently 2.562%, particularly given the increased chatter among policymakers around r* having moved structurally higher. Given the uncertainties associated with said longer-term forecasts, however, any such moves should be taken with a pinch of salt.

Besides the dots, Chair Powell’s press conference will be the other main attraction at the June FOMC.

That said, it seems unlikely that Powell will deviate significantly from recent remarks, instead stressing once more that policy is indeed restrictive, and that policymakers continue to deem it appropriate to give such a policy stance ‘further time’ to work, and bear down on inflation. Such a patient stance will persist despite the aforementioned recent welcome inflation figures, to which Powell is unlikely to over-react.

As with the May press conference, Powell is again likely to stress that a further hike is unlikely, instead outlining three policy paths – a cut due to progress on inflation, a cut due to unexpected labour market weakness, or rates remaining unchanged until sufficient confidence on inflation returning towards target is obtained.

For markets, there seems little chance of a significant surprise from the FOMC this time around, though a knee-jerk hawkish reaction to the updated ‘dot plot’ remains distinctly possible. Over the medium-term, however, so long as a rate cut remains the most likely next move, and hikes remain off the table, the path of least resistance should continue to lead to the upside for equities.

The return of the ‘Fed put’ should see investors remain in dip-buying mode. However this, as well as the relatively narrow degree of policy divergence between G10 central banks, should continue to keep something of a lid on G10 FX volatility for the time being, and the DXY in a relatively tight range.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.